[ad_1]

(Bloomberg) – Temasek Holdings plans to step up investments in Europe, undeterred by setbacks in a region the new regional chief hopes will offer big opportunities for Singaporean state investors.

Most Read Articles on Bloomberg

Nagi Hamie, head of Europe, Middle East and Africa, said the company aims to make up to S$25 billion ($18 billion) in net investments across Europe over the next five years. He is seeking partnerships with companies, including those with ties to the world’s richest businessmen.

“Europe is in a better place than it was a year or two ago,” Hamier said in an interview before the opening of Temasek’s Paris office. “I volunteered to come to Europe because I thought we had a lot of potential to play.”

He said the targeted investment increase could vary depending on opportunities and external events, but would represent a significant increase in Temasek’s European assets, with exposure to the region at 320% as of March 2023. It said it would reach 100 million euros ($34 billion).

Hamier’s commitment comes at a difficult time for Temasek’s European shares. Investments in Standard Chartered and Dutch payments platform Adyen NV have fallen from their peak, while healthcare and agriculture company Bayer faces lawsuits over Monsanto’s herbicide brand. , Bayer’s stock price plunged 51% in the year ending in March.

Mr Hamier said Temasek would not be able to solve problems with some of its European investments on its own. Instead, we have engaged in constructive dialogue with other investors and contributed ideas.

“Are we going to be activist investors? Absolutely not, it’s not in our DNA,” he said. “Our style is to do a lot of things behind the scenes, especially outside of Singapore.”

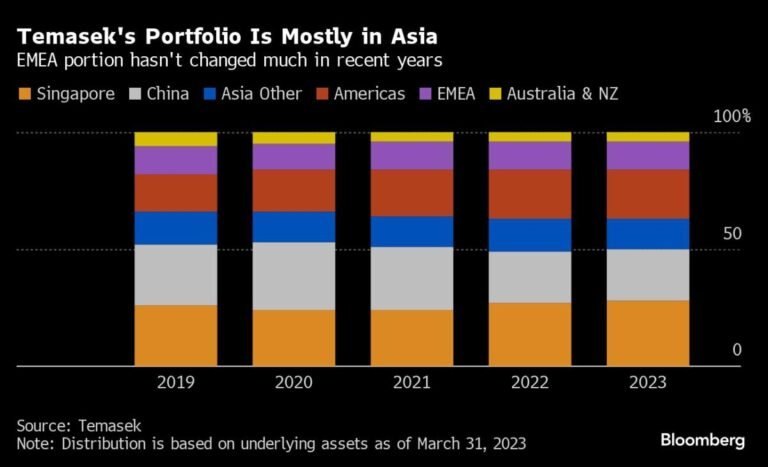

Temasek had S$382 billion under management as of March 2023. The broader EMEA region accounts for 12% of total assets.

Hamie, who rose through the ranks of the state-owned investor to become one of its top executives, previously led the portfolio development group as a troubleshooter and helped facilitate the integration of several of Temasek’s domestic subsidiaries. After living in Singapore for 28 years, he will now be based in Paris and will also lead the company’s energy investments.

The move to Europe comes at a critical time for Temasek, which celebrates its 50th anniversary this year. The profits are a major source of funding for the government’s national budget, and elections are expected to be held as early as this year.

Chinese assets have long been a source of growth for Temasek, accounting for 22% of assets under management as of March 2023, but have suffered from consumption and declining valuations. Additionally, 21% of the company’s portfolio is in the Americas, where stock prices have helped lift many sovereign funds, but more than half of its total holdings are now unlisted.

For Mr Hamier, expanding trade in Europe is necessary to make Temasek’s earnings more resilient in a time of geopolitical tensions, high interest rates and inflation. The region combines large conglomerates with strong cash flows and competitive advantages and a large domestic consumer base, providing a hedge against disruption elsewhere.

“The sweet spot for deals will be in the hundreds of millions of euros, because this way we reduce the number of deals and we can engage in more active portfolio management,” he said, adding that the Paris office initially had about It added that it has a staff of 12 people. “Our portfolio of new investments focuses on companies with very strong cash flows and pricing power.”

family ties

Temasek seeks to combine its Asian roots and long-term investment with European global companies and family businesses expanding into broader markets. Mr. Hamier will appoint John Elkann, CEO of Exor NV, Bernard Arnault, founder of LVMH, François Pinault of Gucci owner Kering SA, and Remo Ruffini, CEO of Moncler Spa, to the company. He was mentioned as someone with whom he has a very good relationship.

“We value family participation because our value proposition is for private clients who want to exit in five years with come-hell-or-high-water maturity issues. Because they may prefer working with us rather than an equity fund,” Hamier said. “We are much more flexible and can participate either as direct equity or as a capital stack.”

He said Temasek would be interested in investing in new energy, renewables and decarbonisation, as well as consumer health, luxury goods, technology, robotics and the “future of work”. .

Temasek is also in the early stages of “rediscovering” whether it can contribute to the boom in the Middle East market, but the EMEA chief said the rollout would be slow and far smaller than the opportunity in Europe. Instead, he said, its portfolio companies would most likely expand deeper into the region.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link