[ad_1]

Kunakorn Rassadornyindee/iStock via Getty Images

I rate Comfort Systems USA, Inc. (NYSE: FIX) as a hold as the stock price is considering high revenue growth in the next few years, which might be unjustified. In the middle of the global pandemic in 2020, there were delays in service and construction, so demand started recovering in 2022 and 2023 when FIX showed revenue growth of 34.7% in 2022 YoY and 25.7% in 2023 YoY. Furthermore, consensus is expecting strong revenue growth in 2024, as the backlog remains at strong levels this year. Nevertheless, the market might be very optimistic with the current stock price of around $318 per share, as that price assumes certain revenue growth and certain FCF margins, which might be far from reality. In this sense, it’s very important to be aware that the future growth assumed by the market is actually feasible. In this article, I will explain FIX’s business model and its drivers briefly, and I will calculate its intrinsic value to know which levels a long-term investor should expect to buy shares. The company seems to be one of the best companies in its industry, so a long-term investor should keep the stock on his radar.

Business model

FIX was established in 1997 through a simultaneous IPO and the acquisition of 12 companies engaged mainly in the commercial and industrial heating, ventilation, and air conditioning (HVAC) business. In 1998, FIX acquired 51 HVAC and complementary businesses that had locations in 13 additional states.

In 2002, as a result of the events in September 2001, FIX ended up with very high debt levels, so it needed to divest part of its assets, selling 19 subsidiaries to EMCOR to reduce those debt levels while building up a healthy balance sheet. After paying most of its debt by 2005, FIX was growing through more acquisitions and reinvestments in its existing business.

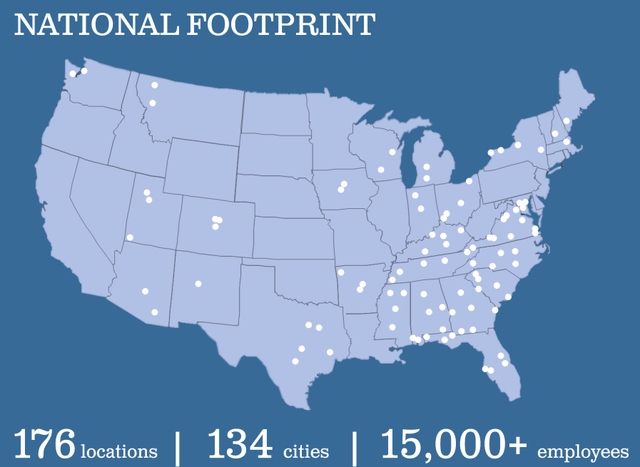

FIX offers mechanical and electrical contracting services through its 45 operating companies. In the mechanical segment, FIX provides HVAC services, plumbing, piping, and controls; off-site construction; monitoring; and fire protection. On the other hand, the electrical segment offers the installation and servicing of electrical systems. To get a better idea, FIX builds, installs, maintains, repairs, and replaces mechanical, electrical, and plumbing (MEP) systems being established in 176 locations in 134 cities throughout the United States.

Comfort Systems Feb 2024

Looking at the chart above, we can notice that the footprint of FIX in the US is concentrated in the East, where the demand for its services has been strong throughout the years. This local presence enables FIX to respond faster to the customer’s needs.

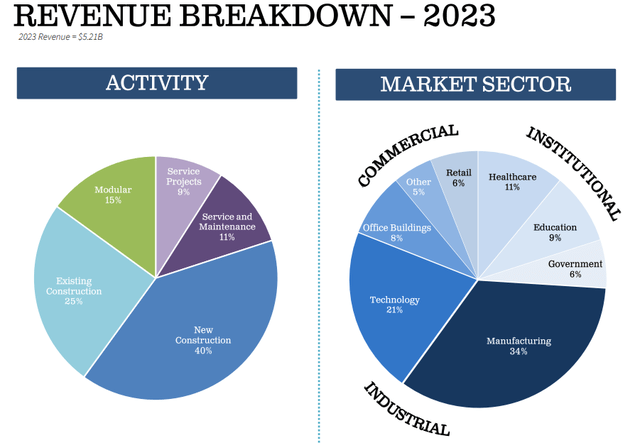

Comfort Systems Feb 2024

In the chart above, in the breakdown by activity, we notice that a great part of FIX’s revenue growth comes from new construction, which represents around 40% of the total revenues, whereas existing construction represents 25%. Here, we need to be aware of the fact that a deceleration of new construction by factors like a recession could have an important impact on FIX’s revenue growth.

Of course, this might be partially offset if FIX strengthens the other activities, such as services and maintenance, service projects, and modular and existing construction, through new acquisitions or organic growth that reinforces those activities.

In the chart of the right by market sector, I need to highlight manufacturing and technology, which combined represent 55% of the total revenues. Both segments have experienced important growth in 2023, as they include data centers, chip plants, food, pet food, and pharmaceuticals. As such, most of the revenue growth of 26% in 2023 YoY is explained by the growth in these sectors. Also, this chart from the right gives us a clear picture of the types of FIX’s customers, which are commercial, institutional, and industrial.

FIX’s industry is divided into two categories: i) construction of and installation of new buildings, which represented 54% of FIX’s total revenues in 2023; and ii) renovation, expansion, maintenance, repair, and replacement of existing buildings, which represented 45.2%.

One important strategy of the company is acquisitions to support its future growth. In 2024, the company will complete the acquisitions of Summit Industrial Construction LLC and J&S Mechanical Contractors, Inc., both of which are being included as part of FIX’s mechanical segment. The price of these acquisitions has not been disclosed, but the acquisition strategy is not negatively impacting the balance sheet of the company.

Long-term drivers

There are some important drivers that might be long-term catalysts for future growth for this company; population growth would be a factor as it increases the demand for commercial, industrial, and institutional space. A second factor is related to the aging installed base of buildings and equipment that are required to be replaced.

A third factor is the increasing sophistication, complexity, and efficiency of mechanical and electrical systems, as the building sector uses around 70% of electricity and around 40% of the US primary energy and associated greenhouse gas emissions. As such, it is very important to reduce energy consumption in order to meet national energy and environmental challenges while reducing costs to building owners and tenants. In addition, there is more awareness of the importance of having better internal air quality in buildings.

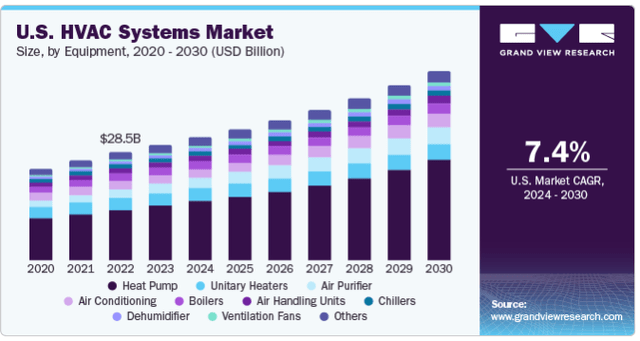

Grand View Research

In the chart above, we can see that the HVAC systems in the US market have good growth prospects ahead, with a 7.4% CAGR until 2030.

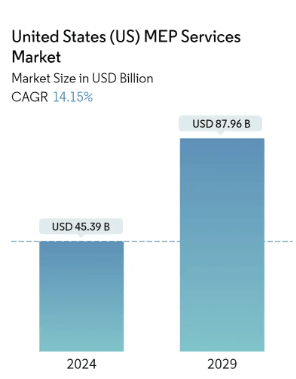

Mordor Intelligence

On the other hand, in the MEP services in the US, FIX has even higher growth prospects, as it is estimated to have a 14.15% CAGR until 2029. So, it’s clear that FIX is in industries with many growth opportunities, but there are two factors that we need to identify: i) how strong FIX’s competitive advantage is since it could help the company take advantage of most of the growth prospects of the industry; and ii) if the current stock price already incorporates most of that growth.

Competitive advantages

Apparently, FIX’s services are not so special or are not oriented to a very particular niche of the market. To find those competitive advantages, I need to find something related to customer satisfaction.

www.comparably.com

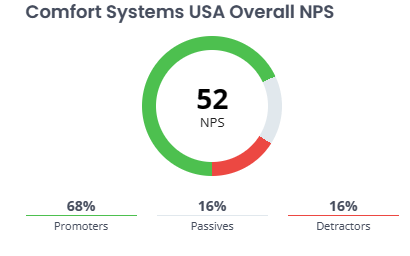

The Net Promoter Score (NPS) is a metric that is used to gauge the grade of satisfaction of the customer with the services or products sold by a company. The results of this tool are often linked to the revenue potential of a company’s products and services. Somehow, the FIX’s score for the NPS can give us an interesting insight into its competitive advantages.

FIX has an NPS score of 52, which is constructed by the percentage of “promoters,” “passives,” and “detractors.” On a scale from 1 to 10, customers who qualified as promoters gave a score of 9 or 10 to the products or services of the company, being more keen to recommend them to other potential customers. Those customers who respond with a score of 7 or 8 are qualified as passives, being more neutral about recommending those products and services; and finally, detractors are those customers who put a score from 0 to 6, who are fully dissatisfied with the products and services.

FIX has 68% of promoters, which is a very decent proportion, 16% of passives, and 16% of detractors. Now the overall NPS of 52 needs to be compared with the scores of other competitors to know more about the FIX’s performance with respect to its peers in the same industry:

www.comparably.com

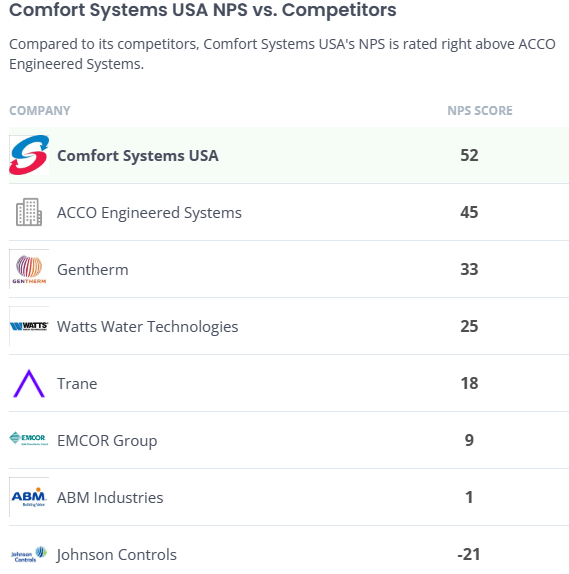

Among these competitors, FIX appears to be the best performer in terms of customer satisfaction. In other words, taking Comparably’s research, we can infer that FIX is the company with the highest number of promoters and a lower number of detractors compared to its main peers, who show the highest NPS score.

Now, I want to reinforce these findings, showing the FIX’s financial performance compared to that of some of its main peers. Usually, the competitive advantages are reflected by solid financial metrics, so I’ve made a table with the most important metrics of the company, taking the average of the last 5 years:

Author

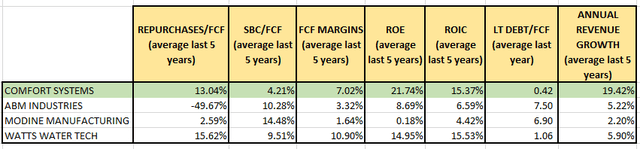

In the table above, we can see that FIX has shown a very good average revenue growth of 19.42% annually, which is explained by the very good revenue growth in the last 2 years. The revenue growth indicates that FIX’s services were more demanded than those of its peers, whose revenue growth was between 2% and 5% annually.

Not only that, the FIX revenue growth was accompanied by high returns on capital, with an average ROE and ROIC of 21.74% and 15.37%, respectively, in the last 5 years. Only Watts Water Tech. (WTS) could offer a similar average ROIC but a lower ROE, and with a way lower revenue growth of 5.9% per year on average.

ABM Industries (ABM) and Modine Manufacturing (MOD) have generated way lower returns of capital and are even growing at a lower annual average revenue growth of 5.22% and 2.2%, respectively. Modine has improved substantially in the last 2 years; that’s why the stock has delivered 1,104% of capital appreciation, whereas FIX stock delivered 296% of capital appreciation in those 2 years. However, I am a long-term investor, so I like to see more stability in financial performance for a longer period in the past, and FIX seems to be more financially stable than Modine and ABM, so that makes FIX a more predictable business for a long-term strategy.

The FIX’s FCF margins are decent, with an average of 7.02% in the last 5 years, but it’s worth noting that the FCF margins have been increasing in the last few years, being 10.46% in 2023, 6.12% in 2022, and 5.13% in 2021. Watts Water Tech’s FCF margins have been more stable in the last 5 years, with an average of 10.90%. ABM and Modine generated poor FCF margins in the last 5 years.

Up to this point, FIX is showing better financial metrics, but there are two additional ones that reinforce our expectations: the LT debt/FCF and stock-based compensation (SBC)/FCF. Indeed, in the last 5 years, FIX has been able to deliver higher revenue growth with a way lower use of debt than its peers and a way lower SBC as a proportion of its FCF, which means that FIX is the company with the least dilution as a result of those rewards to the management.

In addition, FIX allocates a decent 13% of its FCF for repurchases; in general, I would say with all this information, the NPS metric that gauges customer satisfaction and the financial metrics, that the demand for FIX’s services not only comes from a trend in its industry but also from the particular needs of customers who are looking for FIX’s services and who are mostly satisfied with its services.

Valuation

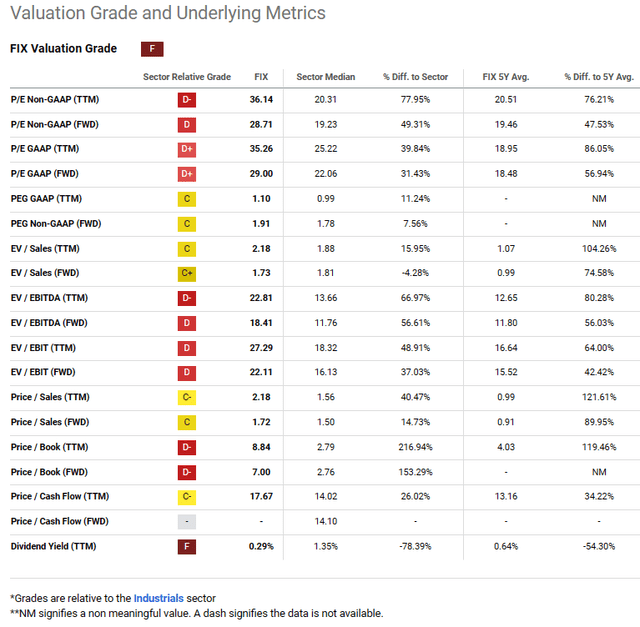

Looking into the different valuation metrics offered by Seeking Alpha, it seems that FIX is not cheap at all, showing that its valuation multiples are more expensive than its sector:

SA

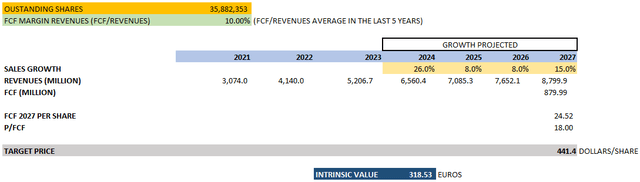

I would like to use another method to know which revenue growth the market is assuming for the current stock price and which price would be more attractive, but first, I need to make some assumptions:

- Outstanding shares: 35,882,353 (as of December 2023).

- FCF Margins: 10% (average of the last 5 years is 7.02%, but those FCF margins have been showing an upward trend in the last decade).

- I assume that FIX is held until the year 2027.

- Revenue growth for 2024: 26%, according to consensus.

- Revenue growth for 2025: 8%, according to consensus.

- Revenue growth for 2026 and 2027: I assume 8% and 15%, respectively; in the last decade, FIX showed for each of the 2 consecutive years of double-digit revenue growth, 2 consecutive years of single-digit growth.

- P/FCF 2027: 18x (average of the last 11 years).

- Discounted rate: 8.5%.

Author

Based on our assumptions, I make a projection of revenue growth of 26% for 2024, 8% for 2024 and 2025, and finally 15% for 2027. So, I take the revenues projected for 2027, and then I multiply those revenues by the FCF margins assumed to be 10%. Then, as a result, I get an approximate FCF of 879.9 million dollars for 2027.

Now, I take that FCF of 879.9 million to be divided by the outstanding number of shares of 35,882,353 shares to get an FCF per share for 2027, getting 24.52. In this sense, I take the FCF per share of 24.52 and multiply it by 18x, which is the FIX’s average P/FCF of the last 11 years. Then, I get a target price of 441.4 dollars per share in 2027, so I calculate the present value to bring it back to 2024.

Thus, finding the intrinsic value:

Intrinsic value = 441.4/(1+discounted rate)^4

Finally, I get an approximate intrinsic value of $318.53 per share. The current stock price is around $317 per share, but there is not enough margin of safety. Here, there is not much room for a wrong assumption, as the consensus estimates a 1% revenue growth for 2026, which would push down our intrinsic value to $297 per share if I assume a 15% revenue growth for 2027.

However, it’s possible that the stock price could keep going up in the short term as it’s expected that FIX delivers double-digit revenue growth in each of the next quarters, but as I mentioned previously, the double-digit revenue growth for 2024 is already included in my model. The problem is how FIX will perform in the next few years, as the consensus expects a deceleration in revenue growth for 2025 and 2026.

From a long-term perspective, we need to isolate the short-term effects and invest based on rationality, focusing on the long-term drivers and the stock price. A long-term investor could buy now, but he should buy more if the stock drops or just wait for a better price in the future. A price below $250 is a good stock price.

Risks and Final Thoughts

The main risk of my thesis is that the revenue growth for 2025 is higher than expected, which could reinforce even more the momentum of the stock to achieve new peaks. However, I would say that we need to be more conservative in our assumptions to be protected from unexpected situations in our investments, particularly if we are long-term investors.

All in all, I think that FIX is a very decent company in its industry, showing a solid business model and some competitive advantages that enable it to increase the pricing for its services when it is necessary while its demand does not change significantly. I think that the company has identified that one of its main strengths is its employees, so FIX takes care of them by offering a good environment to work, more training, etc.

Most of FIX’s customers seem pleased with the company’s services, as I’ve shown before, which indicates that the company has been developing important intangibles that helped it stand out from its competition, particularly in a sector where rapid response, trust, and pricing are key elements to success. So, if you want to be exposed to the HVAC sector and the mechanical, electrical, and plumbing sectors, you should consider FIX as one of your main choices, but without overlooking the price you want to pay.

[ad_2]

Source link