[ad_1]

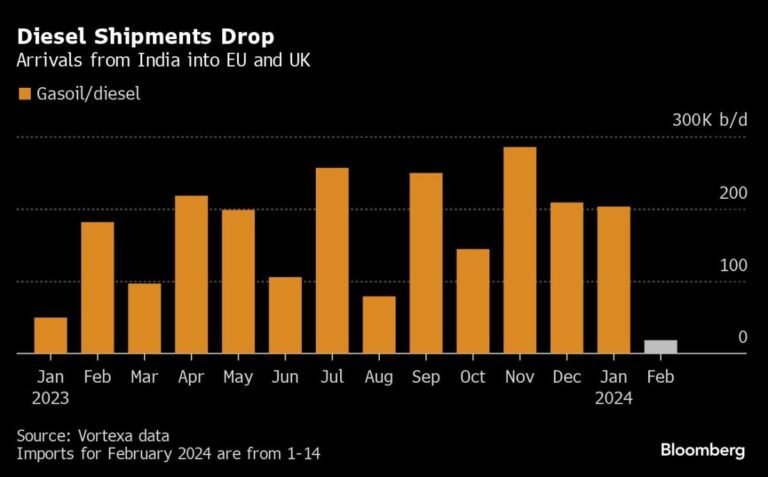

(Bloomberg) – Diesel shipments from India to Europe are at their lowest so far this month since 2022, as Houthi attacks on commercial ships continue to disrupt international trade and boost shipments to Asia. ing.

Most Read Articles on Bloomberg

Exports to the European Union and the United Kingdom, as rising freight costs caused by continued disruption in the Red Sea and unplanned refinery maintenance in Asia made it more advantageous in trade economics to send cargo east than west. The amount decreased rapidly.

Fuel arrivals from India to Europe averaged just 18,000 barrels a day in the first two weeks of February, down more than 90% from the January average, according to Vortexa data compiled by Bloomberg. . Sparta Commodities analyst James Noel Beswick said the drop was due in part to higher shipping costs to the West last month.

“The export economy to the east, the Singapore region, was much better than the west,” Noel Beswick said. Due to the Houthi threat, tankers bound for Europe and the Atlantic Basin are forced to bypass South Africa’s Cape of Good Hope, increasing the distance and cost of their journeys, or take “risky and very high war risk insurance” through the Suez Canal. are forced to use .

There were no diesel fuel imports into the EU and only one import into the UK in the first two weeks of February, the data showed. But the Merlin Sicily and the Merlin La Plata recently loaded barrels in India and headed to Rotterdam, with the former signal vessel expected to arrive later this month, according to port reports and tanker tracking data compiled by Bloomberg. It is said that

Elsewhere, diesel fuel arrivals from India to destinations in Asia, including some shipments to Saudi Arabia and Bangladesh, surged in the first two weeks of the month. More and more cargo is sailing to East Asia on ships such as the Peace Victoria and the Orange Victoria.

Noel Beswick said diesel exports from India to the European region should increase in the coming weeks due to improved arbitrage economics.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link