[ad_1]

-

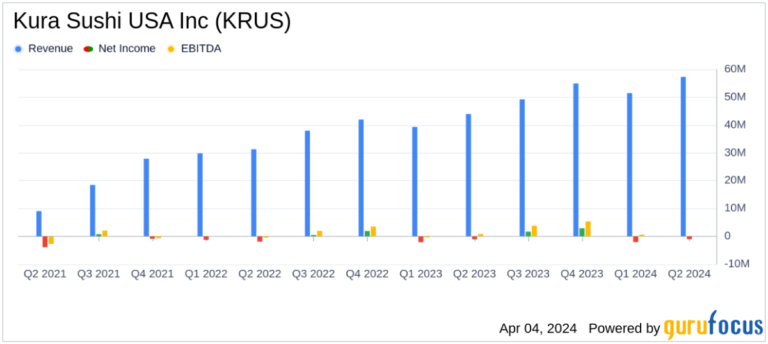

Revenue: It was reported at $57.3 million, lower than the estimated $63,737,700.

-

Net income: The net loss was $1 million, compared to an estimated net profit of $2.528 million.

-

Earnings per share (EPS): The company recorded a loss of $(0.09) per diluted share, which was below estimated earnings of $0.2027 per share.

-

Comparable restaurant sales: Compared to the same period last year, it increased by 3.0%.

-

Restaurant level operating profit: Sales reached $11.2 million, or 19.6% of sales.

-

Adjusted EBITDA: $2.9 million, representing a 23% year-over-year increase.

-

New restaurant: Five new stores opened during the quarter.

April 4, 2024 Kura Sushi USA Inc (NASDAQ:KRUS), a technology-enabled Japanese restaurant concept, announced its financial results for the second quarter of the fiscal year ended February 29, 2024 through an 8-K filing. announced. The company reported a net loss of $1.0 million, or ($0.09) per diluted share, despite total sales of $57.3 million, up from $43.9 million in the year-ago period. , which is consistent with the net loss in the second quarter of 2019. 2023.

Kura Sushi USA operates a conveyor belt sushi chain restaurant in the United States that offers a unique dining experience with features such as rotating and express conveyor belts, on-demand ordering screens, and reward machines. The brand is known for dishes like dashi olive salmon and garlic tuna steak, and its revenue comes primarily from its U.S. operations.

The company’s performance reflects the challenge of managing increases in labor and related costs, which rose to 32.8% of sales due to higher wages and higher pre-opening labor costs. Occupancy and related expenses also increased to $4 million from his $3.1 million in the same period last year, primarily due to the opening of his 14 new restaurants since the second quarter of 2023. .

Despite these challenges, Kura Sushi’s restaurant division had operating income of $11.2 million, or 19.6% of sales. This financial outcome is important in the restaurant industry, where margins are tight and profitability is closely related to effective cost control and operational efficiency.

According to the income statement, food and beverage expenses as a percentage of sales decreased to 29.6%. This is a positive sign reflecting the company’s ability to effectively manage costs through menu price increases and supply chain initiatives. The balance sheet shows a strong cash and cash equivalent position of $56.8 million, with total assets increasing from $304.7 million to $315.5 million as of August 31, 2023. did.

Representative Director, President and CEO Hajime Uba expressed confidence in the company’s direction, stating the following.

After a record fiscal year, I am very pleased to report that our business continues to perform well. The company has opened 10 of his restaurants to date, giving him confidence to stay on track towards his new division goals and improve his revenue outlook. ”

Looking to the future, Kura Sushi has reiterated its full-year outlook for fiscal 2024, predicting total sales of $243 million to $246 million, and plans to open 13 to 14 new stores. The company aims to maintain the ratio of general and administrative expenses to sales between 14.0% and 14.5%.

Value investors and potential members of GuruFocus.com note that although Kura Sushi’s sales are up, the company’s net loss and missed earnings per share estimates suggest room for improvement. Should. The company’s strategic expansion and operational initiatives, including the introduction of DoorDash delivery, could provide a path to increased profitability and shareholder value in the future.

For more information, investors are encouraged to review the full earnings report and listen to the earnings call webcast available in the Investor Relations section of the company’s website.

For more information, see Kura Sushi USA Inc’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link