[ad_1]

Every May, thousands of horse racing fans flock to Churchill Downs to watch the Kentucky Derby. In January, thousands of builders and bankers head to the Kentucky Exposition Center, a massive venue across the street from the racetrack, to discuss houses, not horses, at the Louisville Home Show.

This year’s iteration of the nation’s largest event for companies that build homes in factories and assemble them on-site was a coming-out party for ECN Capital, which lends to homebuyers. The Toronto-based company partnered with Skyline Champion Corp., a Troy, Michigan-based home builder, in September to expand its affordable housing portfolio over the past year. succeeded in re-establishing itself as the champion of Ownership is 19.8%.

“Full-built housing can be part of the solution to the housing crisis,” ECN CEO Stephen Hudson said in an interview at the Louisville show. He said recent changes to regulations in Canada and the United States, including President Joe Biden’s 2022 Housing Action Plan, are making it easier for customers to borrow money for manufactured homes.

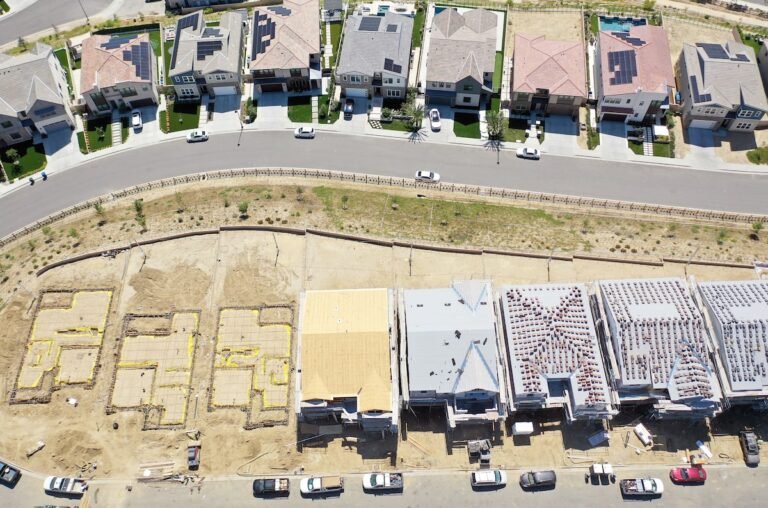

The Louisville show, which drew representatives from more than 1,000 companies, showcased industries ranging from manufacturing low-cost trailers to building high-rise residential buildings that fit into any suburban neighborhood. According to Skyline data, 22 million Americans live in manufactured housing.

Asset managers Blackstone and Carlyle Group are supporting ECN’s expansion plans by acquiring a majority of the loans made by the Canadian company, earning fees on debt origination and repayments. . In August, Blackstone committed $1.14 billion to buy manufactured mortgages from ECN’s Triad Financial Services unit.

Financial institutions are investing in this corner of the credit market in part because default rates remain low despite rising interest rates over the past year, Hudson said. I’m buying a house,” he said.

Editorial board: praises the unconventional housing design

Triad has been lending to homebuyers since 1959. ECN acquired the company in 2017 for $125 million. As part of the parent company’s strategic shift, his ECN, which is listed on the Toronto Stock Exchange, will change its name to Triad Financial Services Corp.

ECN’s new partner, Skyline, is the second largest home manufacturer in North America after Berkshire Hathaway’s Clayton Homes. In a recent press release, Skyline CEO Mark Yost said the company invested in ECN to “help streamline the homebuying experience” for customers.

According to Skyline research, 60 percent of the population can no longer afford traditional housing due to rising real estate prices. The company sells about half of its homes to millennials and 25% to baby boomers.

Homes in Skyline cost an average of $98,000, and prices increase even more when you buy or lease in bulk. Last year, the company sold 26,000 homes built at five factories in Western Canada and 42 factories in the United States, and revenue has increased 17% in each of the past five years. The company offers homes in Canada under his two brands: Moduline and SRI Homes.

Skyline has agreed to maintain its investment in ECN at the current level of 19.8% for the next two years. “Looking at the bigger picture, one can’t help but wonder if ECN is looking at a potential sale to Skyline,” RBC Capital Markets analyst Jeffrey Kwan said in a recent report. Stated.

Along with Triad, ECN owns a division that lends money to buyers of boats and recreational vehicles. Last September, the company announced that it planned to exit the Skyline business following a strategic review following its investment. Kwan said ECN plans to sell or separate its boat and RV lenders in the first quarter of this year.

ECN’s focus on manufactured mortgages comes after the company sold two lending businesses, Service Finance Holdings and Kessler Group, for a total of US$2.2 billion over the past three years. ECN used half of the proceeds to pay shareholders a special dividend of $1 billion.

In 2016, Hudson spun ECN out of Element Fleet Management Corporation, now one of the world’s largest auto finance companies. He founded Element in 2007 by purchasing the credit business from General Electric Co. Hudson also started Newcourt Credit Group in 1984, which he sold to CIT Group 15 years later for $2.4 billion.

[ad_2]

Source link