[ad_1]

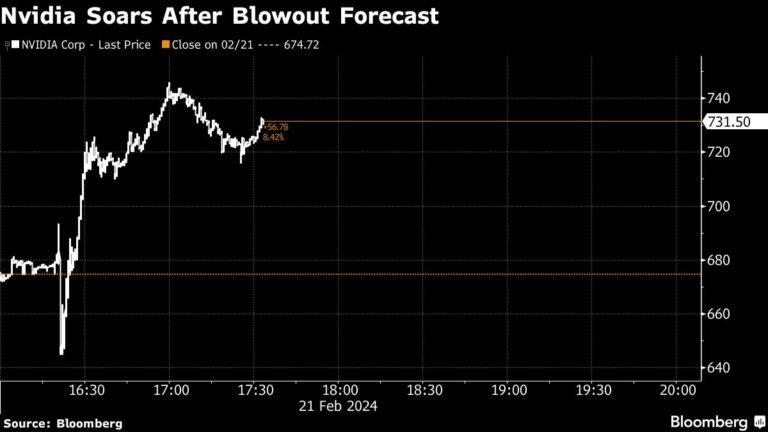

(Bloomberg) — Nasdaq 100 futures rose 2% in early trading as Nvidia Inc.’s explosive revenue forecast took center stage, fueling a rally in tech stocks around the world.

Most Read Articles on Bloomberg

Nvidia soared as much as 13% in premarket trading after results showed demand for artificial intelligence computing hardware is exploding. The company is on track to overtake Alphabet in market capitalization and has been the biggest driver of the U.S. stock market rally this year.

Promises of large-scale high-tech investments added to the market’s bullish mood. Japan’s Nikkei 225 index hit an all-time high for the first time since 1989, and the Stoxx Europe 600 index briefly surpassed its January 2022 closing high.

“As NVIDIA goes, so does the market,” said Kim Forrest, chief investment officer at Boke Capital Partners LLC. “This confirms the narrative that AI will continue to be powerful for the foreseeable future. This narrative supported the market last year, so why doesn’t it do the same this year?”

Tech stocks led the gains in the Stoxx Europe 600 index, rising more than 3%. ASML Holding NV, the region’s largest semiconductor maker, rose as much as 5%. Traders balked after data showed euro zone private sector activity hit an eight-month high despite the increasingly dire situation in Germany’s manufacturing sector. Stocks pared gains as the European Central Bank cut bets on interest rate cuts.

Meanwhile, earnings season is still in full swing.

-

Mercedes-Benz Group AG soared after the German automaker’s gloomy earnings forecast was offset by a $3.2 billion accelerated share buyback plan.

-

Rolls-Royce Holdings soared after announcing better-than-expected profits.

-

BE Semiconductor Industries NV shares soar after fourth-quarter sales rose 16%, with six-quarter sales decline as demand from artificial intelligence customers reversed sustained weakness in the rest of the industry has been resolved.

-

Nestlé SA fell on expectations of slower sales growth.

Among other individual stocks in Europe, Delivery Hero SE fell after the food delivery company announced that talks to sell its Foodpanda business in some Southeast Asian markets had failed. Lloyds Banking Group, which had set aside 450 million pounds ($570 million) for potential compensation and other costs related to Britain’s auto finance review, fell.

The hype surrounding Nvidia’s earnings masked a hawkish tone in the minutes of the Federal Reserve’s last policy meeting, where most officials expressed concern about the risk of cutting interest rates too soon. Federal Reserve President Lisa Cook and Minneapolis Fed President Neel Kashkari are scheduled to speak today and will provide investors with more food for thought, along with employment and home sales data.

U.S. Treasuries were firm after Wednesday’s decline that pushed the 10-year Treasury yield up 5 basis points. The dollar index fell for the fourth day in a row.

West Texas Intermediate crude rose 1.1% on Wednesday, above $78 a barrel, supported by tight physical supplies. Gold rose above $2,029 per ounce. Bitcoin stabilized after falling on Wednesday.

This week’s main events:

-

U.S. new unemployment insurance claims, U.S. existing home sales, Thursday

-

ECB releases January Governing Council report on Thursday

-

Fed President Lisa Cook and Minneapolis Fed President Neel Kashkari meet on Thursday

-

Chinese real estate prices Friday

-

Germany IFO Business Environment, GDP, Friday

-

ECB releases one-year and three-year inflation expectations survey on Friday

The main movements in the market are:

stock

-

As of 9:40 a.m. London time, the Stoxx European 600 was up 0.6%.

-

S&P 500 futures rose 1.1%

-

Nasdaq 100 futures rise 2%

-

Dow Jones Industrial Average futures rose 0.2%.

-

MSCI Asia Pacific Index rose 1.1%

-

MSCI Emerging Markets Index rose 0.9%

currency

-

The Bloomberg Dollar Spot Index fell 0.2%.

-

The euro rose 0.3% to $1.0854.

-

The Japanese yen remained almost unchanged at 150.23 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.1979 yuan to the dollar.

-

Sterling rose 0.3% to $1.2677.

cryptocurrency

-

Bitcoin rose 0.7% to $51,730.16

-

Ether rose 2.6% to $3,004.65.

bond

-

The 10-year Treasury yield fell 1 basis point to 4.31%.

-

German 10-year bond yield remains unchanged at 2.45%

-

The UK 10-year bond yield rose 2 basis points to 4.12%.

merchandise

-

Brent crude rose 0.2% to $83.21 per barrel.

-

Spot gold rose 0.2% to $2,029.85 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Carmen Reinicke and Ryan Vlastelica.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link