[ad_1]

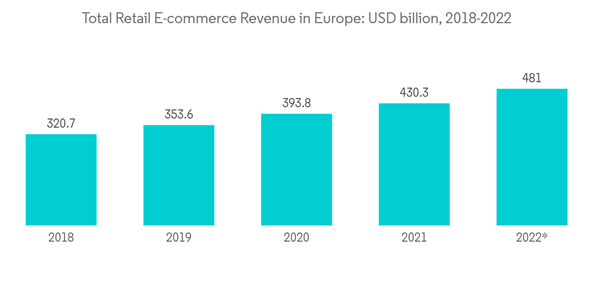

European Contract Logistics Market Total Revenue of Retail E-Commerce in Europe USD Billion 2018 2022

DUBLIN, Feb. 26, 2024 (Globe Newswire) — The “European Contract Logistics – Market Share Analysis, Industry Trends and Statistics, Growth Forecast 2020-2029” report has been added. ResearchAndMarkets.com Recruitment.

Europe Contract Logistics market size is estimated to be USD 78.48 billion in 2024 and is projected to reach USD 89.6 billion by 2029, at a CAGR of 2.69% during the forecast period (2024-2029). grow in

European contract logistics market trends

Contract logistics market experiencing significant growth

The proportion of outsourcing in contract logistics is low, indicating clear growth potential. Globally, contract logistics accounts for only 10-15% of the total market. In Europe, this proportion is estimated to be around 20%. The scope of outsourcing varies widely from country to country. Transportation and storage services are typically largely outsourced.

E-commerce is expected to be a major driver of outsourcing growth. As the e-commerce market grows rapidly, so too do consumers’ expectations for faster and more reliable delivery. As a result, outsourcing of warehousing and order processing is expected to increase. Contract logistics offers e-commerce companies of all sizes the benefits of business control, advanced technology solutions, reduced risk, and scalability.

Contract logistics companies provide services to online businesses and leverage their global network to help them enter new markets. It also helps you get closer to your customers by offering a choice of delivery options and handling customs and value-added tax (VAT) services.

Contract logistics companies provide professional services to companies that manufacture household appliances, communications equipment, computer equipment, and other high-tech products. These help these companies reduce inventory, reduce distribution costs, and launch new products.

Growth in the manufacturing industry is expected to increase demand for contract logistics services

Manufacturing is the backbone of the European economy. Europe holds leading positions in many industrial manufacturing sectors such as machinery and pharmaceuticals. Overall production accounts for 17.3% of the EU’s GDP and 83% of its exports, making Europe the world’s largest exporter of manufactured goods. Furthermore, manufacturing causes 20% of global R&D investment and produces one-third of high-quality scientific publications.

European industry, especially European engineering and manufacturing companies, engages in significant research and innovation. In Europe, there is a long tradition of pre-competitive collaboration. Companies operate within regional innovation and industry ecosystems, often led by world-class companies and involving small and medium-sized enterprises and research institutions in the process.

Europe’s largest countries, such as Germany, the United Kingdom, France, and Italy, traditionally dominate manufacturing. As service orientation increased in these countries, manufacturing industries suffered large losses due to relocation of manufacturing industries and a decline in general employment. Fortunately for Europe, much of its manufacturing has just moved to Central and Eastern Europe, rather than moving overseas. Countries such as Poland, Slovakia and the Czech Republic play a major role in European manufacturing. These countries and their neighbors are experiencing tremendous growth in manufacturing, contributing to Europe’s re-identification as a global manufacturing center. Developed countries in Europe are very important because the necessary infrastructure and skills can be developed quickly. This is expected to create a trend towards reshoring manufacturing to Europe, with automation often being one of the reasons for reshoring to Europe.

European contract logistics industry overview

Prominent players in the market include Deutsche Post DHL Group, Schenker AG (DB Schenker), Ceva Logistics, DSV AS, and SNCF Logistics/Geodis. These European-based players have a large presence all over the world. Although these large companies have a strong presence across the region and account for a significant market share, the market remains somewhat fragmented, with many companies providing contract logistics services at various levels.

Companies need to constantly evolve with industry trends. This will likely help you gain new customers and build a stronger foothold.

Most major companies are based in the Western European region. The number of local contract logistics providers in the CEE region is relatively small. This is an opportunity for existing local logistics companies in the CEE region to enter the contract logistics market and capture a significant market share.

For more information on this report, please visit https://www.researchandmarkets.com/r/8inpjp.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[ad_2]

Source link