[ad_1]

Western European tractor market

DUBLIN, March 25, 2024 (Globe Newswire) — The “Western Europe Tractor Market – Industry Analysis and Forecast 2024-2029” report has been added. ResearchAndMarkets.com Recruitment.

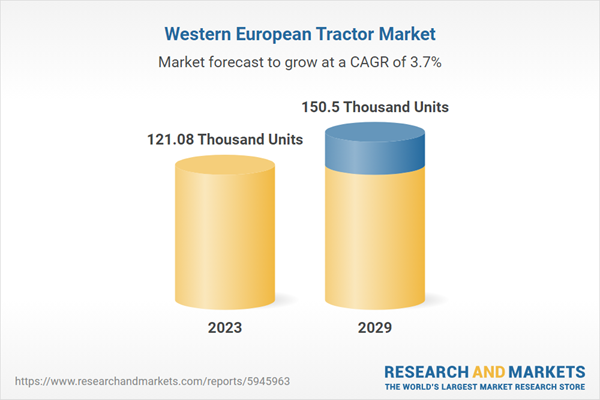

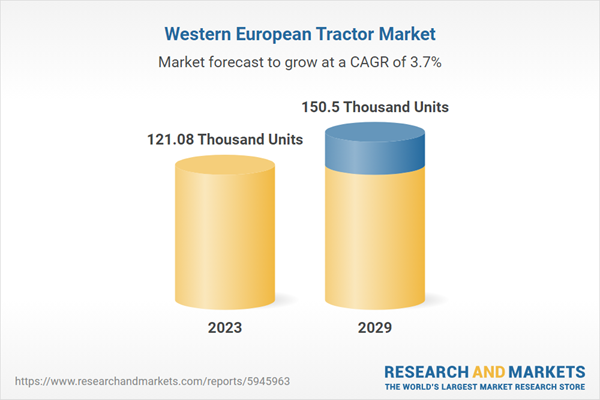

The Western Europe tractor market is expected to reach 150,500 units in 2029 from 121,080 units in 2023, registering a CAGR of 3.69% from 2023 to 2029.

The Western European tractor market is characterized by various global vendors accounting for the majority of the market share. Therefore, it is difficult for new entrants to compete with existing vendors in the market. The main competitive factors of market players include efficiency, product reliability and availability, after-sales service, and price.

Major players in the Western European tractor market include John Deere, CNH Industrial, AGCO Corporation, and Kubota Corporation. These companies invest heavily in research and development to develop new and innovative tractor technology. We are also expanding our presence in emerging markets to take advantage of the growing demand for agricultural tractors.

Main highlights

-

The tractor industry in Western Europe is expected to grow in the coming years due to population growth, increasing urbanization and changing dietary habits.

-

The agricultural tractor market is highly concentrated, with top companies controlling large parts of the industry. Meanwhile, national and global brands are equally represented within the industry.

-

Western Europe agricultural tractors market grew 3% in 2023 from 2022. The increase in crop production and tractor sales is due to government support for farmers and favorable climatic conditions.

Market trends and drivers

Market opportunities and trends

-

Growing focus on smart and autonomous tractors

-

Use of energy efficient agricultural tractors

-

agricultural labor shortage

-

Declining interest in agriculture

-

youth involvement

-

Factors enabling market growth

-

Government subsidy/loan support system

-

Increased food consumption and export of organic products

-

Increased farm mechanization

market constraints

-

Lack of awareness of the latest agricultural machinery innovations

-

High demand for used and rental tractors

-

Negative impact of climate change on agriculture

Technological advances in tractor technology

The confluence of agriculture and digital technology has created new frontiers of innovation, opening multiple paths to the future of smart agriculture. Tractor manufacturers are competitive, constantly innovating and striving to differentiate their products at affordable prices. Tractors based on the most advanced technology are now available in the industry. GPS and remote sensing make agriculture more accurate and productive.

Increased adoption of energy efficient tractors

Governments such as Germany, France, Italy and the UK are targeting a 40% reduction in GHG emissions by 2030 and zero emissions by 2040. Due to environmental concerns and automation, the use of electric tractors is increasing, especially in developed countries. Reduce costs and dependence on traditional diesel tractors.

Segmentation insights

Insights by Horsepower

The 100+ horsepower segment recorded a high market share in the Western European tractor market in 2023. The key factors accelerating the growth of high-power range tractors are farm expansion and consolidation, adoption of precision agriculture, and availability of medium and medium-duty tractors. Large farms and operational flexibility.

Trends driving the sale of tractors in the 100+ horsepower range in the Western European tractor market include:

-

Increased mechanization and farm consolidation: As farms become larger and labor costs rise, farmers are turning to higher-powered tractors to handle a wider range of tasks more efficiently.

-

Demand for higher agricultural productivity: Farmers are looking for ways to increase yields to meet growing food demands. Powerful tractors allow you to plow larger areas, plant faster, and harvest more efficiently.

-

Employing precision farming technology: High-horsepower tractors are often equipped with precision farming technology, such as GPS guidance and automatic steering, which improve accuracy and reduce waste.

-

Government initiatives: Many governments offer subsidies and other incentives to encourage farmers to adopt modern farming methods, including the use of high-performance tractors.

-

Transition to commercial farming: The rise in commercial farming, which requires large-scale equipment, has also increased the demand for high-horsepower tractors.

Insights by drive type

The tractor market in Western Europe is dominated by low mileage HP 2WD tractors. Among the several tractor models available in the country, his 2WD tractor is the most popular among farmers. 2WD tractors are becoming increasingly popular among farmers due to their relative low cost of ownership, adequate functionality and carrying capacity, and customary practices. Additionally, industry players are trying to redesign his 2WD tractors with more powerful and easy-to-handle features so that farmers can upgrade their tractors or purchase and use new tractors.

regional analysis

France dominated the tractor market in Western Europe, accounting for more than 80% of the share in 2023. France is a prominent agricultural hub in Europe and ranks as the sixth largest agricultural producer in the world. It accounts for approximately one-third of Europe’s arable land and half of its total area is arable. Factors that have facilitated the introduction of mechanized agriculture include the consolidation of small farms and the increase in average farm size, which provides economies of scale. Moreover, France exhibits the same characteristics as the German and British markets, with demand for high horsepower tractors exceeding the entry level. Sales of tractors with over 100 horsepower are expected to drive the French agricultural tractors market during the forecast period.

Vendor scenery

Main company overview

-

Dear & Company

-

CNH Industrial

-

Agco

-

mahindra

-

Kubota

Other notable vendors

Key attributes:

|

report attributes |

detail |

|

number of pages |

209 |

|

Forecast period |

2023-2029 |

|

Estimated market value in 2023 |

121.08 thousand units |

|

Predicted market value to 2029 |

150.5 thousand units |

|

compound annual growth rate |

3.6% |

|

Target area |

Europe |

Split report

Segmentation by horsepower

-

less than 25 horsepower

-

25-35 horsepower

-

36-45 horsepower

-

46-65 horsepower

-

66-100 horsepower

-

100HP or more

Segmentation by drive type

-

two wheel drive

-

four wheel drive

For more information on this report, please visit https://www.researchandmarkets.com/r/w7t1g9.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[ad_2]

Source link