[ad_1]

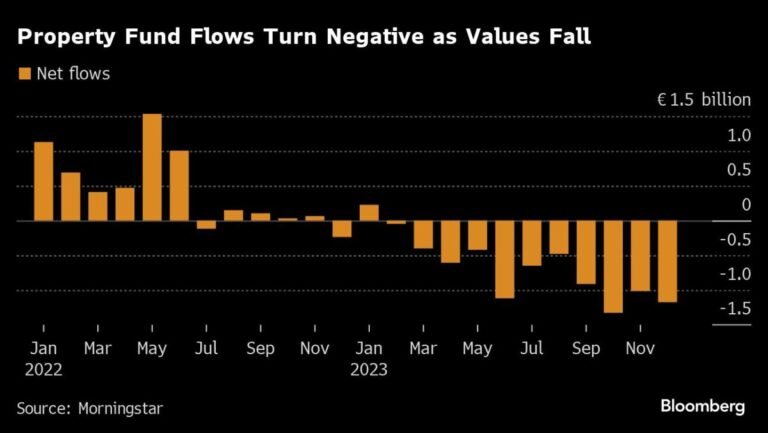

(Bloomberg) — Private investors are withdrawing more than 1 billion euros a month from European real estate funds, as weak demand and rising borrowing costs raise concerns about commercial real estate valuations.

Most Read Articles on Bloomberg

Due to redemptions, the total net assets held by European open-end listed real estate funds fell by more than 10% from December 2022 to the end of last year to 180.7 billion euros, according to data compiled by Morningstar. Outflows have now been recorded for 11 straight months as the end of cheap money made the asset class less attractive.

Investors are currently nervous, particularly about the U.S. commercial real estate market, but this week their concerns shifted to Europe, where bonds issued by the likes of Deutsche Pfandbriefbank fell due to their exposure to the market. European Central Bank officials warned last year that real estate funds accounted for 40% of the eurozone’s CRE market and posed a threat to financial stability.

The mismatch between the liquidity provided to property fund investors and the illiquidity of their assets has meant that many UK funds have had to immediately cease trading and sell their assets following a surge in redemption requests. This became clear in the aftermath of the unfortunate Brexit vote. The story of gates is being repeated there during the coronavirus pandemic, many of which are now closed.

Savills researcher Oliver Salmon said last week: “Many open-end funds are under pressure to sell to meet increasing redemption demands.”

Still, if the ECB starts cutting rates as expected and the soft landing narrative proves accurate, we expect the outlook for CRE to improve later this year.

Redemptions across Europe exceeded €1 billion in each of the last three months of 2023, according to Morningstar data. German investors, who must give a year’s notice before withdrawing funds, withdrew more than 750 million euros from German real estate funds in the last five months of this year, according to Bercow Consulting.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link