[ad_1]

Anti-malware

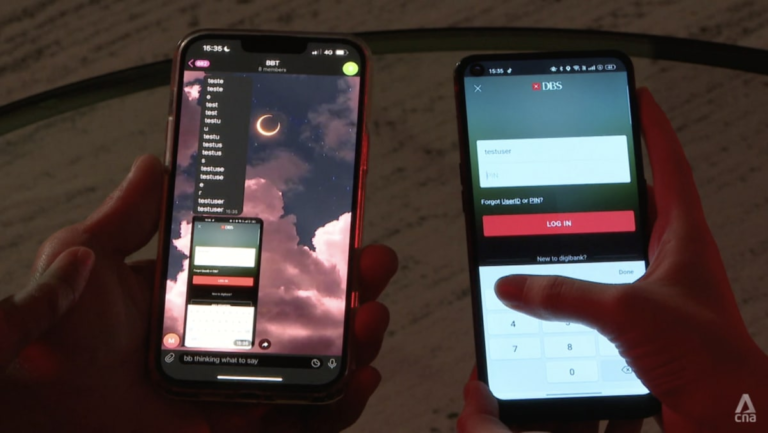

SPF detailed a series of measures implemented last year to combat the surge in Android malware scams.

In August, OCBC became the first bank in Singapore to block some customers from using internet banking and mobile banking apps if it detected potentially dangerous apps downloaded from unofficial portals. The move sparked backlash from customers at the time.

Since then, OCBC has prevented 276 customers from suffering losses of S$38.8 million. Loretta Yuen, general counsel and head of group legal and compliance at OCBC, said this could be due to sideloading a suspicious app and observing anomalies on the device, or to scams using malware that could result in losses from other banks. Finally, it said that it was based on customer reports that they had been affected. Thursday.

Various banks have also released upgraded versions of their apps with malware protection.

“Since then, malware-based fraud incidents have begun to decline significantly as more people upgrade their banking apps,” SPF noted.

In November 2023, Singapore’s three local banks (DBS, OCBC, and UOB) introduced a money lock feature that allows customers to secure some funds in their bank accounts that cannot be transferred digitally.

As of January, more than 49,000 MoneyLock accounts had been opened, with more than S$4.2 billion secured, SPF said. Other major retail banks also plan to phase in the money lock feature by June.

The Singapore Bankers Association director said in January that banks would continue to improve the design of their money lock features over the coming months.

Currently, DBS and UOB customers must set up a new account to use the bank’s Money Lock feature. OCBC customers do not need to set up a new account.

OCBC’s Mr Yuen told reporters that as of February 9, there was S$4.4 billion locked in OCBC accounts worth more than S$40,000. Approximately one-third of customers are over 50 years old, and nearly half are between 30 and 50 years old.

OCBC warned that the methods used by malware scammers are evolving and that more and more scammers are luring victims through their methods, making it appear as though the transaction was legitimate.

Yuen said the bank is considering two new measures and will announce details later.

One such measure aims to detect fraudsters who access victims’ banking apps without putting pressure on their phones. Another measure involves experimenting with “cognitive disruption,” such as changing certain language in OCBC’s banking apps to “break the spell” of fraud.

[ad_2]

Source link