[ad_1]

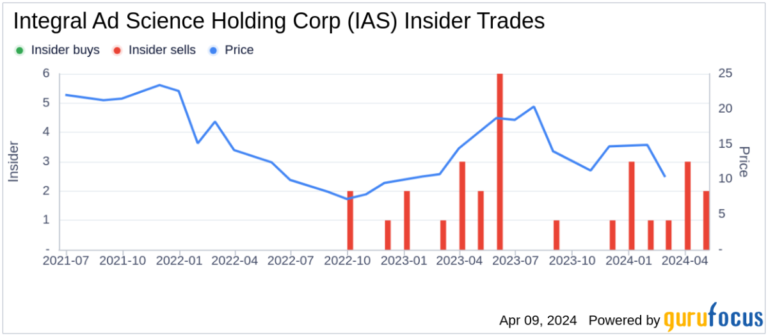

Integral Ad Science Holdings (NASDAQ:IAS), a global leader in digital advertising verification, recently witnessed significant insider selling by the company’s Chief Financial Officer (CFO), Tania Secor. According to an SEC filing dated April 8, 2024, insiders have sold 17,999 shares of the company’s stock, and Tania Secor has sold a total of 92,166 shares in the past year. has not been done at all. This latest transaction continues Integral Ad Science Holding Corp’s trend of insider sales, with a total of 19 insider sales and no insider purchases over the past year.

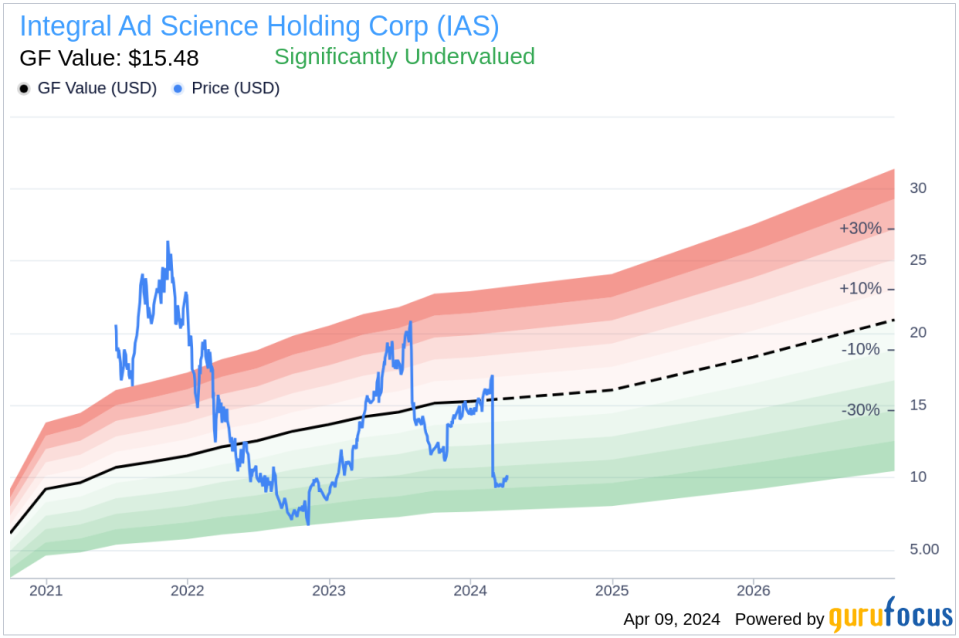

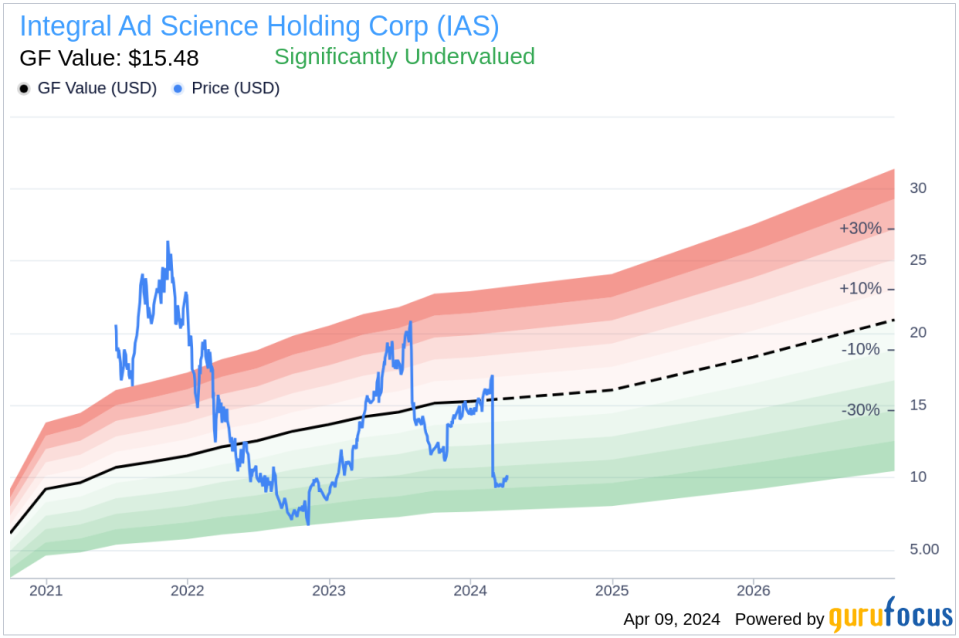

On the day of the sale, Integral Ad Science Holding Corp’s stock was trading at $10.05, valuing the company at $1.61 billion. The company’s price-to-earnings ratio is 252.00, significantly higher than both the industry median of 19.68 and the company’s historical median price-to-earnings ratio. Despite the high price-to-earnings ratio, the stock appears to be undervalued when considering GuruFocus. value. With a stock price of $10.05 and a GuruFocus Value of $15.48, the price to GF value ratio is 0.65, indicating that the stock is significantly undervalued.

GF Value is calculated based on historical trading multiples, GuruFocus adjustment factors related to the company’s past performance, and future performance estimates provided by Morningstar analysts. Integral Ad Science Holding Corp specializes in providing solutions that provide advertisers with online media quality and performance analysis. . The company’s technology increases the value of online advertising by ensuring that digital ads are seen by real people in safe and relevant environments. Recent selling by insiders may attract the attention of investors who track insider actions as an indicator of company performance and future stock price. movement. However, when interpreting insider trading, it is essential to consider the broader context of a company’s valuation and market performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link