[ad_1]

Schmidt said the European industry has enjoyed “the biggest subsidy in the history of the solar industry” in the form of an energy price spike caused by the war in Ukraine. The spike has led to a procurement gold rush as distributors like him overorder stock to meet demand that doesn’t actually exist.

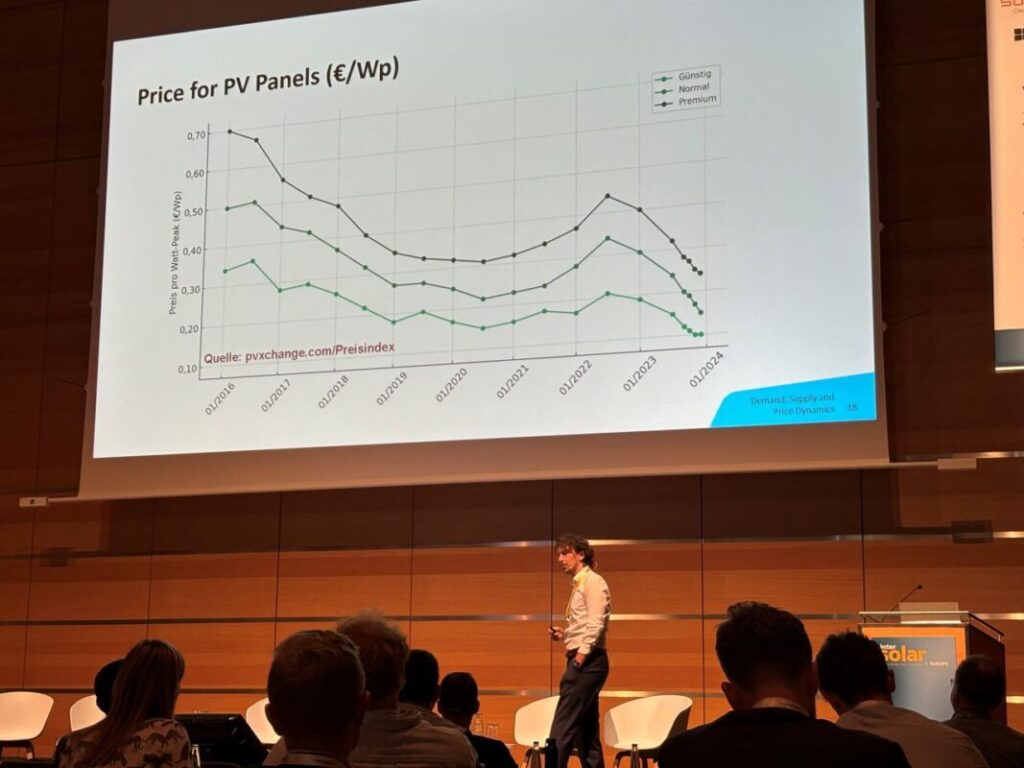

But as the energy crisis eased and those “subsidies” effectively disappeared, the market shifted from sellers to buyers, causing prices to collapse. For companies like his that have unsold inventory sitting in warehouses, price competition is now “extremely intense,” Schmidt said.

“We also need to understand that the subsidies are going away and the storm isn’t over yet,” Schmidt said. “There’s so much competition at every level – installers, distributors, manufacturers. It’s crazy. Everyone is selling at crazy prices and the end consumer is very lucky right now. So tell all your friends: Now is the time to buy.”

Schmidt predicted that this situation would continue, leading to further price declines.

“Banks are no longer willing to lend money to solar companies. It will probably lead to a market-wide and industry-wide bankruptcy and then it will get very bad because we will start to see sell-offs. We are already seeing that in some ways, but we haven’t reached the bottom yet.”

He said the problem was exacerbated by the level of “price transparency” in the industry, with online marketplaces such as eBay being a preferred sales venue for solar equipment.

“I think one of the biggest resellers of PV related products (inverters, modules, etc.) right now is eBay. You can find everything on eBay at any price. It’s amazing. That’s always the case at this stage of the market.”

He concluded by urging the entire industry to think more carefully about whether demand is real or imagined during any future boom.

“I’m sorry, but I don’t have an answer for you right now. I just ask you to think again about what the real demand is, and then I think you can make a better decision next time.”

[ad_2]

Source link