[ad_1]

Artist GND Photo

Synopsis

Simpson Manufacturing (New York Stock Exchange:SSD) is a company that designs and manufactures high quality wood and concrete building products. SSD’s 2023 revenue growth was significantly lower than the previous year. However, despite fluctuations in revenue growth, profit margins have remained strong over the years.Looking to the future, SSDs will It is in a favorable position to expand its market share in the fastener market. Furthermore, the two other major core markets have ample room for SSD to expand and provide the necessary tailwinds for business growth in the near future. However, the current stock price does not have a sufficient margin of safety. On top of that, SSD also faced a difficult macro environment in both the US and Europe. With these points in mind, I recommend his SSD hold rating.

Historical financial analysis

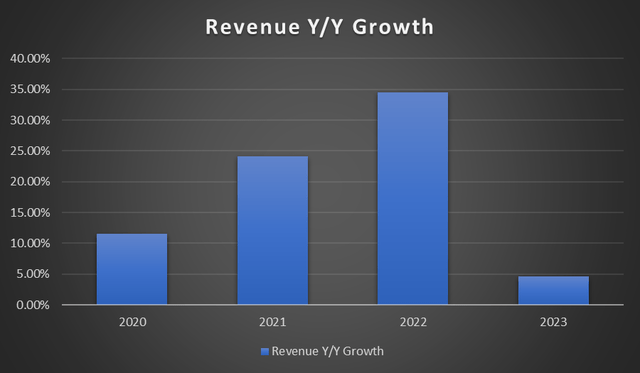

Based on the following graph, the revenue for 2023 is clear. Growth slowed significantly compared to the previous year. The decline in growth was due to a challenging environment, including a decline in U.S. housing starts. Europe also faced severe economic headwinds and a decline in construction activity.

author’s chart

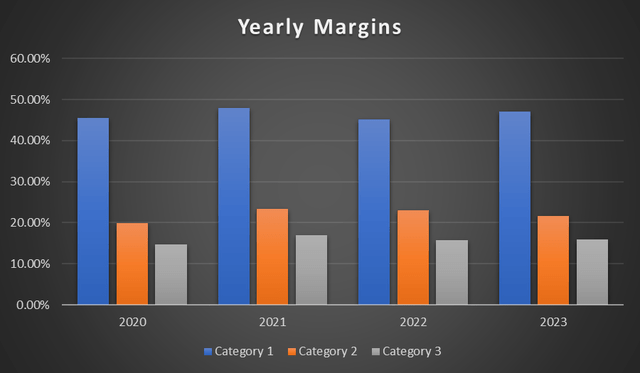

Despite fluctuations in revenue growth rates, SSD margins have expanded slightly over the past few years. Gross profit margin in 2023 is reported to be 47.1% compared to 45.5% in 2020s, operating profit margin is 21.46% compared to 19.88% in 2020s, and net profit margin is 15.9% compared to 14.75% in 2020s. Did.

Looking at the chart, 2021 was a year in which SSD margins expanded. After that, sales remained almost flat compared to the previous year. Margin expansion in 2021 was driven by higher product prices and lower labor and factory expenses.

author’s chart

FY2023 performance analysis

In fiscal 2023, SSD net sales increased by 4.6% year over year to $2.2 billion from $2.1 billion in 2022. This growth was primarily driven by the acquisition of ETANCO, a $12.7 million foreign currency translation benefit from the appreciation of European currencies against the U.S. dollar, and increased share in the SSD end market and product line. .

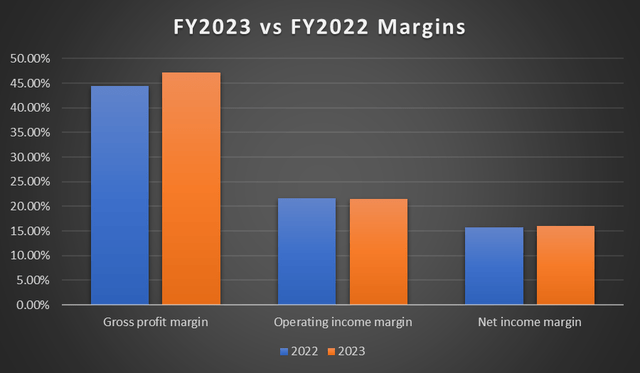

From a profit margin perspective, we analyze gross profit margin. [GPM]operating profit margin [OIM]net profit margin [NIM]. His SSD gross margin expanded from 44.5% to 47.1% in FY2023. This expansion was facilitated by the acquisition of ETANCO and lower raw material costs. Despite growth in GPM, OIM and NIM were nearly flat year over year.

The OIM and NIM reported in FY2023 were 21.46% and 15.9% respectively, while in 2022 OIM was 21.69% and NIM was 15.78%. The reason behind this is due to additional costs incurred in connection with SSD’s growth and expansion plans. However, management believes these additional costs will be well worth it as it expects future SSD sales volume CAGR to outperform the market. Finally, the reported EPS for fiscal year 2023 was $8.26, compared to $7.76 for fiscal year 2022, which represents approximately 6.4% year-over-year growth.

author’s chart

Key markets to watch still have room for growth

The company’s sales product lines can be categorized into wooden buildings, concrete buildings, and others based on SSDs. Of this, wooden construction accounts for the largest share of approximately 85% of total net sales. Concrete construction ranks second with 14.5%, with the rest coming from other segments.

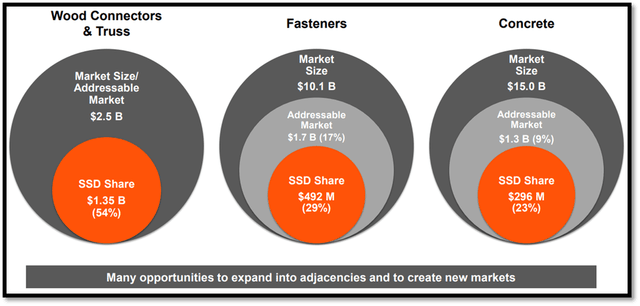

The main products in wooden construction are connectors, fasteners and lateral resistance systems. Products for concrete construction include anchoring products and construction, repair, protection and reinforcement products. Based on the following figure, it is clear that the major markets for SSD are large and there is enough room for SSD to continue to grow. For wooden connectors and trusses, SSDs currently only account for about 54% of the market share, or about $1.35 billion. The addressable wood connector and truss market is estimated to be approximately $2.5 billion.

In the case of the fastener market, SSDs only account for about 29% of the $1.7 billion market. However, the total market size for fasteners is approximately $10.1 billion. This means that the SSD addressable fastener market currently stands at 17% and still has the potential to expand. Finally, specifically, SSD market share is approximately 23% of the $1.3 billion addressable market. Similar to the fastener market, SSD serves only 9% of the $15 billion concrete market. Therefore, the specific addressable market for SSDs still has plenty of room to expand and grow.

SSD investor information

Well-positioned to expand into the $1.7 billion fastener market

SSD aims to become the global market leader in the $1.7 billion fastener addressable market given the significant growth potential this market offers. Additionally, expansion in this segment will also benefit connectors and lateral products. They are complementary to each other, resulting in multiple benefits.

SSD’s established channels and customer base in the building and construction market provides a strong foundation to drive growth in the fastener market. Additionally, our established manufacturing and supply chain processes are advantageously positioned to support our expansion goals. Therefore, in the future, it is expected that SSD will seek to increase its market share in this large market with great growth potential, strengthening its growth prospects.

Annual US housing starts and European construction activity create headwinds

Although consolidated net sales increased and margins remained relatively strong, it is important to highlight that annual U.S. housing starts declined by 9%. Despite this, his FY2023 North American net sales and sales volume for SSDs still grew only a modest 1%. However, it cannot be denied that this is a headwind for SSDs. The situation is not good in Europe, either, as management said the region is facing difficult economic challenges as well as a decline in construction activity.

Based on these considerations, management expects that difficult market conditions will continue through the first half of 2024, but will gradually subside as we move into the second half of 2024. If you look at the market forecast for his 2024 revenue for SSD, it’s about $2.32 billion. Compared to 2022, this represents a year-on-year growth of ~5.45%. Although this is an improvement from the 2022 growth rate, it is still lower than the 10-year median.

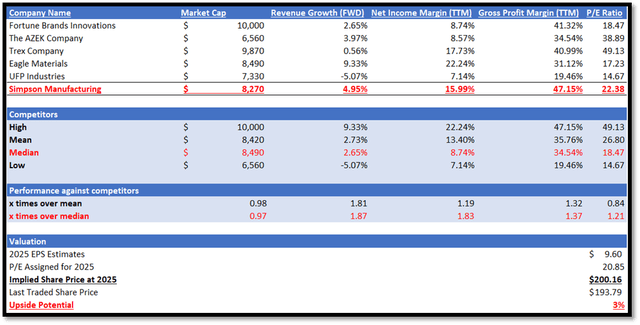

Relative evaluation model

In terms of company size, SSD is similarly sized compared to its industry peers. The company’s market capitalization is $8.2 billion, compared to the median market capitalization of its peers at $8.4 billion. Despite similar size, it outperformed its peers in terms of growth prospects and profitability. SSD’s future revenue growth is 4.95%, compared to the median of its peers of 2.65%. In terms of profitability, SSD also has a higher gross margin TTM of 47.15% compared to its peers’ median of 34.54%. SSD’s net profit margin TTM is 15.99%, which is higher than the industry median of 8.74%.

As a result of better metrics, SSD’s P/E of 22.38x is trading higher than its peer group’s median of 18.47x, which is justified. However, it is trading above the past five-year average of 20.85x. Trading above the five-year average P/E is not justified, given that 2023 sales growth and future growth are lower than the 10-year median of 9.41%.

The market forecast for SSD sales is $2.32 billion in 2024 and $2.45 billion in 2025. For EPS, the forecast for 2023 is $8.66 and the forecast for 2024 is $9.60. This estimate is reasonable and justified given the growth promoters and housing market headwinds discussed above. Applying a P/E ratio of 20.85x to the 2025 EPS estimate gives my price target of $200.16, representing a modest upside of just 3%.

Author rating model

danger

The upside risk to my hold recommendation is related to SSD growth potential in the target market. If the macroeconomic and housing issues in the US and Europe subside, this will provide a tailwind for SSD growth. Moreover, SSD is well-positioned to capture the large-scale fasteners market growth given its established channels and customer base, as well as robust manufacturing and supply chain processes.

conclusion

In conclusion, SSD’s revenue growth rate in 2023 has slowed down significantly compared to 2020-2022. This slowdown is due to lower housing starts in the US and severe economic headwinds in Europe. On the bright side, despite fluctuations in revenue, its margins actually remained strong over the same period.

The future outlook for SSDs is mixed. While there is still plenty of room for expansion in the company’s three core markets and it is well positioned to expand into the large zipper market, management believes that the challenging market environment that SSDs will face in 2023 is expected to increase in the first half of 2024. I expect it to carry over. However, the situation is expected to subside in the second half.

In terms of valuation, SSD is outperforming its peers, but its P/E ratio is a little too high. To remain conservative, I adjusted the P/E down to the five-year average. At this multiple, my price target indicates slight upside potential. Given the mixed outlook, the upside does not provide a sufficient margin of safety. Therefore, I recommend a Hold rating.

[ad_2]

Source link