[ad_1]

General_4530/Moment (via Getty Images)

Global PMI data for January suggested improving global economic conditions in early 2024, adding to a positive outlook, with the sun shining particularly brightly on the financial services sector as financial conditions ease.

However, further improvement depends primarily on the outlook for global interest rates and inflation.

Although there was welcome news in January of a decline in selling price inflation, there are signs that manufacturing costs will rise amid renewed supply constraints, particularly in Europe due to the Red Sea crisis and in sectors such as construction materials and food. Since this can be seen, future measures will be necessary. It will be closely monitored through PMI data over the coming months.

Delivery delays recur in Europe due to Red Sea attacks

S&P Global’s PMI Comment Tracker data reveals attacks on ships are in the red. Sea had a noticeable impact on the supply chain in January, impacting delivery times for various manufacturing sectors.

Unsurprisingly, the impact hit Europe hardest, with diversions to carriers around Africa adding up to two weeks to average lead times for European producers.

As a result, delivery times for UK and Eurozone suppliers have been extended for the first time in a year.

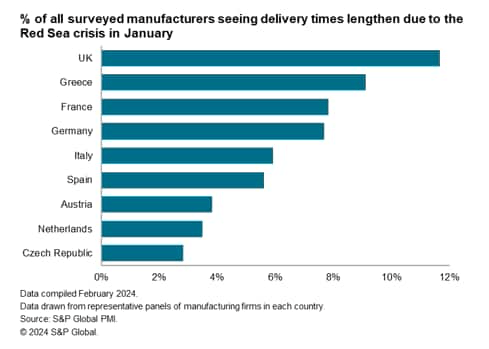

Of the European countries surveyed, UK manufacturing was the most affected, with 12% of the survey team saying lead times had worsened in January. Delivery delays were also common for producers in Greece (9%), followed by France and Germany (8%).

While Europe is facing the longest delays, other economies including South Korea, Australia and the United States have also reported disruptions to maritime-related supply chains.

Construction materials and food sectors face longest delays

To explore where supply delays were most pronounced by sector, we take a closer look at January’s global sector PMI data for further insight.

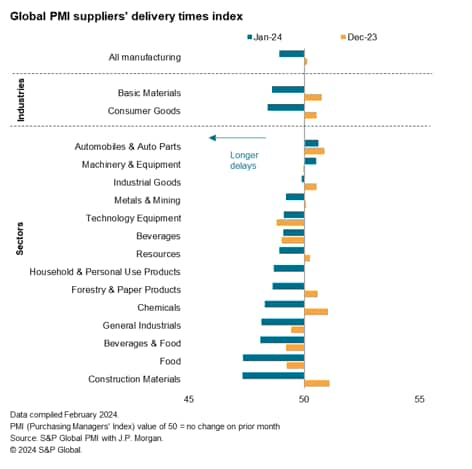

At a broad industry level, producers of both basic materials and consumer goods saw supplier delivery times lengthening in January after improving for 12 and 11 consecutive months, respectively.

Additionally, detailed sector data shows that lead times increased again in January in 14 sectors and half of the sector groups for which supplier delivery data is available.

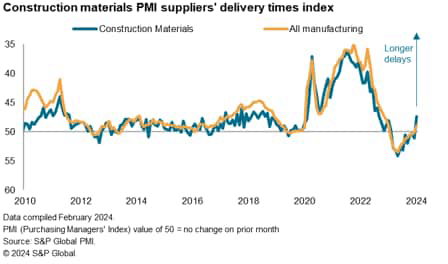

Of these, the construction materials sector saw the sharpest deterioration in vendor performance. Anecdotal evidence reveals that disruptions in the Red Sea and supply shortages are key factors in extending delivery dates to early 2024.

The beverage and food sector group follows with the second highest global delay rate, with food manufacturers in particular feeling the sharp deterioration in supplier performance.

Increased demand contributed to pressure on supply chains, but geopolitical turmoil and shortages were once again cited as the main reasons for delays in beverage and food shipments.

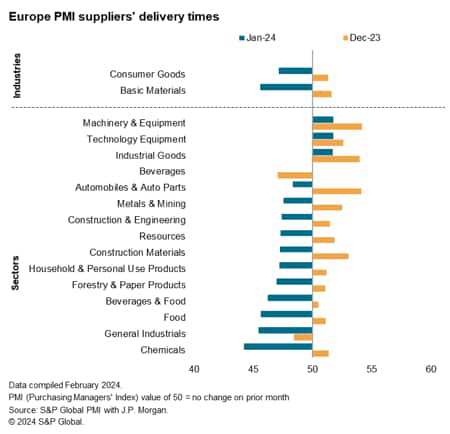

Looking specifically at Europe, disruptions from the Red Sea crisis were most prominently reported by PMI respondents, with vendor performance deteriorating again in both the basic materials and consumer goods industries, where supplier delivery times are tracked. did.

This was the case in two-thirds of the 15 detailed sectors tracked, with each supplier’s delivery index falling below the neutral mark of 50.0 for lead time extensions in January.

However, in Europe, the most notable deterioration in lead times in early 2024 was seen in the chemicals sector rather than construction materials, consistent with recent warnings from companies and observers in the sector. .

Most sectors build optimism and avoid Red Sea impact

One of the key questions to ask in the presence of delays due to Red Sea disruption is to what extent is this impacting business operations?

Encouragingly, the overall picture presented includes convincing signs that product producers show no inclination to build safety stocks, even as global manufacturing lead times are once again extended. There is optimism among private companies around the world, which have so far been largely unaffected by the Red Sea. .

Improved business optimism at the start of the year comes as private sector goods producers and service providers expect global central banks to cut interest rates in 2024, with easing financial conditions supporting demand. was greatly supported by.

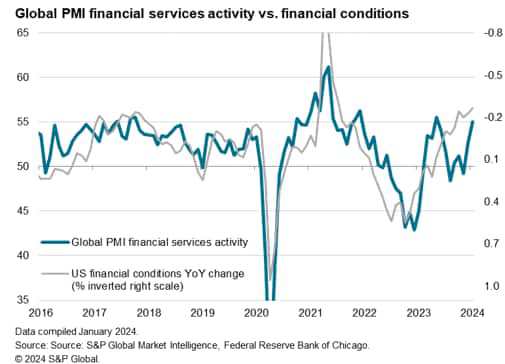

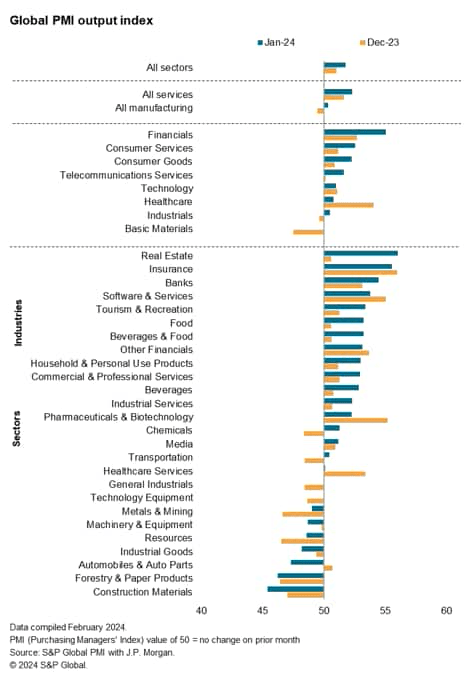

This is particularly evident in financial services activities, as the Chicago Fed’s Financial Conditions Index in the graph below shows, with the financial industry ranking first among eight industry groups in January due to easing financial conditions. surfaced.

The majority of the 26 detailed sectors and sector groups also saw increases in their respective business activity (output) indices at the beginning of the new year, unsurprisingly concentrated in services and service-related sectors.

On the other hand, it is noteworthy that the industrial products sector group was the only sector group to experience a deepening recession in early 2024, including both the construction materials sector and the machinery and equipment sector.

Delivery delays were a contributing factor in sectors such as construction materials (which faced the sharpest deterioration in vendor performance of the sectors surveyed), but anecdotal evidence suggests that the broader demand environment within the industrial products sector group Weakness continues to be the main root cause of production weakness. evidence.

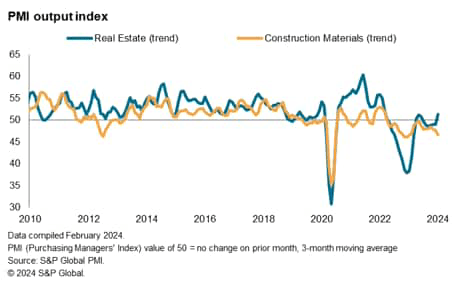

It must be added that the real estate sector, which has a strong correlation with the construction materials sector, improved at a more noticeable pace at the beginning of the year, thereby widening the gap with the latter.

It would be interesting to study when and how the convergence of the two occurs.

Increased manufacturing costs

Another important aspect to investigate is the impact of the recent Red Sea incident on inflation. As things stand, we are seeing increasing reports of rising shipping costs among manufacturers around the world, although not to the extent seen during the pandemic.

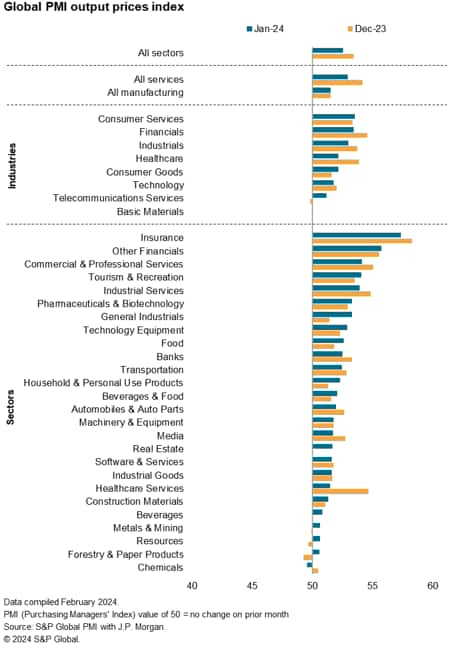

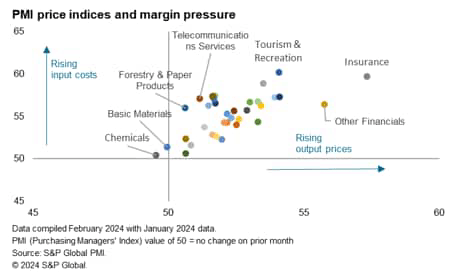

While the services sector remains at the top of the rankings for cost growth, cost pressures are beginning to rise again in various manufacturing sectors.

The good news is that the construction materials sector, the sector most affected by the Red Sea crisis, did not see higher costs due to increased transport delays.

However, given the reliance on shipping for bulky and heavy construction materials, the sector remains at risk, especially if, as noted earlier, demand and production in this sector become more concentrated in real estate activities. there is a possibility.

Meanwhile, the rapid rise in beverage and food costs will be worth monitoring given the impact this will have on headline consumer inflation. Global food costs rose at the fastest pace in four months, with production price inflation in the food production sector at its highest level since September 2023.

Although food price inflation is currently still below the global average for all goods and services, the prospect of increasing supply constraints, particularly in this sector, poses a risk of higher inflation and is a concern for policymakers. There is a possibility that there will be increased vigilance among consumers about lowering sales prices. Fee.

As things stand, warnings that food prices could soar as a result of the Red Sea conflict are making headlines in the media, including from major food supply companies.

Finally, sectors that are failing to pass on cost burdens to customers despite further increases in input prices should be on the watch list as well.

These sectors are typically most vulnerable to weak demand when inflation worsens due to geopolitical or other disruptions.

original post

Editor’s note: The summary bullet points in this article were selected by Seeking Alpha editors.

[ad_2]

Source link