[ad_1]

(Bloomberg) — China Aluminum Corporation said it sees “relatively high” risks in bauxite supplies from Guinea, underscoring the country’s growing dependence on one country for the raw material.

Most Read Articles on Bloomberg

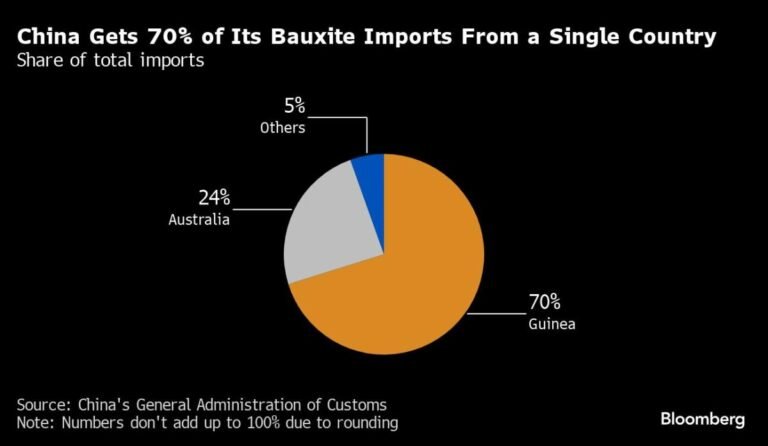

The West African country last year supplied 70% of China’s bauxite imports, which are used in aluminum production. That left Chalco, as the company was known, highly exposed to the turmoil there.

“The company’s bauxite mines in Guinea are subject to supply fluctuations due to local policy changes and frequent strikes,” the world’s largest aluminum producer said in its annual results report.

Charco said it would seek to ensure continuity of supply from a single mine in Guinea and aim to develop more mines in the country’s north. He will also consider collaborating on bauxite projects elsewhere and developing further supplies domestically.

Guinea overtook Australia and Indonesia to become the largest exporter of bauxite in the 2010s. Most of it is sent to China, where it is processed into alumina and then aluminum metal. Domestic bauxite production in China is in decline, and Indonesia has halted exports to process more of the mineral at home.

Bloomberg Intelligence analyst Michel Leon said in a note this month that China may eventually have to rely on Guinea for 90% of its bauxite imports. He said Guinea could follow Indonesia’s example and require foreign companies to build refineries there.

Chalco’s net profit last year increased by 60% to 6.72 billion yuan. The company warned that the outlook for commodities is highly uncertain due to slowing global economic growth and rising geopolitical risks. “The domestic market still faces problems such as a lack of effective demand and weak expectations.”

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link