[ad_1]

European solar panel manufacturers warn they are “ready to shut down production lines” unless the EU takes urgent measures to save the sector, including buying back stocks built up in recent years due to an influx of cheap solar panels. are doing. Version from China.

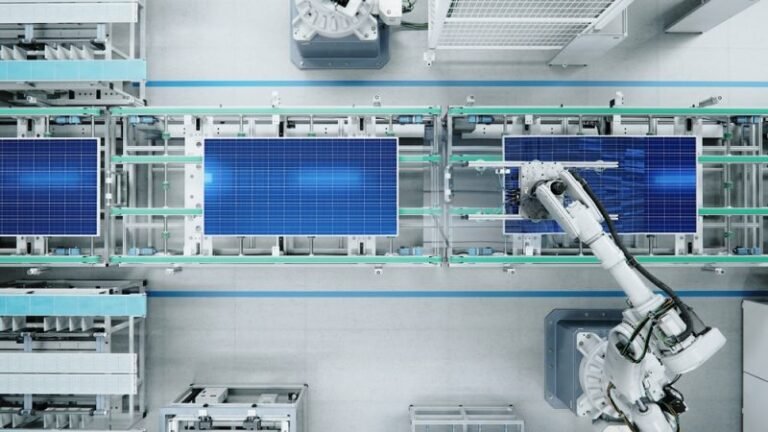

The EU wants to expand domestic production of key technologies such as solar panels, wind turbines and heat pumps to reduce dependence on China, which currently accounts for nearly 80% of the world’s share, as part of its “Green Deal industrial plan” I believe. Manufacture of solar power.

The European Commission wants to produce 40% of Europe’s solar panel demand in Europe by 2030, along with other key technologies.

The target is Draft “Net Zero Industry Act” (NZIA)which will be further negotiated between the European Parliament and EU countries on Tuesday (6 February).

But industry representatives warn that such efforts may be too slow.

“We are currently in an unprecedented situation,” Zygimantas Vaichunas, policy director at the European Solar Manufacturing Council (ESMC), told Euractic.

“This is a critical situation for producers,” he said, with European manufacturers on the brink of halting production in Europe.Swiss solar power manufacturer Mayerberger has already publicly announced Threatening to close shop in Germany If political action is not taken, production will be moved to the United States.

“The EU is currently entering a pivotal phase, with major PV increases in the EU over the next 4-8 weeks. [photovoltaics] “Module producers and their European suppliers are prepared to shut down production lines unless substantial emergency measures are implemented immediately,” ESMC said in a letter to European Commission President Ursula von der Leyen last week. This was stated in a letter, which was confirmed by Euractic.

On the afternoon of Monday 5 February, the European Commission will make a statement to the plenary session of the European Parliament on “The current state of the EU solar industry in light of unfair competition”.

Buy solar panels like a vaccine

European manufacturers can currently produce 6 gigawatts (GW) of solar modules per year, but in 2023 alone, the EU will Approximately 56GW.

Annual expansion is expected to increase further as EU countries decarbonise their energy systems. This allows countries like Germany to Warning Without Chinese modules, solar power capacity expansion goals, and by extension climate change goals, will not be met.

But over the past two years, solar modules have piled up in Europe and prices have fallen sharply, industry representatives lament.

Vaichunas said this was due to overproduction in China, which meant “we had to cut prices and export as much as possible.”

“Currently, there is a surplus of imported solar modules in ports and warehouses across the EU.” Estimates range from 70 to 85 gigawatts (equivalent to at least 140 million to 170 million photovoltaic modules),” the association wrote in a letter to von der Leyen.

“Chinese companies are selling solar modules below the cost of production,” Vaichunas said. As a result, European manufacturers could no longer sell their own modules.

European producers are therefore calling for the purchase of “the accumulated EU photovoltaic module stocks” through a special fund at EU level.

This would require purchasing about 800 megawatts (0.8 GW) of modules, which European manufacturers cannot sell, Vaitunas said.

The European Commission could create a “special purpose vehicle”, creating a new fund worth between 200 million and 250 million euros, said Dries Akke of SolarPower Europe. told Euractiv.

“We’re talking about important millions, not crazy millions,” Ack said.

No need to defend?

Vaichunas said he also supported the EU considering “trade defense measures” – new tariffs on solar panels from China – as a “last resort”, but Akke said: warned against this idea.

His association, SolarPower Europe, represents not only installers and European manufacturers, but also Chinese manufacturers, which Akke says truly reflects “the reality of solar power.”

“There is no way we can reach 2 degrees, let alone 1.5 degrees.” [of global warming] It’s protectionism,” Akke said.

Although Europe had already imposed tariffs on Chinese solar panels in the past, “solar manufacturing in Europe remains extinct,” he added.

According to one study, production in China is now about 35% cheaper than in Europe. report By the Joint Research Center of the European Commission.

However, industry representatives expect this gap to narrow in the coming years. “We expect prices to be at rock bottom right now,” Vaichunas said, adding that even for modules imported from China, “it’s clear that prices will rise in the future.”

Representatives from both industries expressed their hopes for the Net Zero Industry Act. The law would require EU member states to retain a certain percentage of subsidies for solar power expansion for modules manufactured outside China, such as in Europe or the United States.

“In two or three years’ time, things will be completely different because there are all these legislative initiatives going on,” Vaichunas said, referring to the NZIA and other EU legislation. Ban on importing products made with forced labor.

But the question, he said, was “how can European manufacturers survive in this really critical situation” while NZIA is not in force.

“What I’m talking about is in case we potentially lose these critical capabilities in the coming months. [a production capacity of] In principle, once we get to 6 GW, recovery after that will be even more difficult,” Vaichunas said.

(Jonathan Packroff | Euractiv.com – Edited by Natalie Weatherald)

Read more at Euractiv

[ad_2]

Source link