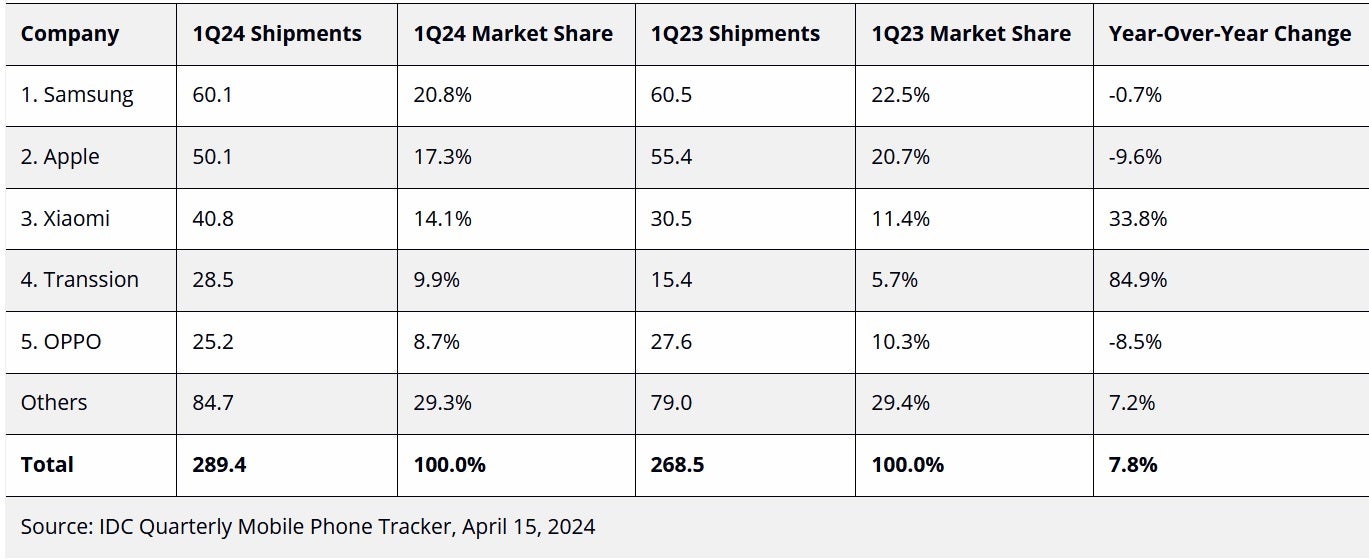

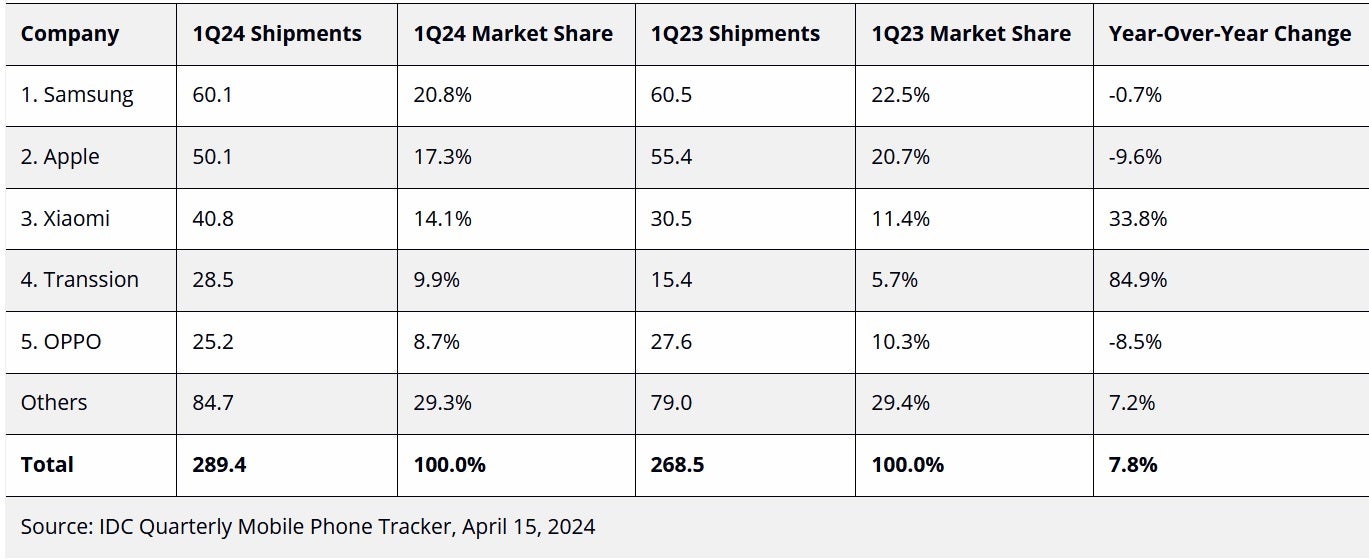

The first quarter of 2024 was not a good quarter for iPhone. According to IDC, iPhone shipments worldwide decreased by 9.6%, even though the overall smartphone industry recovered. Global shipments increased by 7.8% from the previous year to 289.4 million units, led by Samsung. The manufacturer’s Galaxy S24 flagship series with Galaxy AI features contributed to Samsung’s 60.1 million mobile phone shipments in three months. Although on an annual basis he decreased by 0.7%, Samsung still maintains its industry-leading market share of 20.8%.

Apple’s first-quarter iPhone shipments were down 9.6% annually, but that’s because Apple shipped 50.1 million iPhones from January to March, which is good enough for second place. iPhone’s global market share in the same quarter was 17.3%. With shipments increasing by his 33.8% in the first quarter, Xiaomi took his third place with a market share of his 14.1%. The company shipped 40.8 million smartphones in the first three months of this year.

The fastest-growing smartphone maker this quarter was China’s Transsion, which has seen strong growth in recent months. The company sells mobile phones in Africa, the Middle East, Southeast Asia, South Asia, and Latin America. Shipments in this quarter increased by 84.9% to 28.5 million units, and the global market share fell short of his 10%.

Samsung takes top spot in IDC’s Q1 2024 Global Smartphone Report

Oppo, which shipped 25.2 million phones in the first quarter, was the fifth-largest smartphone maker during the period. This was an 8.5% year-over-year decline in shipments, and Oppo ended the quarter with a global market share of 8.7%.

“As expected, the smartphone recovery continues to advance, with market optimism gradually increasing among top brands,” said Ryan Rees, group vice president of Worldwide Mobility and Consumer Device Trackers at IDC. While Apple managed to take the top spot at the end of 2023, Samsung managed to reaffirm its position as the leading smartphone provider in the first quarter.

He further added, “IDC expects these two companies to maintain their positions at the high end of the market, but with Huawei’s resurgence in China and significant gains for Xiaomi, Transsion, OPPO/OnePlus, and vivo. Both OEMs will likely gain attention as a result of this.” As the recovery progresses, top companies will gain market share while smaller brands struggle to gain ground. ”

According to IDC, the average selling price of smartphones is on the rise. According to the analytics firm, consumers are considering purchasing premium models that they plan to use for a long time. IDC also notes that Apple may have sold more iPhone 15 Pro and iPhone 15 Pro Max than non-Pro models, which led to Apple earning more revenue per unit sold. However, the report also notes that Apple had to take the unusual step of cutting iPhone prices by up to $180 in China, the world’s largest smartphone market.