[ad_1]

(Bloomberg) — Euro zone leaders trying to keep populist parties at bay are unlikely to get much help from the economy this year, even if the European Central Bank cuts interest rates.

Most Read Articles on Bloomberg

With European Parliament elections scheduled for June, 2024 means that for many of the continent’s established political classes, 2024 risks the rise of movements from France’s National Rally to Germany’s AfD. Stands out. Germany’s state elections in September are also a cause for concern.

This schedule coincides with an expected easing of economic contraction as global and euro area growth accelerates, inflation subsides and high borrowing costs are expected to reduce. However, the potential for such feel-good factors does not seem to be that great at this point.

“In the long run, we will see full employment, strong wage growth and probably less inequality,” said Holger Schmieding, an economist at Berenberg in London. “But I don’t think we’ll see any impact until the European elections in the autumn or the German state elections. That’s too short-term.”

Germany has been in the spotlight this year, with Chancellor Olaf Scholz’s coalition government struggling with budget problems and support for the AfD surging.

The election will be held in three eastern states where the party currently has a large lead in opinion polls and where the government is pouring money into subsidies to encourage job creation.

Further darkening the political picture are several strikes, first by train drivers and then at airports and local transport.

Farmers have also been protesting in other countries, including Germany and France, where President Emmanuel Macron’s party has lagged behind Marine Le Pen’s national rally for almost a year.

The good news is that the labor market shows little sign of weakening and the region’s economy is on track to improve over last year. Still, as ECB President Christine Lagarde acknowledged last month, the prospects are limited.

He said on January 25 that even though the survey results “point to further acceleration in growth,” “the upcoming data continues to suggest weakness in the near term.”

This is in line with the International Monetary Fund’s forecast last week, which showed eurozone expansion accelerating modestly from 0.5% in 2023 to 0.9% this year.

Of the four largest economies, officials say only France and Germany are seeing improved performance, although their fiscal stalemate still casts doubt on the outlook.

And even if the ECB cuts interest rates, it may not immediately result in a big change in growth.

Using the SHOK model created by Bloomberg Economics, we consider two scenarios. One scenario is that the policymaker begins his quarter cut in borrowing costs in March and every subsequent decision, and the other is that he begins cutting interest rates in June. This is the slow timeline that policymakers tend to suggest. .

The former would boost gross domestic product by about 0.22 percentage points by the end of the year compared to the latter, and exceed the growth rate in 2024 by just over 0.1 percentage points. This means that the influence on voters going to the polls is minimal. Additionally, there is reason to be cautious as authorities focus on suppressing prices.

“If the ECB wanted to boost the economy in time for the EU elections, it would have had to cut interest rates already,” said Guntram Wolff, head of the German Council on Foreign Relations in Berlin. “It is natural that the ECB is more concerned about reputational risk, because inflation has been above the 2% target for a long time and that is what people remember.”

One thing that might cheer voters would be relief from the cost of living crisis. Growth in real incomes (inflation-adjusted wages) has been negative for many years, but is likely to accelerate in the future.

Berenberg’s Schmieding said improved living standards due to higher wages and price stability could change perceptions. But he cautioned that consumers are likely to focus more on recent experiences.

“People are still angry about high prices,” he says. “He expects the political situation to calm down in the long term as the economic situation improves for low-income households, which have been hit hard by soaring energy prices.”

The delay in cheering there coincides with the European Commission’s Eurobarometer survey from December. In 22 countries, the majority of respondents said their standard of living has declined and is not expected to improve over the next 12 months.

Meanwhile, Germany faces the continuing challenge that consumer price inflation will take longer to reach the ECB’s 2% target than other major euro zone countries, according to Bundesbank forecasts.

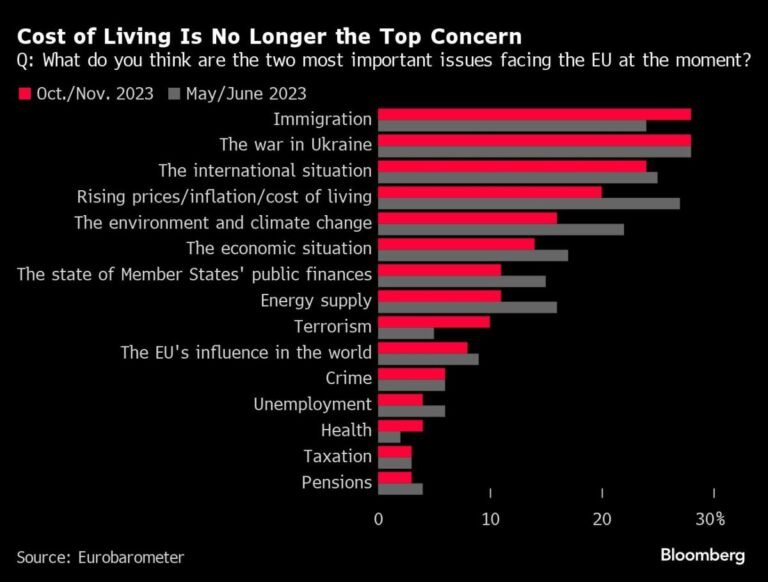

Moreover, it’s not just inflation and the cost of living that push voters into extreme situations. These issues were the top national concerns, while migration and the war in Ukraine were the top concerns for the entire region, according to Eurobarometer.

This speaks to the deep psychology behind the shift to populist parties.

“The key is financial insecurity: the fear of losing your job, not being able to get into a well-known field or profession, or not being as well off as others,” says Berlin-based Harty. – Dean of the school and professor of international political economy. “The far right exploits economic insecurity and fuels fear about the future.”

EU-skeptical parties could win more than 25% of the vote in June elections and top opinion polls in nine of the EU’s 27 member states, according to the Eurasia Group.

Regardless of the outcome, there is little room for convincing voters on the financial front, as governments are focused on debt restructuring to reduce borrowing in the eurozone, which accounts for about 90% of economic output. Europeans have little choice but to swallow the bitter pill of having less money in their pockets.

“Governments need to cut spending even as consumers continue to suffer from rising mortgage costs and store prices,” said Lena Komileva, chief economist at G+ Economics. “The cumulative increase in wages will be less than the increase in costs faced by consumers,” she said.

–With assistance from Mark Schroers, Kamil Kowalcze, Sonja Wind, and Maeva Cousin (economists).

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link