[ad_1]

Guangzhou Hongmi Wisdom Science and Technology Innovation Co., Ltd. (SZSE:000523)’s recent earnings report did not come as a surprise, with the stock price unchanged over the past week. We’ve done some research and think investors are missing some encouraging elements in the underlying numbers.

Check out our latest analysis for Guangzhou Hongmian Zhihui Science and Technology Innovation Ltd.

Take a closer look at Guangzhou Hongmi Wisdom Technology Innovation Co., Ltd.’s earnings

In high finance, a key ratio used to measure how well a company converts its reported profits into free cash flow (FCF) is: Incidence (from cash flow). Simply put, this ratio subtracts his FCF from his net income and divides that number by the company’s average operating assets for the period. You can think of the accrual rate from cash flow as the “non-FCF rate of return.”

As a result, a negative accrual rate is positive for the company and a positive accrual rate is negative. Although an accrual ratio greater than zero is rarely a problem, it may be considered noteworthy if a company has a relatively high accrual ratio. To quote his 2014 paper by Lewellen and Resutek: “Firms with higher accruals tend to have lower future returns.”

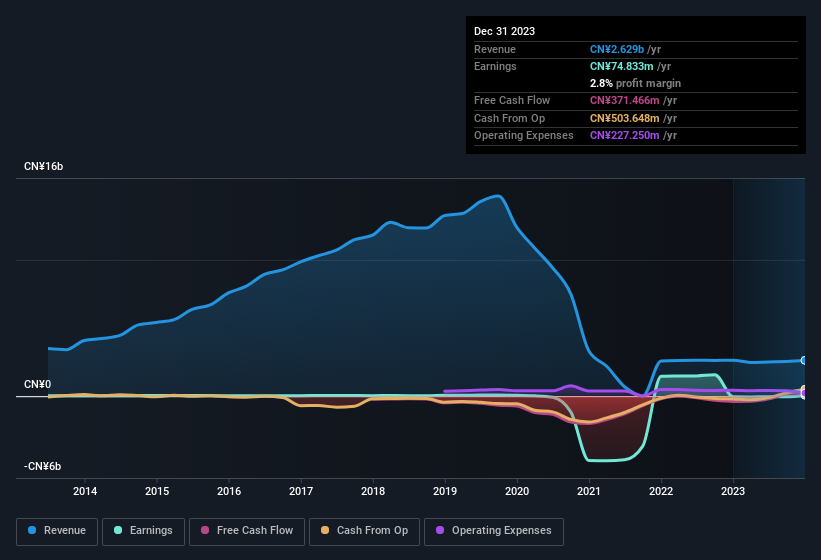

For the twelve months ending December 2023, Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou recorded an accrual ratio of -0.33. Therefore, its statutory earnings are significantly less than its free cash flow. In fact, over the past 12 months, the company reported free cash flow of CA$371m for him, significantly higher than the CA$74.8m he reported in profit. Considering Guangzhou Hongmi Wisdom Technology Innovation Co., Ltd.’s free cash flow was negative in the same period last year, the trailing twelve month result of CA$371m appears to be a step in the right direction. However, we can see that recent tax benefits and unusual items have impacted the statutory profit and therefore the accrual rate.

Note: Investors are always advised to check the health of a company’s balance sheet. Click here to see Guangzhou Hongmian Zhihui Science and Technology Innovation Ltd.’s balance sheet analysis.

How do unusual items affect profits?

Honmian Zhihui Science and Technology Innovation Ltd.Guangzhou’s profit was reduced by unusual items worth CA$46 million over the past twelve months, which resulted in a high conversion rate, as reflected in the unusual items. It was helpful. In a scenario where these unusual items include non-cash expenses, you would expect a high accrual rate, and that is exactly what happened in this case. It’s never good to see a rare item hurt a company’s profits, but on the positive side, things may improve sooner or later. Our analysis of the majority of publicly traded companies around the world shows that significant anomalies often do not repeat themselves. This is not surprising since these line items are considered rare. In his 12 months to December 2023, Guangzhou Hongmi Wisdom Science and Technology Innovation Co., Ltd. had unusually large expenditures. As a result, it can be inferred that the unusual matters caused the statutory profit to be significantly lower than it would otherwise have been.

unusual tax situation

Looking at the accrual ratio, we can see that Guangzhou Hongmi Wisdom Technology Innovation Co., Ltd. benefited from tax incentives that contributed to its profit of CA$37m. This is a bit unusual, given that it’s more common for companies to pay taxes than receive tax breaks. Obviously, receiving tax benefits is a good thing. And given that it lost money last year, the benefit appears to be evidence that the company is hoping to find value in its past tax losses. However, our data shows that tax benefits may temporarily increase statutory profits in the year they are recorded, but may reduce profits thereafter. If tax incentives are not repeated, statutory profit levels are expected to decline, at least in the absence of strong growth.

Our view on the earnings performance of Guangzhou Hongmi Wisdom Technology Innovation Co., Ltd.

In conclusion, Guangzhou Hongmi Wisdom Technology Innovation Co., Ltd.’s accrual ratio and its unusual items suggest that the company’s statutory profit is probably quite conservative, but the existence of tax incentives will not last. The numbers may have been inflated due to the shape. Based on these factors, we think Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou’s earnings potential is at least as good as it seems, if not more. So if you want to dig deeper into this stock, it’s important to consider the risks facing this stock. During the analysis, Guangzhou Hongmi Wisdom Technology Innovation Co., Ltd. 1 warning sign And it is unwise to ignore this.

Our research into Guangzhou Hongmi Wisdom Technology Innovation Co., Ltd. focused on certain factors that could make the company’s earnings look better than they actually are. And it passed with flying colors. But if you can focus your attention on the details, there is always more to discover. For example, many people consider a high return on equity to be a sign of good economic conditions, while others like to ‘follow the money’ and look for stocks that insiders are buying.It may take a little research on your behalf, but you may find the following free A collection of companies with a high return on equity, or a list of stocks that insiders are buying to help.

Valuation is complex, but we help make it simple.

Please check it out Guangzhou Hongmi Wisdom Science and Technology Innovation Co., Ltd. Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link