[ad_1]

Understanding Science Applications International Corp’s dividend dynamics

Science Applications International Corp (NASDAQ:SAIC) recently announced a dividend of $0.37 per share, payable on April 26, 2024, with an ex-dividend date of April 11, 2024. The company’s dividend history, yield, and growth rate are also in focus as investors look forward to future payouts. Let’s examine Science Applications International Corp’s dividend history and assess its sustainability using data from GuruFocus.

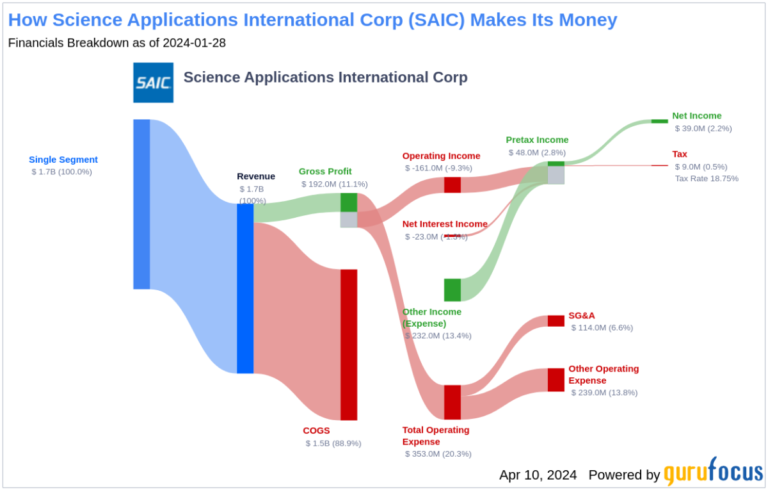

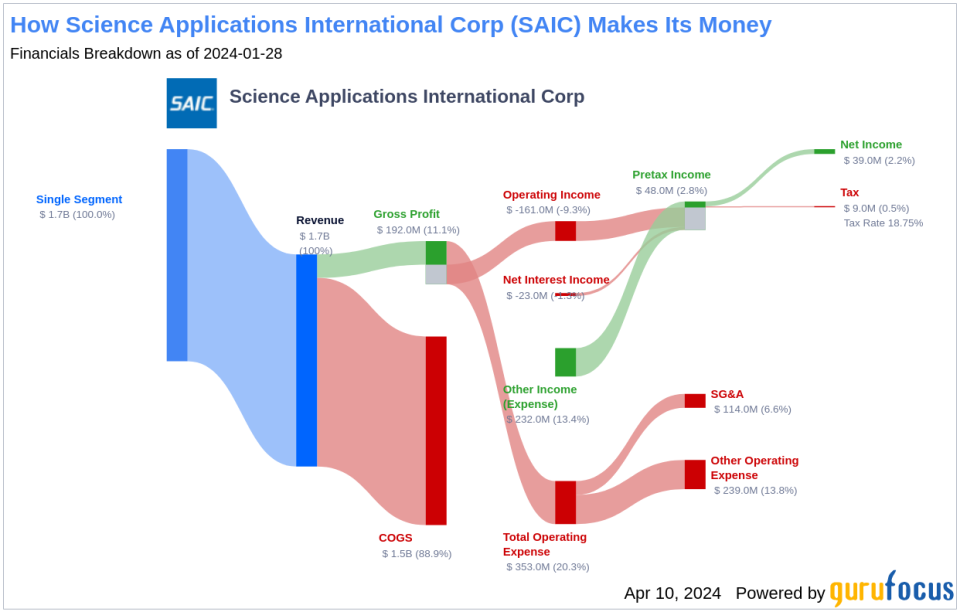

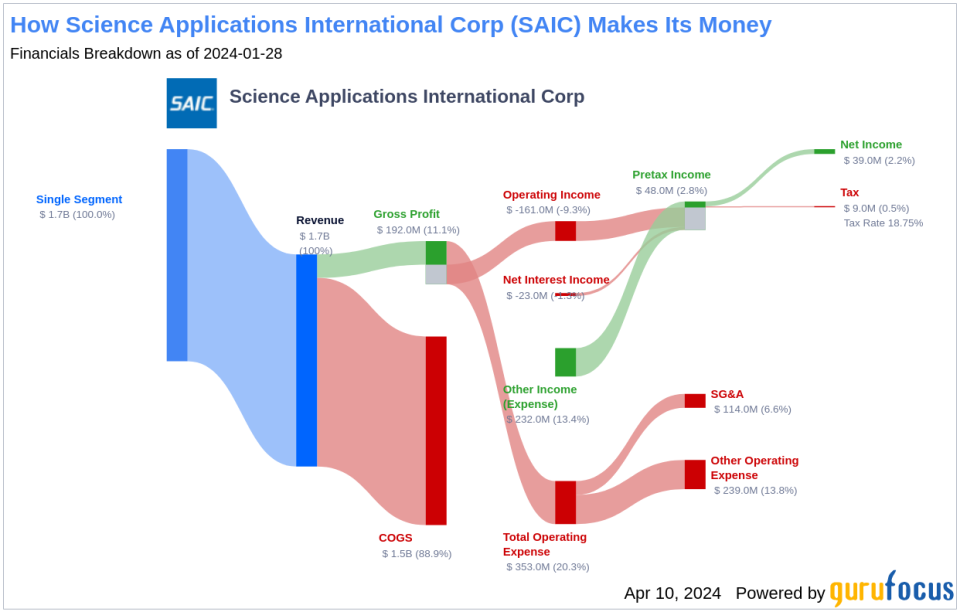

What does Science Applications International Corp do?

Science Applications International Corp provides technology, engineering, and enterprise IT services primarily to the U.S. government. Specifically, the company provides engineering, systems integration and information technology for large-scale government projects, offering a wide range of services with an emphasis on high-end technology services. The company’s end-to-end enterprise IT products span the entire spectrum of a customer’s IT infrastructure.

A glimpse at Science Applications International Corp’s dividend history

Science Applications International Corp has maintained a consistent dividend payment record since 2013. Dividends are currently distributed on a quarterly basis. Science Applications International Corp. has increased its dividend every year since 2014. For this reason, the stock is listed as a Dividend Achiever, an honor bestowed on companies that have increased their dividends every year for at least the past 10 years.

Below is a graph showing annual dividends per share to track historical trends.

Analyzing Science Applications International Corp’s dividend yield and growth rate

As of today, Science Applications International Corp’s trailing 12-month dividend yield is 1.14% and its trailing 12-month dividend yield is 1.14%. This suggests that the same dividend payments are expected over the next 12 months. When extended to a five-year period, this rate increased to 2.60% per year. Over the past 10 years, Science Applications International Corporation’s annual dividend growth rate per share has been 6.70%.

Based on Science Applications International Corp’s dividend yield and 5-year growth rate, Science Applications International Corp stock has a 5-year cost yield of approximately 1.30% as of today.

Questions about sustainability: Dividend payout ratio and profitability

To assess dividend sustainability, you need to evaluate a company’s payout ratio. Dividend payout ratio helps determine the proportion of a company’s profits that it distributes as dividends. A low ratio indicates that the company is retaining a significant portion of its earnings, thereby ensuring that it has funds for future growth or unexpected economic downturns. As of January 31, 2024, Science Applications International Corp’s dividend payout ratio is 0.46.

Science Applications International Corp’s Profitability Rank helps you understand the company’s earning power compared to its peers. GuruFocus ranks Science Applications International Corp’s profitability at 9 out of 10 as of January 31, 2024, suggesting a good profitability outlook. The company has reported positive net income every year for the past 10 years, further cementing its strong profitability.

Growth indicators: future outlook

To ensure dividend sustainability, companies must have solid growth metrics. Science Applications International Corp’s Growth Rank of 9 out of 10 suggests that the company’s growth trajectory is favorable compared to its competitors.

Earnings are the lifeblood of any company, and Science Applications International Corp’s earnings per share, combined with its 3-year earnings growth rate, suggest a strong earnings model. Science Applications International Corp’s revenue grows at an average annual growth rate of around 4.90%, which is lower than around 60.03% of its global competitors.

The company’s three-year EPS growth rate indicates its ability to grow earnings, which is a key factor in maintaining a dividend over the long term. Over the past three years, Science Applications International Corp’s revenue has grown on average by about 8.50% per year, which was lower than about 52.96% of its global competitors.

Finally, the company’s 5-year EBITDA Growth rate is 4.90%, which is lower than around 65.19% of its global competitors.

next step

In conclusion, Science Applications International Corp’s consistent dividends and growth rate, coupled with a reasonable payout ratio and strong earnings metrics, paint a positive picture for dividend sustainability. However, while the company’s growth metrics are strong, they do suggest that there are areas where it lags behind some of its global competitors. Investors should consider these factors when considering the long-term prospects for Science Applications International Corp’s dividend payments. If you want to diversify your portfolio with high dividend yield stocks, GuruFocus Premium users can explore opportunities using the High Dividend Yield Screener.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link