[ad_1]

European stocks don’t always get the same love as US stocks, but there’s a lot to like about the Vanguard FTSE Europe ETF (NYSEARCA:VGK) is gaining momentum, increasing by 17.7% over the past six months. This gives investors access to 1,295 European stocks, which are still cheaper than U.S. stocks and offer higher dividend yields.

I’m bullish on VGK based on its cheap valuation, attractive dividend yield, diversified exposure to a surprisingly exciting group of European stocks, and low expense ratio.

This is not to say that European stocks are necessarily better than US stocks, but for investors who have neglected the Old Continent, now is a good time to diversify your portfolio and consider exposure to European stocks as a complement to your portfolio. Looks like a good time to add. US holdings.

What is the strategy of VGK ETF?

According to Vanguard, the $19.5 billion ETF “aims to track the performance of the FTSE Developed Europe All-Cap Index, which measures the investment return on stocks issued by companies based in Europe’s major markets. ”.

VGK holds shares in various European countries including Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

A diverse and quietly exciting portfolio

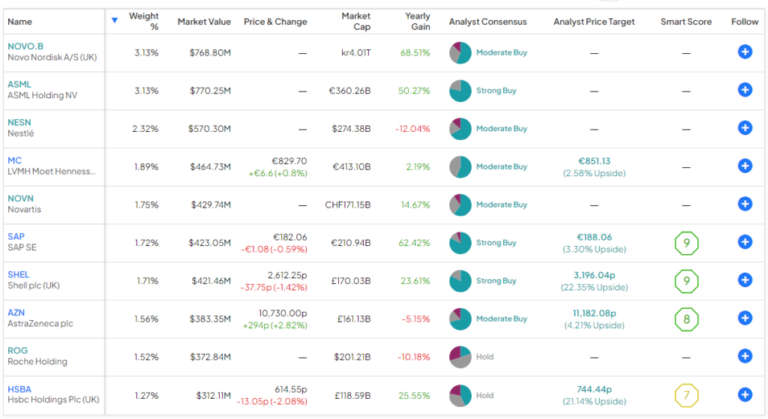

VGK offers investors incredible diversification. The ETF holds 1,295 stocks, but the top 10 holdings account for only 20.0% of its assets. Below is a summary of his top 10 holdings in VGK, taken from TipRanks’ holdings tool.

As you can see, pharmaceutical giant Novo Nordisk (New York Stock Exchange:NVO) is the fund’s top holding, with a weight of 3.1%. This also shows that VGK is less concentrated than the S&P 500 (SPX), with the top holder being Microsoft (NASDAQ:MSFT) is the Vanguard S&P 500 ETF (NYSEARCA:VOO).

While the United States has rightly earned its reputation as a hub for innovative technology stocks, Europe has its share of quietly exciting and innovative companies as well, and they shouldn’t be overlooked.

For example, top holding Novo Nordisk is a leader in the popular category of weight loss and weight management drugs (up 70% over the past year based on investor excitement for this class of drugs), and ASML Holding (NASDAQ:ASML) supplies equipment and machinery used in the production of semiconductors, one of the hottest areas in the market. ASML has increased by 48.9% over the past year.

ASML joins VGK’s top 10 holdings, along with enterprise software company SAP AG, another European technology stock (New York Stock Exchange: SAP), which has quietly returned an impressive 60% over the past year.

Notably, Novo Nordisk’s Smart Score is a “Perfect 10” and SAP scores 9 out of 10. Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score of 1 to 10 based on eight key market factors. A score of 8 or higher corresponds to an outperform rating. These stocks include energy giant Shell (New York Stock Exchange: Shell), which placed it in another top 10 position with a Smart Score of 9 out of 10.

Other notable top holdings include legendary luxury goods conglomerate LVMH Moët Hennessy (OTC:LVMUY) and Novartis (New York Stock Exchange:NVS), AstraZeneca (NASDAQ:AZN), Roche (OTC:RHBY).

Historically favorable valuation

The main advantage of investing in VGK is that it is significantly cheaper than the S&P 500. There are some impressive companies here that are doing great, but for the most part European stocks are still much cheaper than US stocks. In fact, according to Morgan Stanley (New York Stock Exchange:MS), the difference in valuations between U.S. and European stocks recently hit an all-time high.

While the S&P 500 currently trades at a valuation of 23.5x P/E, VGK’s average price-to-earnings ratio is much lower at 13.9x, giving investors more downside and potentially more upside.

Attractive dividend yield

In addition to trading at a much lower multiple than the S&P 500, VGK is also attractive because it boasts a much higher dividend yield than the S&P 500. In fact, VGK’s dividend yield of 3.2% is more than double his dividend yield of 1.4%. Additionally, VGK has paid dividends to shareholders for his 16th consecutive year.

The good thing about VGK’s dividend is that while many European stocks pay dividends on an annual or semi-annual basis, VGK pays dividends on a quarterly basis.

Investor-friendly expense ratio

VGK is also attractive because it is an extremely cost-effective ETF to own. Vanguard pioneered the idea of low-cost index ETFs, so it’s no surprise that VGK offers an investor-friendly expense ratio of just 0.09%. This means that an investor who allocates her $10,000 to the fund will pay only $9 in fees on an annual basis.

This greatly helps investors save money and preserve the value of their portfolio over the long term. Assuming the fund continues to earn 5% annually and maintains this expense ratio, this same investor will pay just $115 in fees over the next 10 years.

Is VGK stock a buy, according to analysts?

Turning to Wall Street, VGK has a Moderate Buy consensus rating, based on 647 buys, 567 holds, and 82 sell ratings assigned over the past three months. Masu. VGK’s average price target of $84.17 implies an upside potential of 24.8%.

Bottom line: Make space for Europe

Despite gaining momentum and performing well over the past year, European stocks remain significantly cheaper and yield higher than their U.S. counterparts. While VGK won’t necessarily outperform US stocks, considering these factors, it’s not a bad idea for US investors to consider gaining exposure to Europe.

I’m bullish on VGK based on its relatively cheap valuation, 3.2% dividend yield, diversified exposure to European stocks, favorable expense ratio, and potential upside valued by Wall Street analysts. is.

disclosure

[ad_2]

Source link