[ad_1]

Top Line

Semiconductor stocks surged in after-hours trading on Wednesday as chip giant Nvidia extended its market rally on Tuesday, helping the company overtake Microsoft as the world’s most valuable public company and boosting CEO Jensen Huang’s net worth.

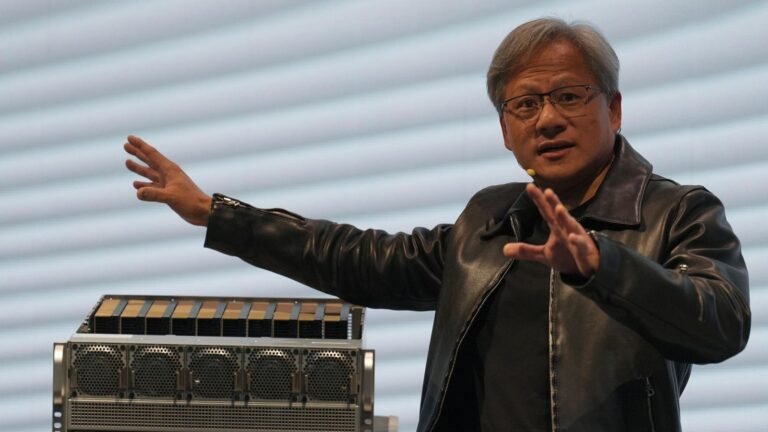

Nvidia Chief Executive Jensen Huang’s net worth has soared along with the company’s market capitalization.

Key Facts

In after-hours trading on Wednesday morning, when major U.S. markets were closed for Independence Day, Nvidia shares rose about 0.6% to above $136.

The surge came after Nvidia shares hit an all-time high on Tuesday, trading at $135.58 at the close, up more than 3.5%.

Nvidia’s stock price surged, driving other semiconductor stocks higher overnight, mostly in Asia, which is home to some of the world’s biggest tech manufacturers, including Nvidia’s biggest competitors.

Shares in semiconductor rivals like Taiwan Semiconductor Manufacturing Co. (TSMC), another big beneficiary of the AI boom, jumped more than 4% by the close in Taipei, while Hong Kong-listed Chinese makers Hua Hong Semiconductor and Semiconductor Manufacturing International Co. also rose 0.4% and 1%, respectively.

Shares in South Korean semiconductor makers Samsung Electronics and SK Hynix rose 3% and 7%, respectively, during trading hours but the gains tapered off as the day went on to close at 1.75% up and 0.43%, respectively, on the Seoul market.

Shares of major U.S. semiconductor companies were largely unchanged in after-hours trading on Wednesday, with Arm Holdings (ARM) and Micron Technology (MU), which rose about 9% and 4% on Tuesday, only rising modestly to 0.34% and 0.81%, respectively, while Intel, which fell more than 1% on Tuesday, was relatively flat.

tangent

Shares in Hon Hai Technology Group, commonly known as Foxconn, also surged on the back of Nvidia’s rally. The Taipei-listed stock closed up more than 2% at the end of trading on Wednesday. The Taiwanese giant is partnering with Nvidia to build a series of AI data centers that will use the U.S. giant’s chips to develop a range of AI applications, including robotics platforms, electric vehicles and large language models (LLMs).

How quickly did Nvidia go from gaming chipmaker to AI giant?

Nvidia on Tuesday overtook tech giant Microsoft to claim the title of the world’s most valuable public company, just weeks after taking second place from iPhone maker Apple. The achievement caps Nvidia’s rise from a respected video game hardware maker to a purveyor of dedicated AI chips, one of technology’s hottest commodities. The pivot has dramatically reversed Nvidia’s fortunes in a matter of years, growing from a market cap of about $16 billion in 2016 to just under $800 billion toward the end of 2021 before falling to about $300 billion in 2022 due to sluggish demand for gaming chips and a broader collapse in the U.S. stock market. A boom in generative artificial intelligence, spurred by the release of OpenAI’s ChatGPT in late 2022, helped propel Nvidia to new heights as demand for dedicated AI chips soared. Since then, the company’s value has risen nearly vertically, from about $400 billion in late 2022 to $1 trillion in mid-2023, $2 trillion in early 2024, and $3 trillion by mid-2024. Nvidia’s stock is up more than 170% this year alone, and its phenomenal growth shows little sign of slowing as tech companies compete for dominance in the emerging market for AI.

Forbes Rating

The AI boom has not only catapulted Nvidia to a rare position of wealth and power. CEO Jensen Huang, who co-founded the chipmaker in 1993, has also seen his fortune grow astronomically in recent years. Following Nvidia’s recent stock surge, Forbes estimates Huang’s net worth at $118.7 billion, up $4 billion on Tuesday alone. He now surpasses Indian billionaire Mukesh Ambani and is about $12 billion away from cracking Forbes’ list of the world’s top 10 richest people, behind Microsoft billionaire Steve Ballmer, owner of the Los Angeles Clippers, and Bill Gates. Ballmer’s net worth is $130.6 billion and $133.5 billion, respectively.

Receive Forbes Breaking News Text Alerts: Start a text message alert and stay on top of the biggest stories making headlines that day. Text “Alerts” to (201) 335-0739 or sign up now. here.

References

[ad_2]

Source link