[ad_1]

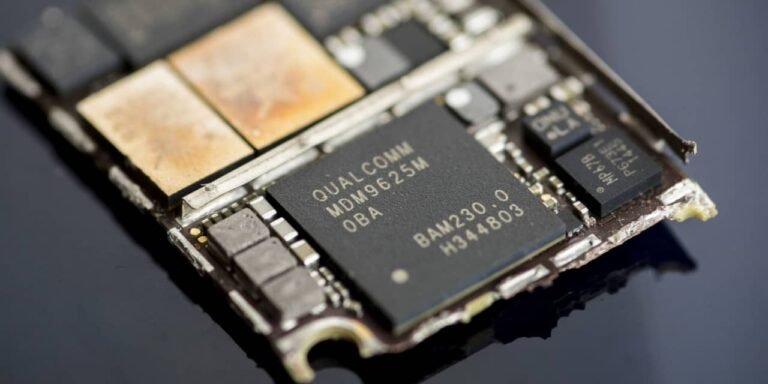

Qualcomm, a maker of mobile processors and 5G wireless chips, will maintain its strong share of iPhone modems this year, Piper Sandler said.

Analyst Harsh Kumar on Tuesday reiterated an overweight rating on Qualcomm stock with a price target of $165. The stock fell 1.8% to $150.30 in midday trading Tuesday, while the S&P 500 and Nasdaq Composite were down 1.2% and 1.5%.

“Historically…

Qualcomm, a maker of mobile processors and 5G wireless chips, will maintain its strong share of iPhone modems this year, Piper Sandler said.

Analyst Harsh Kumar on Tuesday reiterated an overweight rating on Qualcomm stock with a price target of $165. Shares fell 1.8% to $150.30 in midday trading Tuesday.

S&P500

and

Nasdaq Composite

They were 1.2% and 1.5% lower.

“Historically, modem manufacturers have had to have their modems approved and certified worldwide before they can launch them on a global scale,” he wrote. “I haven’t heard any such news about Apple’s built-in modem. From this, it is possible that in 2023 he will depend on his iPhone modem, as well as in 2024 he will depend on his QCOM modem 100%. We strongly believe that gender is high.”

The analyst noted that Qualcomm and Apple signed a new three-year agreement last September for phones to be released in 2024, 2025 and 2026. He believes chipmakers will report strong results in the near term.

“We feel that the talk that Apple will introduce modems this year or that Apple has a larger market share than QCOM predicted is a misunderstanding and unsubstantiated,” he said. Qualcomm is “leading modem expectations conservatively.”

Advertisement – SCROLL TO CONTINUE

Qualcomm stock has risen about 16% over the past 12 months. Compared to this,

iShares Semiconductor

Exchange traded fund.

Email Tae Kim at tae.kim@barrons.com.

[ad_2]

Source link