[ad_1]

-

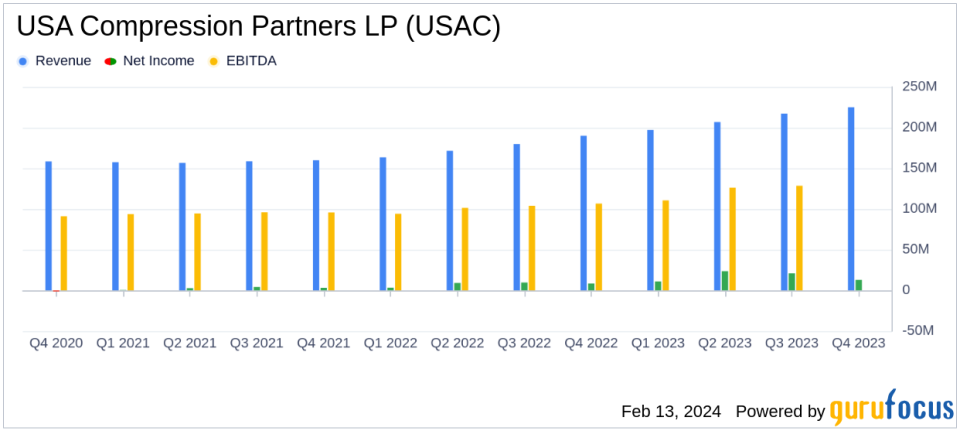

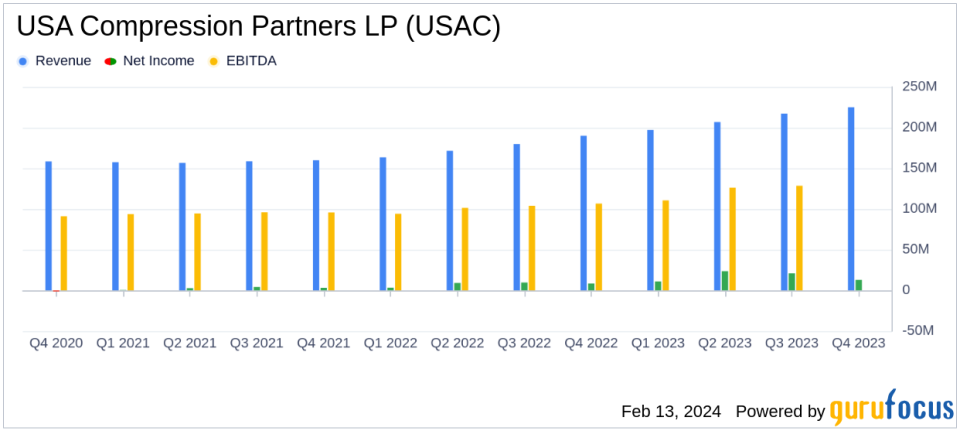

revenue: Achieved record total revenue of $225 million in Q4 2023, a significant increase from $190.1 million in Q4 2022.

-

Net income: Net income for the fourth quarter of 2023 increased to $12.8 million from $8.4 million in the same period last year.

-

Adjusted EBITDA: Reported strong performance with adjusted EBITDA of $138.6 million in the fourth quarter of 2023 compared to $113 million in the fourth quarter of 2022.

-

Distributable cash flow: Distributable cash flow increased to $79.9 million and coverage ratio increased to 1.48x.

-

Utilization and expansion: The average horsepower utilization rate reached up to 94.1%, and the average revenue horsepower achieved a record of 3.41 million horsepower.

On February 13, 2024, USA Compression Partners LP (NYSE:USAC) released an 8-K filing detailing one-quarter of its significant financial results. USAC, a leading provider of compression services for natural gas and crude oil production in the United States, reported record revenue and horsepower utilization for the fourth quarter of 2023.

Company Profile

USAC specializes in compression services essential to processing and transporting natural gas through domestic pipeline systems and increasing crude oil production through artificial lift processes. USAC engineers focus on several shale operations in the United States, including Utica, Marcellus, Permian Basin, and Eagle Ford, designing, operating, servicing, and repairing compression units while maintaining associated support inventory and equipment. We are doing

Financial and operational performance

The company’s financial performance for the fourth quarter of 2023 resulted in record sales of $225 million, a significant increase from $190.1 million in the same period last year. This growth is due to the company’s operational efficiency and high market demand for compression services. Net income also increased to $12.8 million from $8.4 million in the fourth quarter of 2022, despite a $10.5 million loss on derivative instruments.

USAC’s adjusted EBITDA for the quarter was $138.6 million, up from $113 million in the fourth quarter of 2022. This reflects the company’s ability to optimize operations and effectively manage costs. Distributable cash flow also increased to $79.9 million, resulting in a coverage ratio of 1.48x, demonstrating strong ability to cover distributions and invest in growth.

Operational highlights include record average revenue generating horsepower of 3.41 million horsepower and average horsepower utilization of 94.1%, demonstrating the company’s operational excellence and high demand for its services. Average monthly revenue per revenue generating horsepower was a record $19.52 in the fourth quarter of 2023, compared to $17.81 in the fourth quarter of 2022, further demonstrating the company’s pricing power and market leadership. I’m emphasizing it.

Financial status and future outlook

Commenting on the results, Eric D. Long, president and CEO of USAC, said, “Our fourth quarter results demonstrated consecutive quarterly record revenues, adjusted EBITDA, distributable cash flow, and It consists of distributable cash flow coverage.” He also expressed optimism for 2024, citing continued tightness in the high-horsepower compression market and expected increases in crude oil and natural gas production in major basins.

The company’s balance sheet reflects total asset value of $2.736 billion and net long-term debt of $2.336 billion, leaving the partners with a total deficit of $(293.285) million. Masu. Looking ahead, USAC provided full-year 2024 guidance for net income in the range of $95 million to $115 million and adjusted EBITDA in the range of $555 million to $575 million.

For value investors and potential GuruFocus.com members, USAC’s strong fourth quarter 2023 performance and positive outlook for 2024 make a compelling case for the company’s financial health and growth prospects. I am. The company’s ability to generate record revenues and maintain high utilization rates in a highly competitive industry speaks to its operational efficiency and strategic positioning.

For more detailed information and analysis, investors are encouraged to review the entire 8-K filing and consider how USAC’s financial results may impact their investment decisions.

For more information, please see the full 8-K earnings release from USA Compression Partners LP here.

This article first appeared on GuruFocus.

[ad_2]

Source link