[ad_1]

There is a “Magnificent Seven” in the US stock market. In Europe, there is “granola”. First identified by Goldman Sachs in 2020, these 11 stocks reflect a broader segment of the European stock market than America’s technology-heavy Magnificent Seven.

In addition to being among the most valuable stocks on the African continent, these companies share strong revenue growth, low volatility, high and stable profit margins, strong balance sheets, and sustainable dividends. Masu. The 11 brands of granola are as follows.

- GSK GSK

- Roche RHHBY

- ASML ASML

- Nestlé NSRGY

- Novartis NVS

- Novo Nordisk NVO

- L’Oreal LRLCY

- LVMH Moët Hennessy Louis Vuitton LVMUY

- AstraZeneca AZN

- SAP SAP

- Sanofi SNY

Goldman Sachs strategists wrote in an April 2020 report: Europe is more likely to have a combination of structurally strong and/or stable sectors, such as healthcare, consumer staples, and technology. While not everything may be going well, there is generally some growth and/or stability in earnings. [dividend yields] It ranges from 2.0% to 2.5%. ”

As with the Magnificent Seven in the US, granola dominates the market. Goldman analysts said on February 12 that Goldman accounted for 60% of the gains in European stocks over the past year. In fact, “from a global perspective, granola has outperformed even the so-called Magnificent 7 in the past two years. Why European stocks are doing well despite weak domestic GDP. Granola is a big part of that.”

Starting with Goldman’s research and going back to 2021, we look at the Morningstar Europe Index’s Most Valuable Index, along with valuation and fundamental data from other databases, to understand the underlying drivers of Granolas stock’s outperformance. I researched a company.

Magnificent Seven vs. Granola

Although there are no companies on the list of top European stocks with market capitalizations of $1 trillion, six of the Magnificent Seven have market capitalizations at that level: Nvidia NVDA, Meta Platforms META, Apple AAPL, and Amazon. com AMZN, Microsoft MSFT, Alphabet’s GOOGL/GOOG. The exception is Tesla TSLA, which is worth about $630 billion.

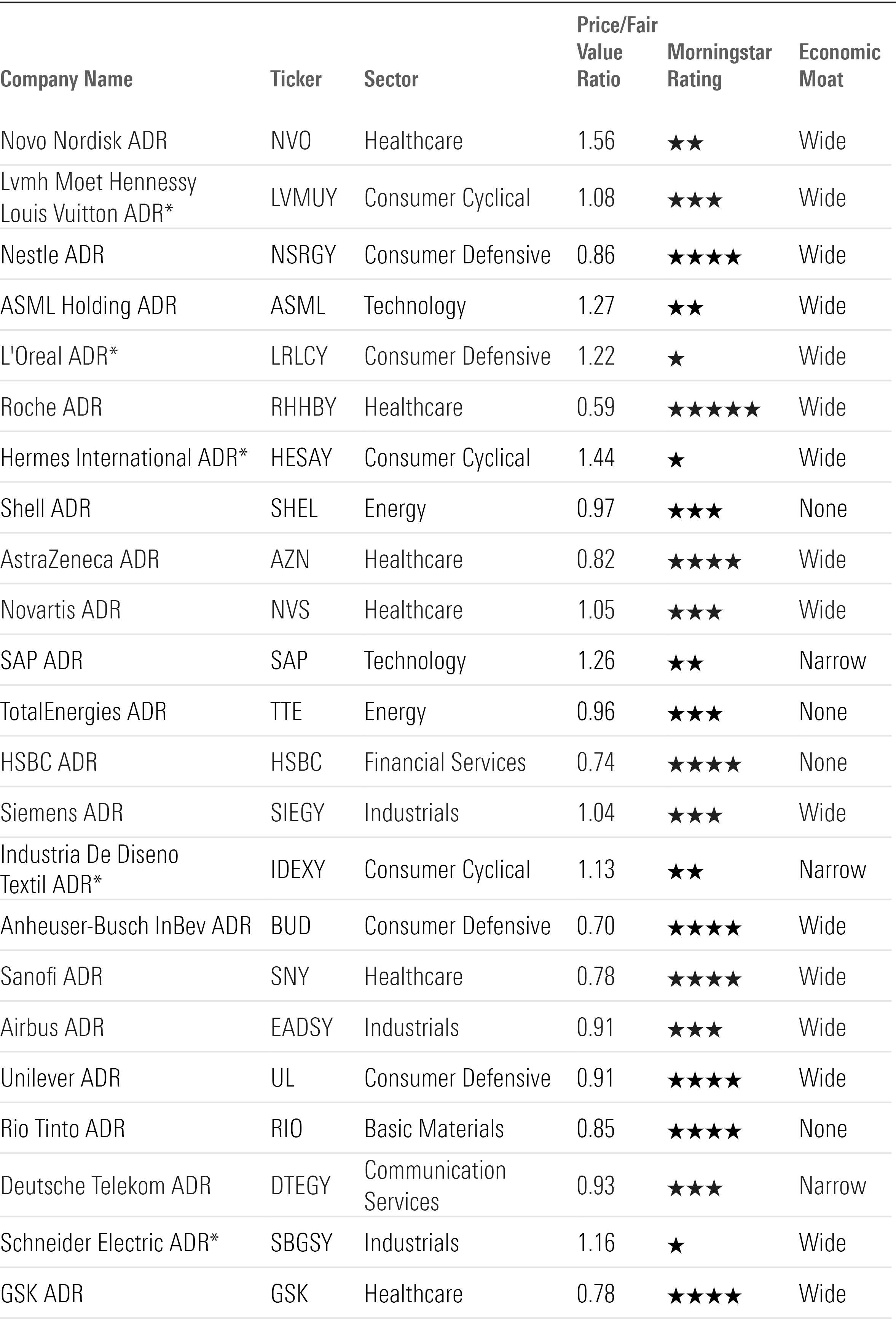

Europe’s most valuable company is Danish drugmaker Novo Nordisk, whose obesity drug Ozempic has propelled profits to new highs. Novo is valued at $555 billion. (See the table at the end of this article for a comprehensive look at Europe’s largest stocks.)

The second major difference between The Magnificent Seven and Granola is the variety of sectors. The Magnificent Seven are all technology stocks, but Morningstar classifies only three of his companies (Microsoft, Apple, and Nvidia) as technology stocks. Amazon and Tesla are consumer cyclical stocks, while Alphabet and Meta are part of the communications services sector.

Granola represents a broader cross-section of the economy, including names in healthcare, consumer defense, and consumption cyclical sectors. ASML, a global supplier of semiconductor manufacturing equipment, is the only high-tech stock. Several granola companies are world leaders in their respective fields, including Nestlé (foods), LVMH (luxury goods), L’Oréal (cosmetics), and Novo (diabetes). This list includes some of the world’s largest pharmaceutical companies. Other companies besides Novo include Roche, Novartis, Sanofi, AstraZeneca, and GSK.

granola performance

Since 2021, Granola’s average revenue has been very stable. Calculated on a euro-denominated total return basis, the value of both companies’ equal-weighted portfolios would be twice as high, resulting in a cumulative total return of 103% as of February 19, compared to the cumulative return of their U.S. peers. The total return is 128%.

We looked at historical return on equity as a measure of profitability. This measure is far from perfect, especially for companies whose revenues are heavily dependent on intangible assets. Still, it shows how much the top stocks are making in both Europe and the United States.

Both groups have improved their return on equity over the past few years. And despite being more volatile, the Magnificent Seven is much more profitable than granola.

European stocks are cheap

We also use consensus data to assess whether The Magnificent Seven’s high profitability is justified and whether it is trading at a premium relative to its European peers. We also investigated. The graph below shows that valuation ratios have declined in recent years due to rising return on equity. Despite this, both stocks are trading at significant premiums to their respective markets.

Granolas stock currently trades at 31 times forward 12-month earnings. In contrast, European stocks are trading at 13 to 14 times expected earnings. In the US, The Magnificent Seven currently trades at 34 times earnings (compared to the US market, where it trades at around 20 times earnings).

The Magnificent Seven’s historic premium over its European peers makes sense given its high return on equity. The European list is equally weighted, but influenced by the very high valuations of certain companies, particularly ASML and Hermès International, which have price-to-earnings ratios of approximately 43x and 49x, respectively.

Comparing Granola’s valuations to Morningstar’s fair value estimates, five companies are undervalued. The US-listed stocks of GSK, Nestle, AstraZeneca, Sanofi and Roche are rated 4 stars, while Roche is significantly undervalued as a 5 star stock. LVMH and Novartis are considered three-star stocks with considerable value.

Of the Magnificent Seven, only Alphabet is underrated and is rated 4 stars. Microsoft, Nvidia, Amazon, and Tesla have received pretty good reviews.

Overall, Granolas stock has delivered solid returns for investors, and it’s not that different from U.S. stocks. This subset is smaller on average than the Magnificent Seven, but more diverse. The higher profitability justifies the valuation premium over the rest of the market, but the fact that the US cohort is even more profitable explains why the European version trades at a discount to it. Masu.

[ad_2]

Source link