[ad_1]

Reporting its financial results for the first quarter of 2024, Apple announced profits of $33.9 billion ($2.18 per diluted share) on revenue of $119.6 billion. The company’s revenue increased 2% and profit increased 16% compared to the same period last year (Apple’s Q1 2023 revenue slowed by exchange rates, coronavirus, and inflation, February 3, 2023) ). Apple executives emphasized that this quarter’s results are based on 13 weeks of activity, compared to 14 weeks in last year’s first quarter. This is good news compared to the fourth fiscal quarter of 2023, which saw a slight revenue decline, and this result means that the first quarter of 2024 will be the first quarter of 2022 for Apple, both in terms of revenue and profit. This was the second-highest quarter in history, after .

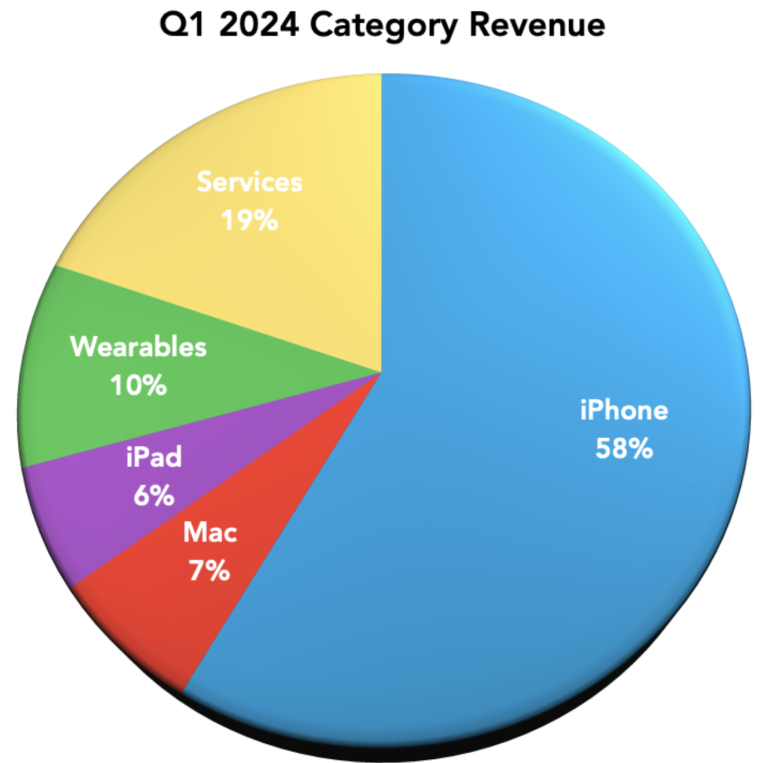

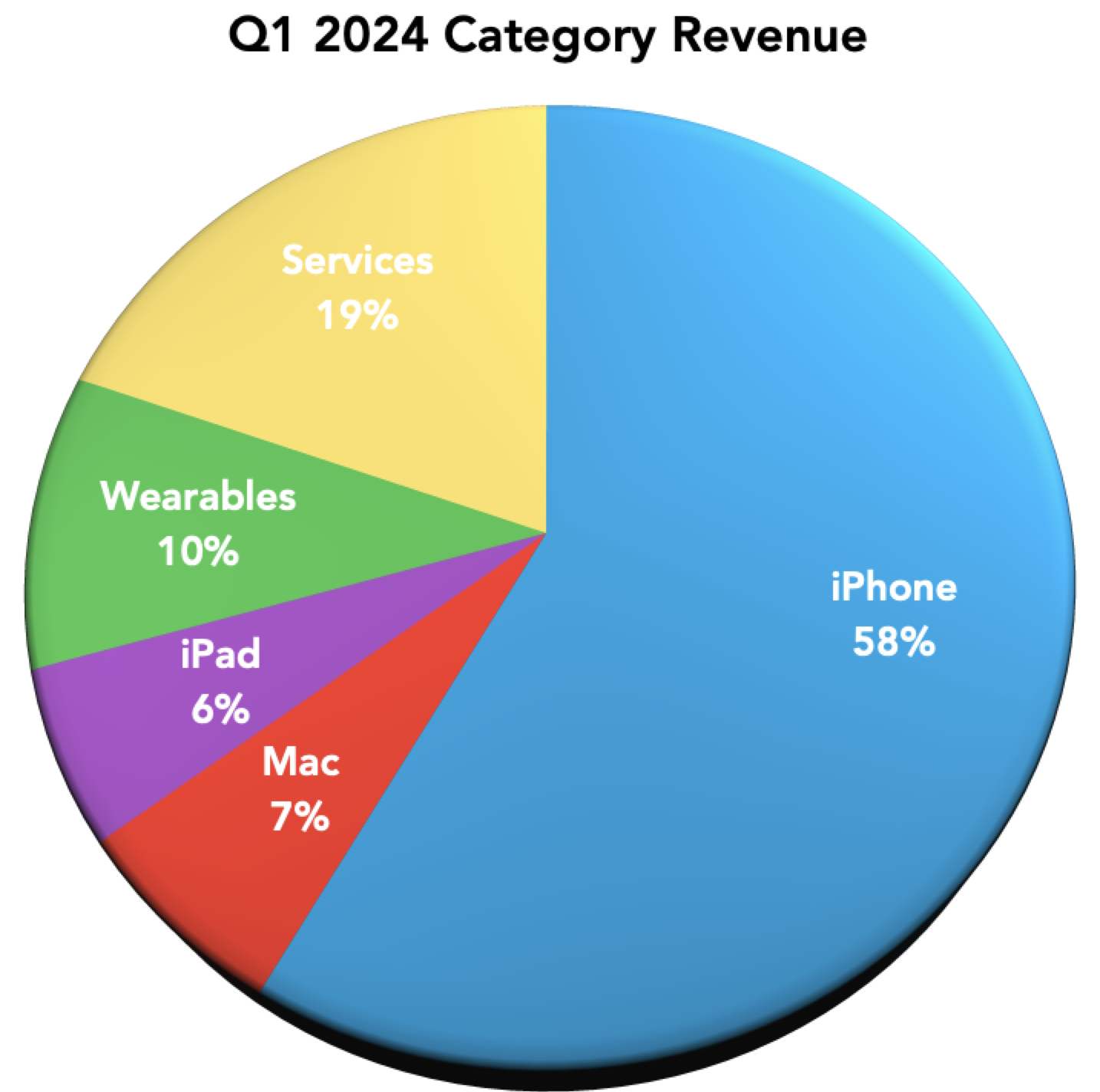

The biggest driver in the quarterly revenue pie chart was once again the iPhone, accounting for 58% of Apple’s revenue, and the services division hit an all-time high, accounting for 19% of quarterly revenue. Together, the two categories accounted for 77%. Of the remaining segments, Macs held on to about 7% of the total, while iPads and wearables both declined, with their respective pieces of the pie falling 2% from a year ago (see Apple’s 2023 1st Quarterly sales slowed by currency (see “Interest Rates, COVID-19 and Inflation”, February 3, 2023).

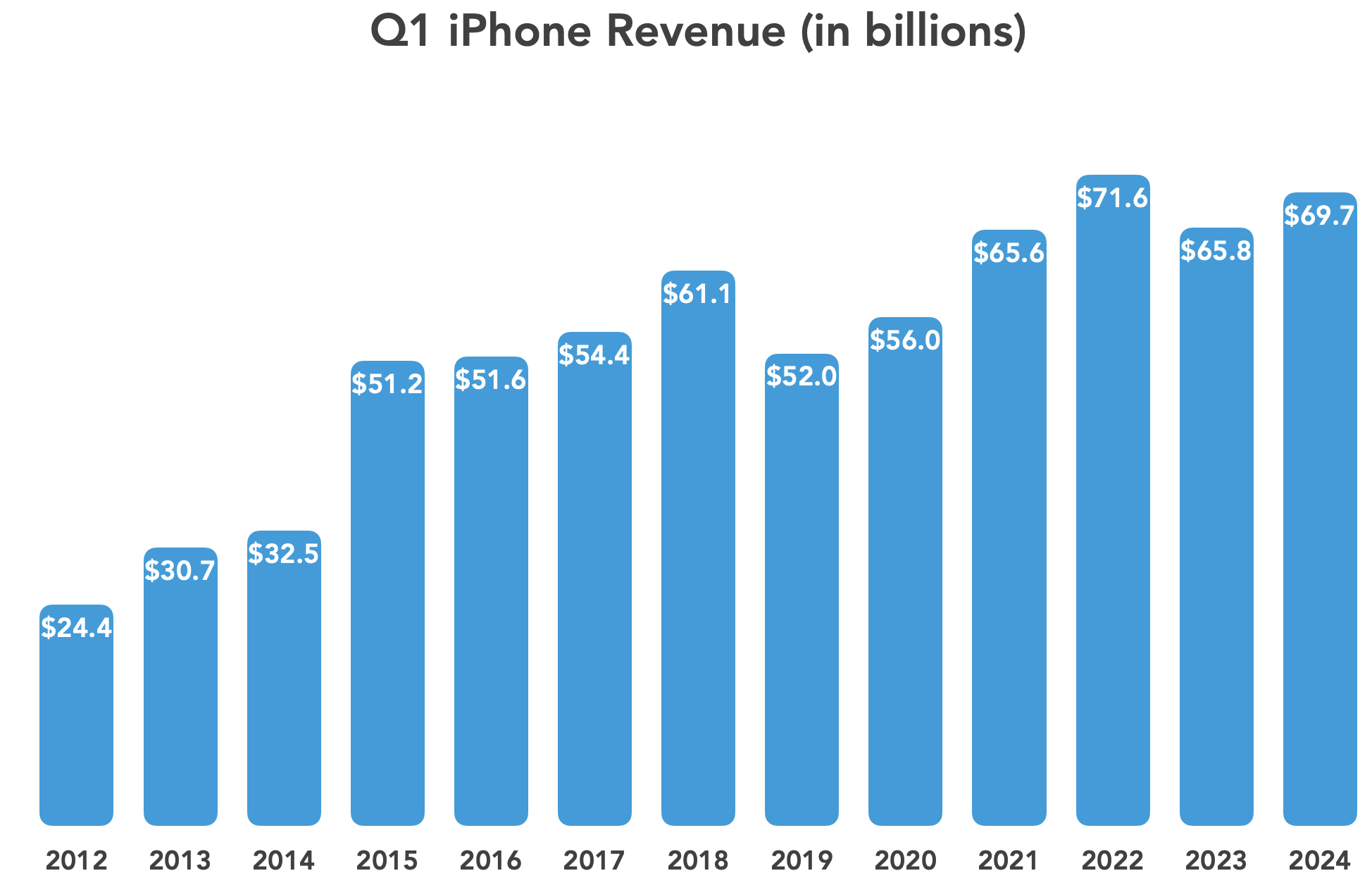

iPhone

The iPhone was particularly strong. Despite the performance being below its all-time high in 2022, Apple still brought in $69.7 billion in iPhone sales, a 6% increase from 2023. Although the iPhone 15 series was a relatively minor evolutionary update, Apple claims customer satisfaction reached 99% and the number of iPhone upgraders hit an all-time high.

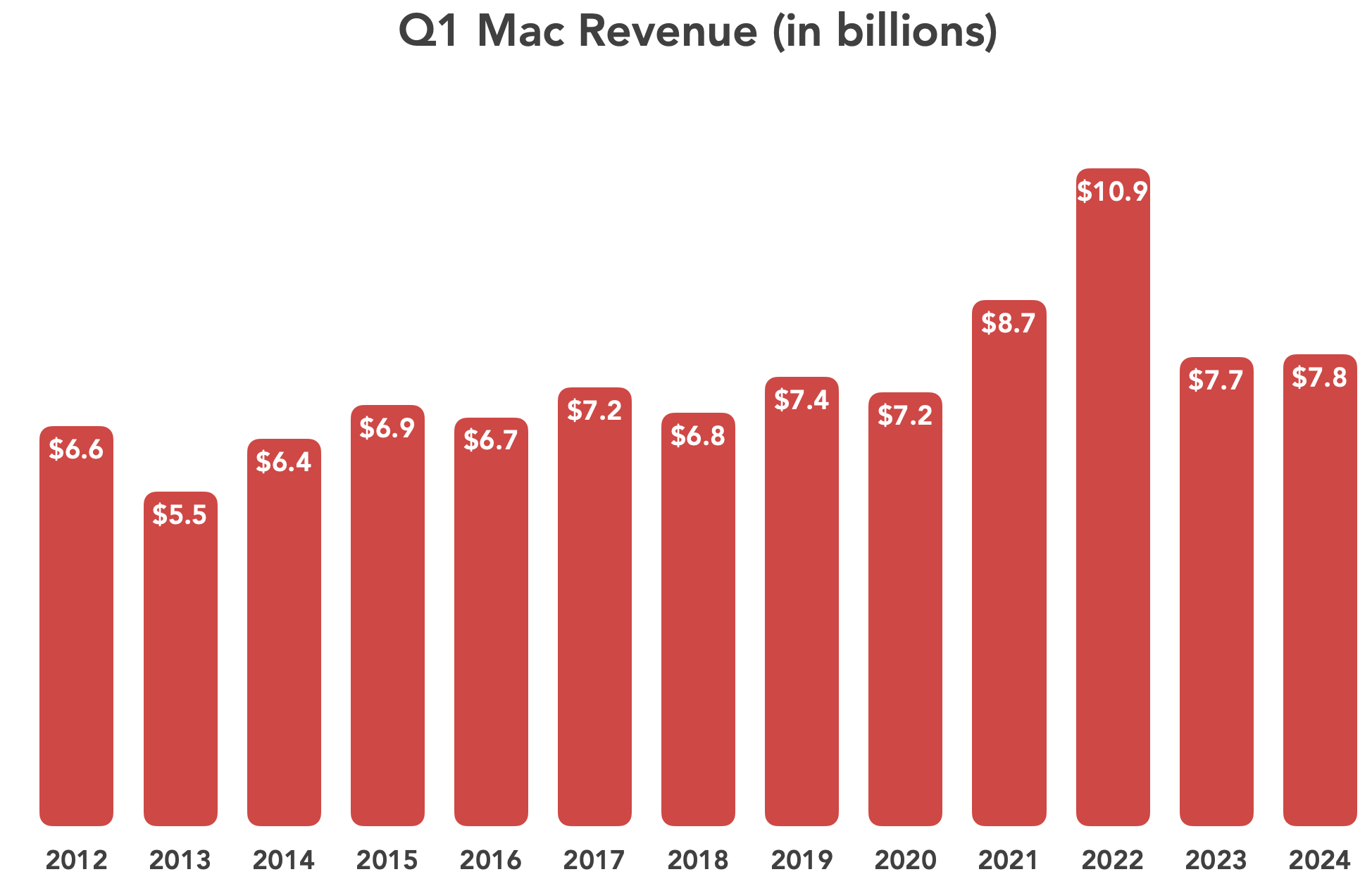

Mac

The first quarter of 2024 saw the introduction of M3-powered versions of the 24-inch iMac, 14-inch MacBook Pro, and 16-inch MacBook Pro, leading to a slight increase in Mac revenue over last year’s first quarter results. (As Tim Cook once again emphasized) The first quarter of this year was less than 1%, even though it was one week shorter than the same period last year.

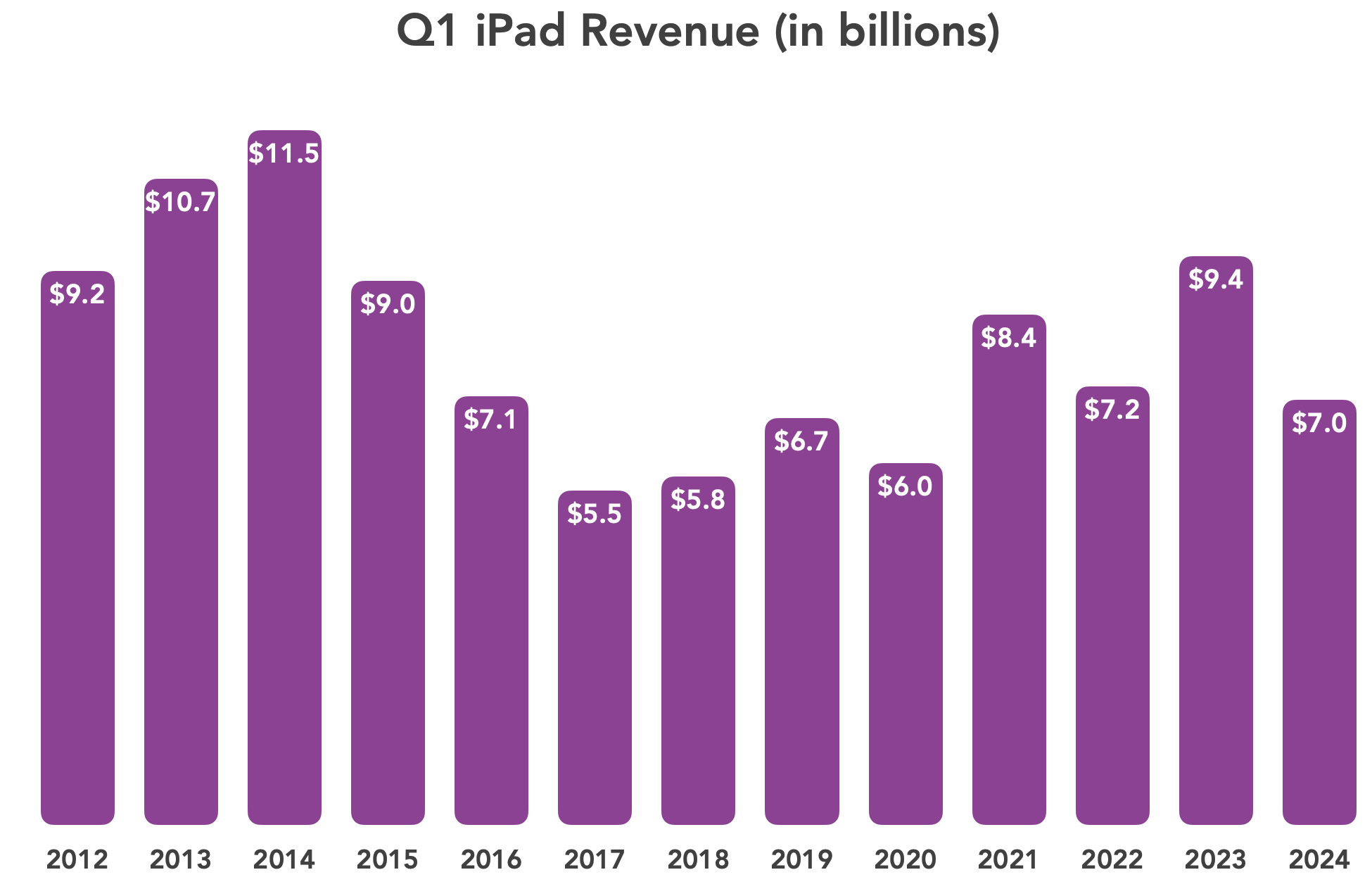

iPad

It’s hard to say the iPad is struggling, considering it still brings in $7 billion in revenue. Nevertheless, it was a 25% decrease from “difficult to compare” sales of the product in 2023. The M2 iPad Pro model was released in late 2022 and was unusually high as Apple caught up with pent-up demand from previous supply disruptions. Factory closure. However, this was also the lowest iPad sales since 2020. Given that Apple didn’t release a new iPad last year, it seems likely that the next new model release will significantly boost iPad sales.

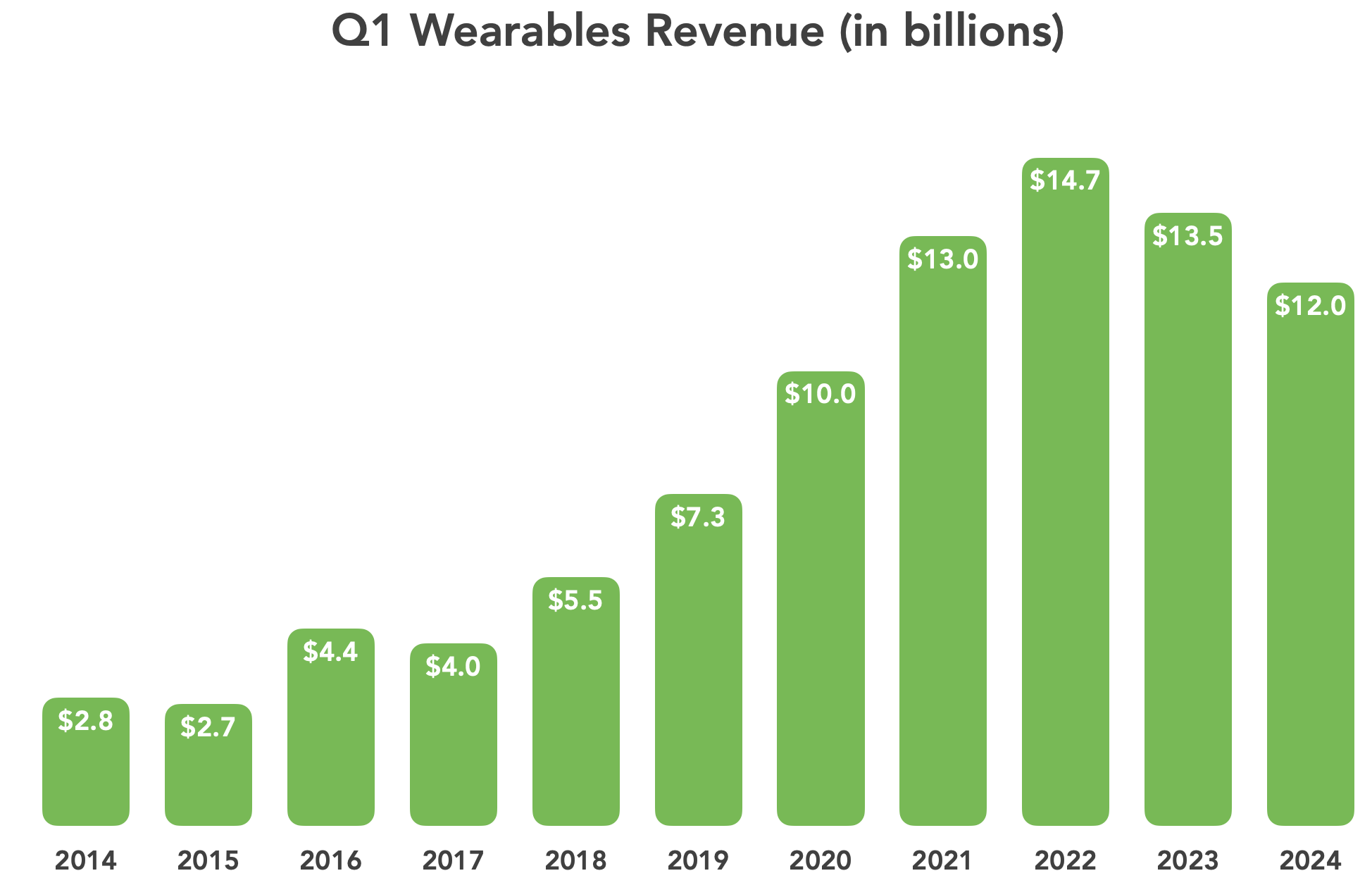

wearable

As with the iPad, sales in the wearables category were “difficult to compare” to last year’s results, with sales down 11%, even including sales of the just-released Apple Watch Series 9 and Apple Watch Ultra 2 models. In the coming quarters, Apple’s new Vision Pro will be included in the wearables category, but given the low initial production volumes, it won’t make a big difference to the bottom line for some time. Nevertheless, Apple highlighted the interest that business customers have expressed in the device. In response to a question from an analyst, Cook declined to compare Vision Pro’s expected sales trajectory to previous Apple products, saying, “Each product has its own journey.”

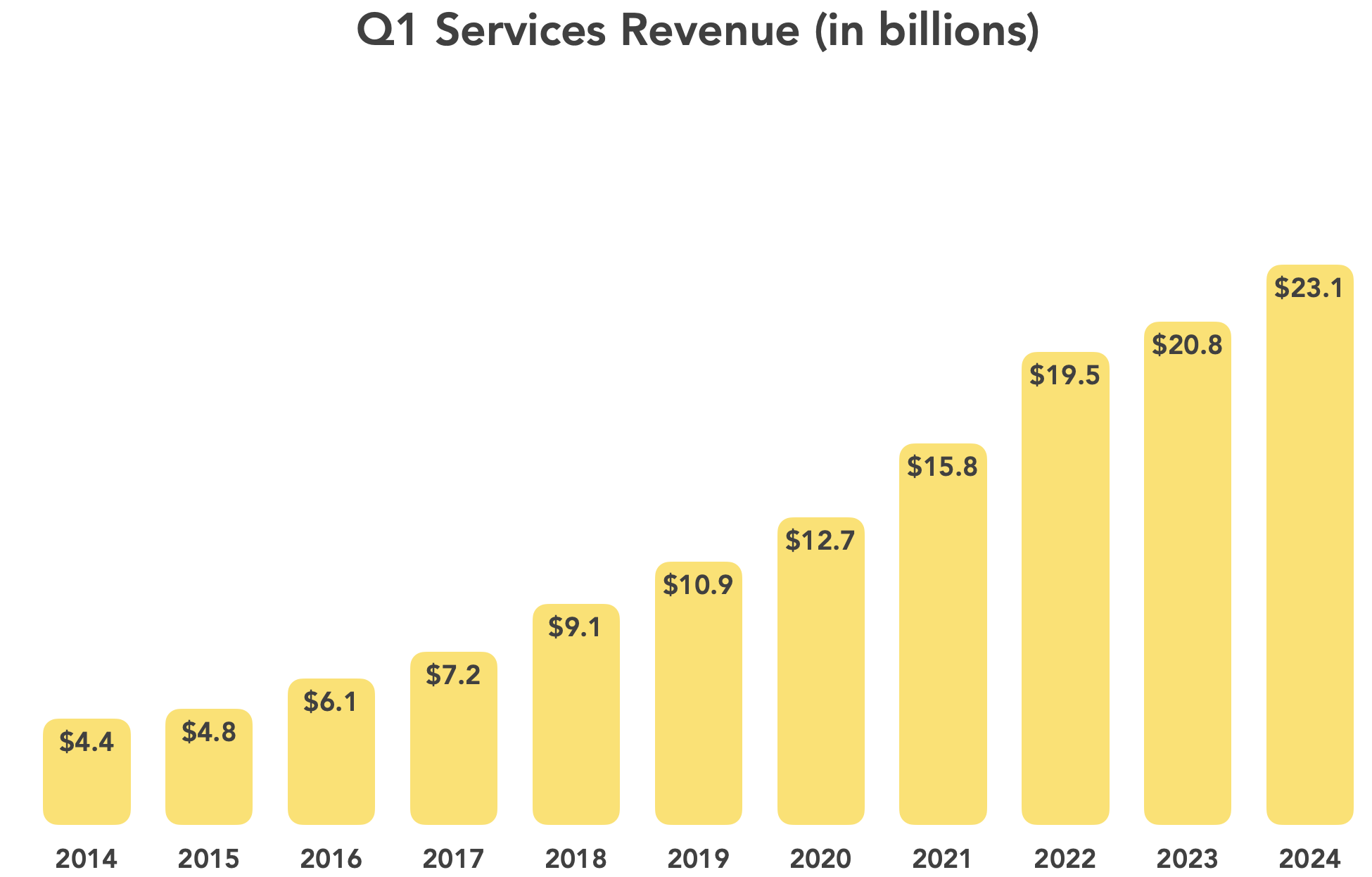

service

Once again, the Services segment was a bright spot in Apple’s revenue picture in the first quarter, posting an 11% year-over-year increase, the highest of any of Apple’s reportable segments. With 2.2 billion Apple devices currently in its installed base, the opportunity for the company to serve these devices bodes well for continued growth in this category.

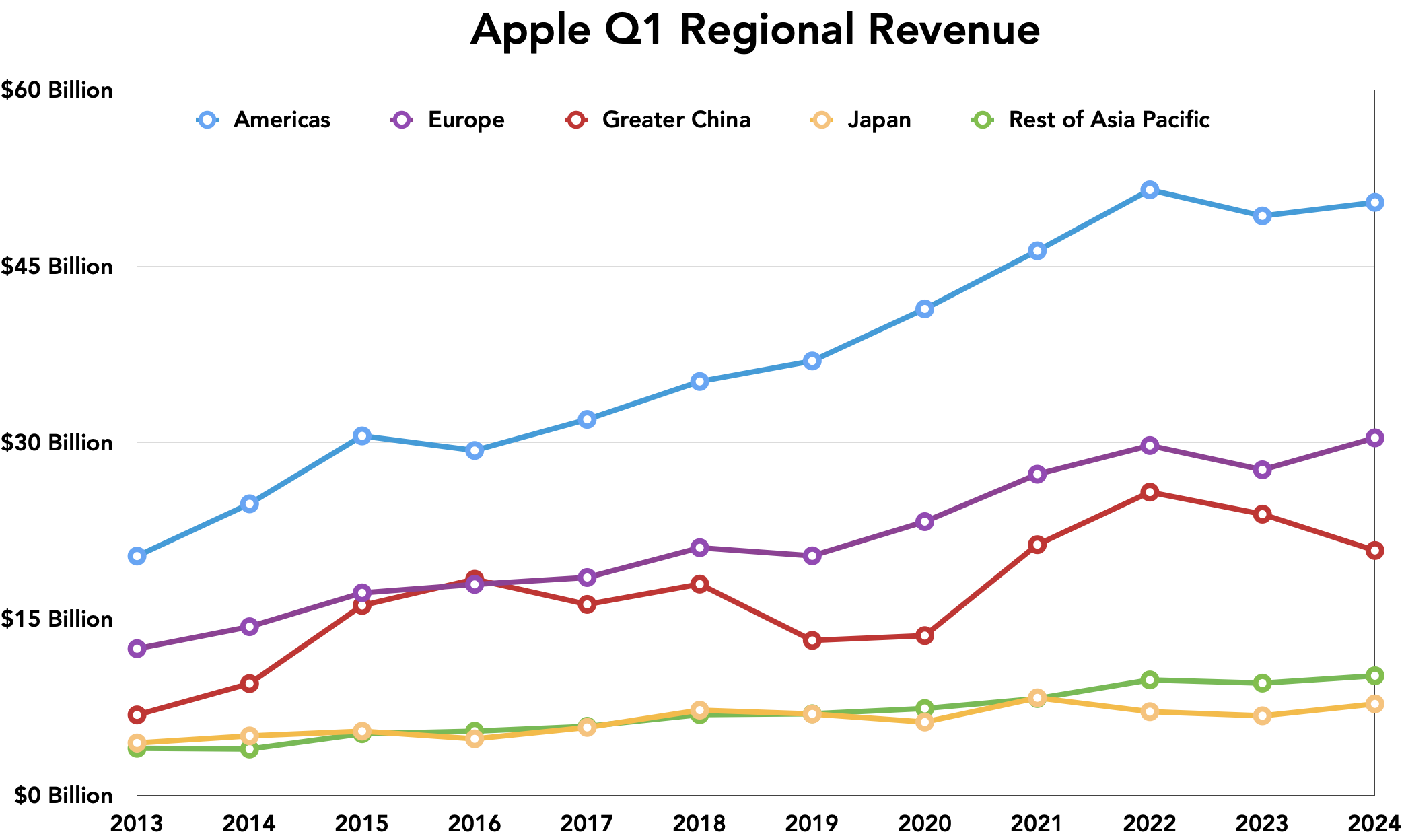

Regional results

Sales from Greater China fell 13% year over year, but other countries made up for the drop, and Cook expressed delight in Apple’s performance in emerging markets such as Latin America and the Middle East. . The Americas achieved a 2% revenue increase compared to the same period last year, which had a longer week. Even better, revenue in Europe and Asia-Pacific increased by his 10% and 7%, hitting record highs, and in Japan, revenue increased by 15%.

For the future

Apple remains highly profitable and has returned to a growth trajectory, but slowing sales in China and the unknown impact of Apple’s persistent efforts to meet the EU’s new app distribution requirements mean You’ll be out of work for months (see “EU troops open Apple’s walled garden”, January 29, 2024). On the plus side, Apple’s iPhone and services division seems likely to continue to perform well, with a new iPad sure to emerge later this year to strengthen that division.

[ad_2]

Source link