[ad_1]

Apple on Thursday released its earnings report for the December 2023 quarter, or the first quarter of fiscal 2024. Revenue of $119.58 billion was not a record, but it beat expectations for the same period and fell short of the $123.9 billion in the December 2022 quarter. . Of that amount, $33.9 billion represented profit for the quarter.

To put it another way, the iPhone accounted for $69.7 billion in revenue, or nearly 60% of product sales over the same period. That’s just crazy and something no rival can match. It also happened in a year when most companies were struggling and the entire smartphone business was in decline.

The iPhone not only exceeded Apple’s expectations, it also crushed Android like never before. Counterpoint Research provided data in his two reports that highlight how uneven the competitive landscape was not just in the fourth quarter of 2023, but throughout 2023.

iPhone accounted for 64% of US smartphone sales in the December 2023 quarter. Counterpoint Research explains that Apple’s big quarter led to an 8% year-over-year increase in smartphone shipments across the U.S. during the same period.

The report also notes that while Apple continued to sell more iPhones than in previous quarters, Android vendors struggled to sell devices priced under $300. Samsung came in second place with 18% of U.S. sales, and Motorola came in third with 8%. Google’s Pixel accounted for 2% of the market.

Counterpoint researchers predict low-single-digit growth in the U.S. market in 2024 as the economy recovers.

In a separate report, Counterpoint Research highlighted the international performance of iPhone throughout 2023.

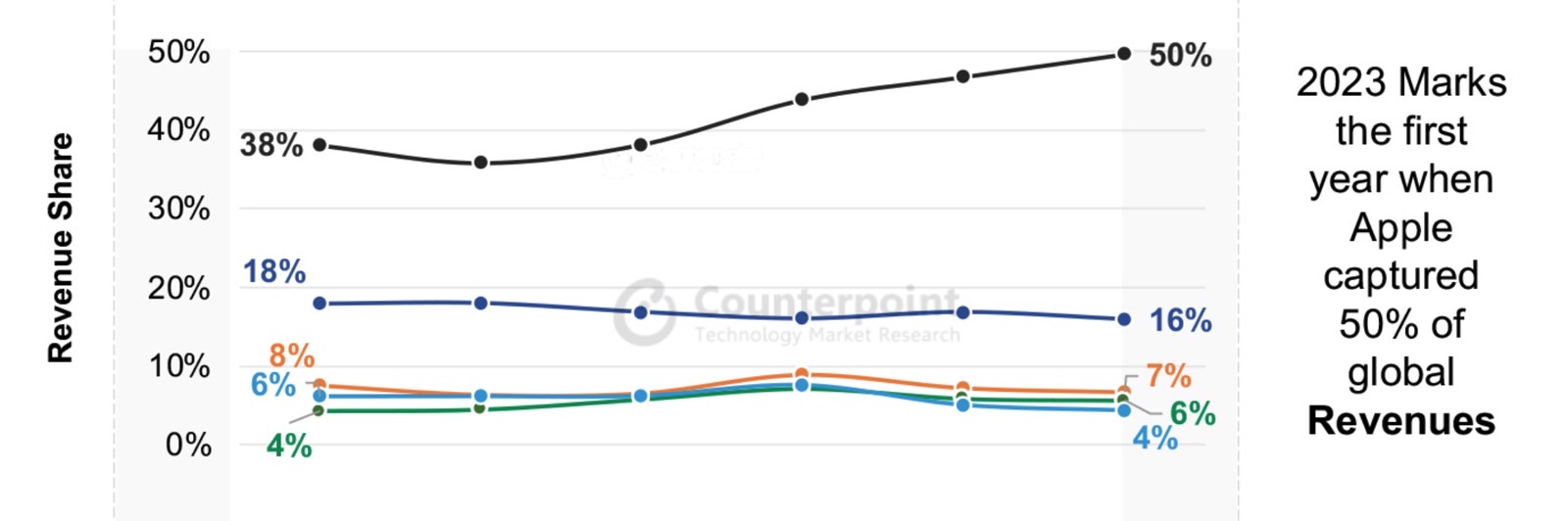

Apple may not reveal its iPhone sales numbers, but we might not need it. The research firm also provided other statistics that show just how much control Apple has. The iPhone accounted for 50% of global smartphone sales revenue last year.

This is the first year that Apple has reached this number. That’s half of this year’s roughly $410 billion in sales. Smartphone sales decreased by 2% in 2023 compared to 2022, resulting in sales of “just under $410 billion.”

Additionally, smartphone shipments declined by 4% to 1.17 billion units in 2023. However, most of the smartphones sold last year were Android devices. Apple ships an average of at least 200 million units a year. The important thing here is that the iPhone captured 50% of the revenue without having 50% of the market share.

The report notes that Apple has overtaken Samsung in annual sales for the first time. Apple reached his 20% of market share. This equates to approximately 234 million iPhones. Samsung came in second place with 19%.

If that wasn’t enough, the iPhone’s average selling price (ASP) continued to rise in 2023, reaching $890. Samsung’s ASP took his second place, with a similar increase compared to 2022. But Samsung’s $288 ASP pales in comparison. Last year’s global ASP rose to $350, mainly due to the impact of the iPhone.

The US wasn’t the only country that helped Apple crush Android last year. The iPhone also experienced growth in various other major markets, which may have offset weak sales in China. Jeff Fieldhack, director of Counterpoint Research, said:

Apple replaced Samsung as the biggest player in terms of shipments for the first time in a full year. While the United States was the largest volume contributor to Apple’s growth, it also received a big boost from double-digit growth in emerging markets such as India, the Caribbean, and Latin America (CALA) and the Middle East and Africa (MEA).

This growth offset any challenges Apple may have faced in China due to Huawei’s resurgence. His 2% growth in ASP along with this sees him surpass $200 billion in annual revenue and enter a revenue supercycle, driven by ecosystem tenacity and premiumization trends. .

The iPhone has seen increased competition in China over the past year, and the market is likely to remain a concern in the coming months and years. Huawei’s resurgence in the premium segment threatens iPhone 15 sales. Other local Android vendors will also put pressure on Apple’s older models (iPhone 13 and iPhone 14) in the near future.

[ad_2]

Source link