[ad_1]

David Eben put it well: “Volatility is not a risk we care about.” Our focus is to avoid permanent loss of capital. ” In other words, financially smart people seem to know that debt (usually associated with bankruptcy) is a very important factor when assessing a company’s risk.I understand that Integral Ad Science Holding Co., Ltd. (NASDAQ:IAS) uses debt in its business. But the real question is whether this debt is putting the company at risk.

Why does debt pose a risk?

Generally, debt only becomes a real problem if a company cannot easily pay it off, either by raising capital or with its own cash flow. Part of capitalism is the process of “creative destruction” in which failing companies are ruthlessly liquidated by bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, resulting in permanent shareholder dilution. Having said that, the most common situation is one in which a company manages its debt reasonably well and to its own advantage. When we think about a company’s use of debt, we first think of cash and debt together.

Check out our latest analysis for Integral Ad Science Holding.

What is Integral Ad Science Holding’s net debt?

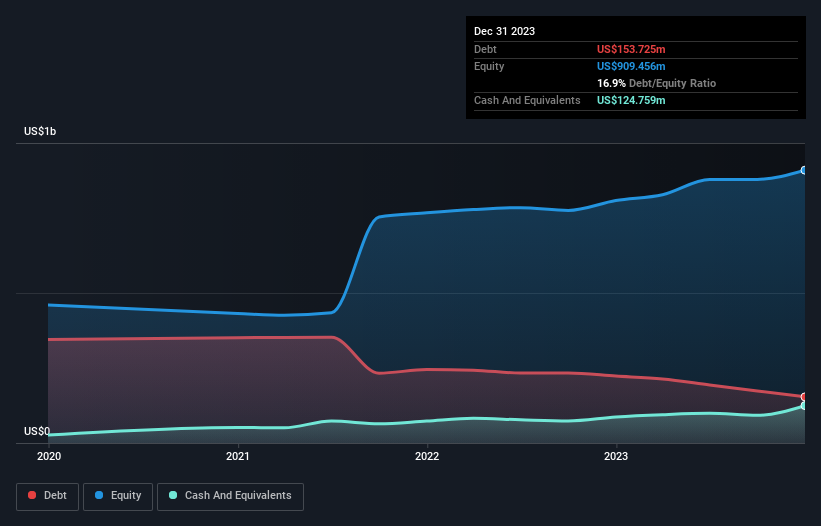

As you can see below, Integral Ad Science Holding’s debt was US$153.7m at December 2023, down from US$223.3m in the same period a year ago. On the other hand, the company has his cash of US$124.8m, making its net debt around US$29.0m.

How healthy is Integral Ad Science Holding’s balance sheet?

Zooming in on the latest balance sheet data, we can see that Integral Ad Science Holding had liabilities of US$82.5m due within 12 months, and liabilities of US$199.8m due beyond that. Offsetting these obligations, the company had cash of US$124.8m and receivables valued at US$121.2m due within 12 months. So its liabilities outweigh the sum of its cash and (short-term) receivables by US$36.4m.

Integral Ad Science Holding’s listed shares have a total value of US$1.59b, so this level of debt is unlikely to pose much of a threat. However, we recommend shareholders continue to monitor the balance sheet, as it has ample debt.

We use two main ratios to determine debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), and the second is how much earnings before interest and tax (EBIT) covers interest expense (or interest cover, for short). It’s about how many times you cover it. . This way, we consider both the absolute amount of debt and the interest rate paid on it.

Integral Ad Science Holding’s low interest coverage of 1.4x EBIT is initially surprising, given that its net debt is just 0.50x its EBITDA. Therefore, we are not necessarily cautious, but we believe that the debt is not insignificant. Importantly, Integral Ad Science Holding’s EBIT decreased by an astonishing 46% in the last twelve months. If this decline continues, paying off debt will be harder than selling foie gras at a vegan convention. There’s no question that we learn most about debt from the balance sheet. But ultimately, the future profitability of the business will decide whether Integral Ad Science Holding can strengthen its balance sheet in the long term. So if you want to see what the experts think, you might find this free report on analyst profit forecasts to be interesting.

Finally, companies need free cash flow to pay down debt. Accounting profits alone are not enough. So we always check how much of that EBIT is converted into free cash flow. Fortunately for shareholders, Integral Ad Science Holding actually generated more free cash flow than its EBIT over the last two years. There’s nothing better than having cash coming in to stay in the good graces of lenders.

our view

We’re unimpressed with Integral Ad Science Holding’s interest expense, and are cautious given its EBIT growth rate. However, the conversion of EBIT to free cash flow was significantly redeemed. Considering all the factors mentioned above, Integral Ad Science Holding appears to be managing its debt quite well. However, you need to be careful. Debt levels are considered to be sufficient to warrant continued monitoring. When analyzing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet, far from it. For example, Integral Ad Science Holding 4 warning signs I think you should know.

If you’re more interested in fast-growing companies with rock-solid balance sheets, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we help make it simple.

Please check it out Integral Ad Science Holdings Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Interested in its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link