[ad_1]

(Bloomberg) — Volkswagen, Renault and Stellantis are thinking the unthinkable, seeking alliances with stalwart competitors to build cheaper electric cars and head off an existential threat. There is.

Most Read Articles on Bloomberg

The sense of crisis is growing as Chinese rivals and Tesla Inc. expose the competitive weaknesses of Europe’s biggest consumer car maker, making it clear that a business-as-usual approach is a losing option.

Carlos Tavares, CEO of Stellantis NV, which was created through the merger of Italy’s Fiat and France’s Fiat in 2021, said: “In the future, companies that are not suited to face Chinese competition will be in trouble.” I am fully aware that this is the case.” PSA Group said in an interview last week. He previously said Europe’s car industry faced a “catastrophe” if it did not adapt.

Pressured by the slowing pace of EV adoption, auto executives are toying with ideas ranging from pooling development resources to bundling operations across Europe’s borders to boost competitiveness in a once-in-a-generation shift. are being discussed. The next few months will be crucial.

Full-electric vehicle sales this year are expected to grow at the slowest rate since 2019, as competition intensifies due to an unexpected loss of momentum rather than eliminating gas-guzzling vehicles, according to BloombergNEF. It is said that Even Tesla has been affected by the economic slowdown, which has led to widespread discounting. The 20% share price drop this year has wiped out about $150 billion from VW’s market capitalization. This is more than twice as much as VW.

Headwinds to the sector include governments ending incentives, rental companies balking at rising repair costs, and consumers growing frustrated with climate change policies that affect their household finances. Examples include being present. Elections in the US and Europe could further heighten anti-EV sentiment as we approach a tipping point.

Stricter emissions regulations will come into effect in the European Union in 2025, meaning manufacturers will have to sell more battery-powered cars or face steep fines. In an unlikely worst-case scenario, Volkswagen AG could lose more than 2 billion euros ($2.2 billion) if it fails to sufficiently reduce vehicle emissions, according to Bloomberg calculations based on company and regulatory data. You may be subject to a fine.

As pressure mounts on European automakers to sell more EVs, China’s state-backed manufacturers are entering the cooling market with better and cheaper models.

BYD’s Dolphin, for example, is listed for about 7,000 euros less than the similarly equipped VW ID.3, which the German automaker originally pitched as the Beetle of the EV era. The Chinese manufacturer plans to underline its European ambitions at next week’s Geneva auto show by unveiling several electric models, including a luxury SUV to rival the Mercedes-Benz G-Class.

Unless European carmakers come up with a viable Plan B, there is a risk of major disruption to the industry, which employs around 13 million people and accounts for 7% of the EU economy.

“As an industry, we have spent billions of dollars to enable electric mobility,” said Holger, who heads ZF Friedrichshafen AG, a German parts manufacturer that employs about 165,000 people worldwide.・Mr. Klein says. “The question here is, do we have the right parameters?”

Renault SA CEO Luca de Meo has advocated a partnership similar to the one that pooled assets in Germany, France, Spain and the UK to create a European aircraft maker to compete with Boeing Co. ing. The executive argues that an “Airbus of cars” would allow the company to reap the benefits of larger EVs while sharing the huge costs of producing cheaper ones.

Interest in broader cost sharing was piqued late last year when Renault unveiled a concept for an electric city car for less than 20,000 euros, half the price of VW’s ID.3. DeMeo’s efforts are inspired by Japanese light cars. Popular light vehicles are manufactured by multiple manufacturers and receive preferential treatment from regulators.

Various approaches are emerging. While Stellantis’ Mr. Tavares has openly discussed his interest in mergers and acquisitions, other companies are focused on less onerous partnerships.

Renault’s Mr. De Meo last week downplayed speculation about a major merger, saying on Bloomberg TV that agility is more important than size. He acknowledged that talks on a joint EV platform are taking place “left and right”.

“It’s very difficult to make money on small cars, so we’re very open to sharing that kind of investment,” said DeMeo, who previously worked at Volkswagen and Fiat. “We’re trying to find a way.”

Europe’s upheaval could spill over into the U.S., with General Motors and Ford Motor Co. also cutting back on investments in electric vehicles and signaling a willingness to partner with other companies in the industry. President Joe Biden’s administration is considering giving manufacturers more time to transition to electric vehicles, The New York Times reported over the weekend.

Traditional automakers are returning more money to shareholders as they scale back investment plans, showing that resource scarcity is not an issue. GM, Ford and Stellantis spent a combined $22.7 billion on stock buybacks and dividend payments last year, and Renault last week proposed its largest shareholder dividend in five years.

When the EU approved plans last year to effectively stop sales of new internal combustion engine cars from 2035, it wasn’t supposed to work out this way. There are many reasons for the deterioration of EV sentiment. Consumers experience software glitches and end up with unexpectedly high operating costs. Due to the complexity of maintenance, EVs cost more to insure than conventional vehicles, for example in the UK they cost twice as much. But for mainstream buyers, affordability may be the biggest hurdle.

Read more: Sluggish demand for used EVs makes it difficult to sell new cars

However, BNEF analyst Colin McKerracher said the downturn is expected to be temporary as battery technology and charging infrastructure improve.

Still, the disconnect between expectations and reality is causing pain. At its electric vehicle hub in the eastern German city of Zwickau, Volkswagen has laid off more than 200 temporary workers and cut shifts on one of its assembly lines.

Talks on EV cooperation could be important for Volkswagen as the auto giant struggles despite huge investments. In the aftermath of the 2015 diesel scandal, Europe’s largest automaker launched perhaps the industry’s most ambitious EV push under then-CEO Herbert Diess. But buggy software delayed the launch of major electric models and contributed to his ouster in 2022.

His successor, Oliver Blume, reversed a number of initiatives, including scrapping a 2 billion euro factory in Germany. Management has instructed employees to prepare for additional cost reductions this year.

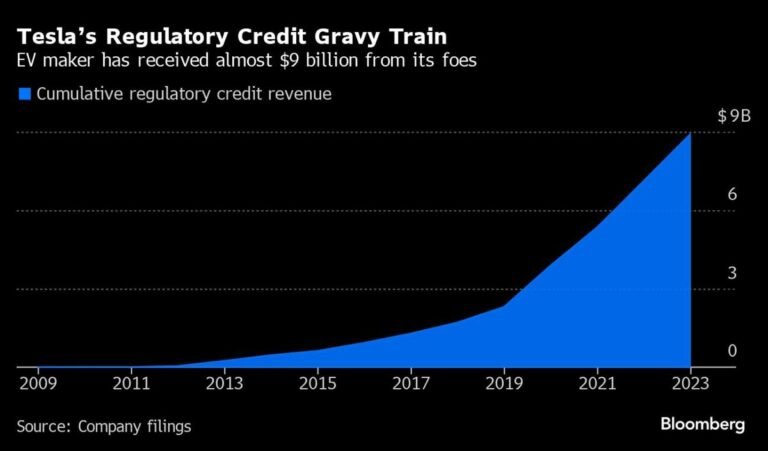

Unless European automakers can get their strategies back on track, they risk falling further behind, and efforts to meet regulatory rules could force them to hand over even more money to Tesla to buy emissions credits. It could mean – literally just money.

They may have one last chance. Volkswagen, Stellantis and Renault are all working on their own sub-€25,000 models, while Mercedes and BMW plan to launch several new EVs with improved technology by mid-decade. is.

A last resort may be to sue for further trade and regulatory protections. The EU is planning to consider a phase-out plan for conventional cars, and manufacturers are already preparing for a coordinated lobbying campaign immediately after the European Parliament elections in June, according to people familiar with the matter. The European Commission is already investigating the extent to which China supports its EV industry, which could lead to additional tariffs as early as July.

Read more: Why is Europe pushing back against China’s EV influx?

Delaying the end of internal combustion engine cars may offer some respite, but it won’t solve the competition problems that are holding back Europe’s transition to the electric age.

“There’s a lot of nervousness among CEOs and boardrooms about what 2024 will look like, and there’s a lot of wait-and-see attitude,” said Alexandre Marian, managing director at AlixPartners in Paris.

–With assistance from Elisabeth Behrmann and Craig Trudell.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link