[ad_1]

CoinShares, Europe’s largest cryptocurrency investment company, recorded a profit of approximately $42 million in the fourth quarter of 2023.

In its long-term strategy, the company emphasized the “securitization” of cryptocurrencies and the tokenization of real-world assets.

CoinShares reaps profits after 2022 challenges

CoinShares said in a recent report that it has started growing again after a difficult 2022.

“We continued to execute on our strategy, delivering total revenue, profit and profit of £33.3m in the fourth quarter. Our focus on profitability resulted in adjusted EBITDA of £25.7m for the quarter, with a strong margin was 77%.”

read more: Top 5 cryptocurrency exchanges for spot trading

The company also explained its intention to expand across Europe this year and enter the U.S. market through its asset management company Valkyrie. CoinShares recently exercised its option to acquire Valkyrie.

“As we look to 2024, we are firmly focused on strengthening our leadership in Europe by building a strong product platform and expanding our reach in the U.S. market through our Valkyrie partnership.”

The U.S. Securities and Exchange Commission (SEC) recently approved Valkyrie as one of 11 spot Bitcoin exchange-traded fund (ETF) applicants. CoinShares’ decision to acquire the company was influenced by a favorable SEC ruling.

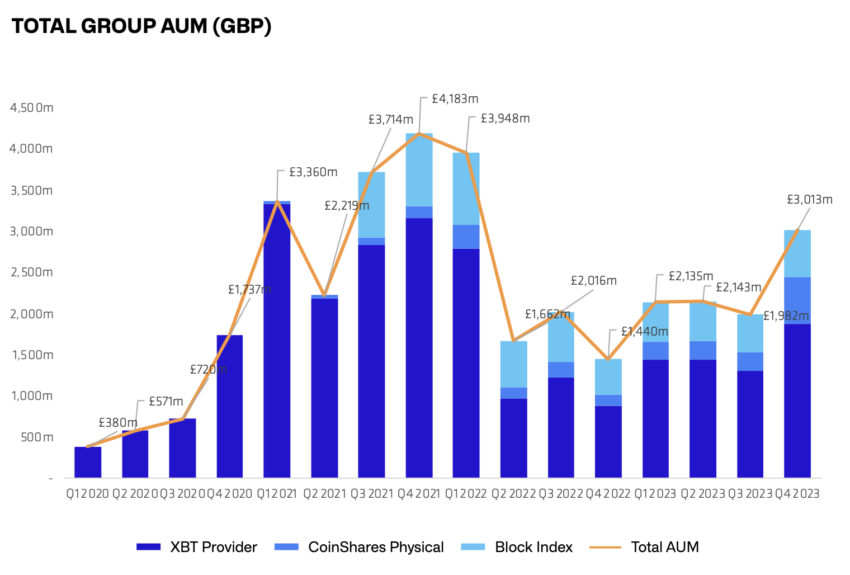

Meanwhile, CoinShares currently reported total assets under management (AUM) worth USD 5.87 billion.

CoinShares records profits as cryptocurrencies gain widespread adoption in Europe

This follows the rapid expansion of the European cryptocurrency industry. Just recently, BeInCrypto reported that Binance’s recent survey shows strengthening adoption of cryptocurrencies in Europe.

In a recent report published by Binance, the company conducted interviews with participants from four European countries (France, Italy, Spain, and Sweden).

“A recent Binance survey revealed that a whopping 73% of European residents are optimistic about the future of cryptocurrencies.”

Read more: 11 Best Altcoin Exchanges for Cryptocurrency Trading in January 2024

Meanwhile, as cryptocurrency adoption surges in Europe, regulators are imposing strict regulations on Bitcoin mining in the region.

On January 31, cryptocurrency activist and venture capital investor Daniel Batten shared part of a European Commission report highlighting plans to reduce cryptocurrencies.

“While we were sleeping, the European Commission was producing a report with plans to classify Bitcoin as an environmental hazard, a threat to the EU’s energy security, and a haven for financial criminals. ”

Meanwhile, global crypto exchanges continue to focus on expanding into various regions of Europe.

Cryptocurrency exchange Kraken announced on February 9 that it has obtained virtual asset service provider (VASP) registration from the Dutch Central Bank (DCB) in the Netherlands.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.

[ad_2]

Source link