[ad_1]

(Bloomberg) – Southern European countries, long derided by their wealthy northern neighbors, have turned the tables by cementing their role as growth drivers in the struggling eurozone.

Most Read Articles on Bloomberg

S&P Global’s economic survey released this week showed that Spain and Italy’s economic expansions accelerated in March, faster than economists expected. Greek manufacturing indicators showed a similar trend. As a result, the currency area index broke out of contraction for the first time in 10 months.

“Spain and Italy provided the biggest boost, with growth accelerating to the strongest level in almost a year,” Hamburg Commercial Bank said. This helped offset the sustained production contraction in Germany and France that began in mid-2023.

A surge in tourism since the pandemic, strong exports and lower energy prices due to limited reliance on renewable energy and Russian gas have given the so-called Mediterranean periphery the upper hand in the euro zone.

Just over a decade ago, these same countries, looked down upon as spendthrift and unproductive, were at the center of a debt crisis that called into question the very existence of their currencies.

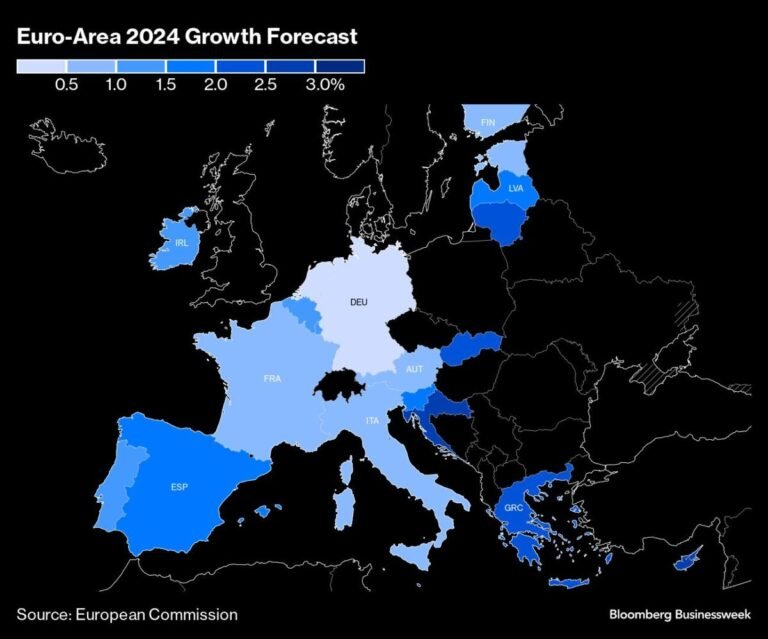

Spain, Portugal and Greece are expected to be among the best performing countries in the 20-nation bloc this year, according to the European Commission.

By contrast, the French government has just lowered its growth forecast for 2024 and is calling for tens of billions of euros in spending cuts after reporting a much higher budget deficit than predicted for 2023. Germany appears to be in the final stages of a shallow recession, weighed down by consumer hesitation, weak external demand and high borrowing costs.

Investors such as Vanguard Asset Management, JPMorgan Asset Management and Neuberger Berman have been buying up bonds in Southern Europe, taking advantage of a rise that has sharply narrowed premiums to Germany and France.

For example, the spread between Portuguese 10-year bonds and German Bundestags is about 65 basis points, roughly half of its peak in mid-2022.

Since the coronavirus crisis, Spain’s economy has been particularly strong, with an accelerating export boom in everything from financial services to manufacturing.

“It’s not the new El Dorado, but it’s a country that will continue to attract investors,” Natixis economist Jesús Castillo told Bloomberg.

He said Spain benefits from being less affected by rising fossil fuel prices, as well as having lower labor costs compared to France, Germany and Italy, a skilled workforce and a well-functioning health system. He said that it is possible to obtain “benefits”. He also said the country would benefit from companies returning to production.

Domestic demand also remains strong, with consumers and businesses bringing debt levels down to their lowest levels since before the 2008-2012 crisis, and unemployment hovering near its lowest level since 2007.

“We really like Spain,” said Ales Koutney, Vanguard’s head of international rates. “We believe that the fundamentals continue to be poorly priced by the market. Everything looks good in Spain, but in the long term, especially given the data we have recently received from France, We see that there is a lot of room for compression between France.”

The spread in 10-year bond yields between Spain and France has halved since its peak in mid-2022, to just over 30 basis points (bp).

In neighboring Portugal, the government said tourism brought in a record 25 billion euros ($27.2 billion) in 2023, up from 21 billion euros the year before. The country has also seen a steady increase in exports, which traditionally include textile products as well as cars and auto parts. Since 2019, it has become Europe’s largest bicycle manufacturer.

It has also become a real estate hotspot for foreign buyers. Wealthy investors have been snapping up commercial buildings in recent years, as well as hotels and residential real estate.

Portugal has also been able to reduce its need to use gas to generate electricity, thanks to improved rainfall and the installation of more wind turbines. Last year, wind energy met 25% of total electricity demand, hydropower 23%, and gas-fired power plants 19%.

Weaning off gas was a particular challenge for Germany, which had become accustomed to powering its heavy industry with cheap imports from Russia in the decades before the invasion of Ukraine and the ensuing energy crisis.

Greece, which regained investment-grade status late last year, has seen record levels of tourism each year since the pandemic. The sector accounts for about a quarter of the economy and generated a 15.7% increase in revenue in 2023.

The construction industry has also been a major driver of growth, with building permits issued last year increasing by about 56% over 2019.

In another sign that Greece is emerging from its debt crisis, the sale of a 30% stake in Athens International Airport two months ago was the biggest initial public offering in more than 20 years.

–With assistance from João Lima and Sotiris Nikas.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link